6 月 11 日,当以太坊价格接近 3,500 美元大关时,交易员经历了冲击,导致 9000 万美元的 ETH 杠杆多头在 48 小时内被清算。尽管此次下跌很大程度上受到宏观经济发展的影响,包括美国央行修改后的前景和美国失业救济申请数据,但以太坊投资者现在已经转为看跌,两个具体指标表明了这一点。

On June 11, when

6 月 12 日,美联储公布了利率预测,其中四位官员预计到 2024 年底利率不会发生变化。其余 15 位官员意见不一,预计年底前将降息一至两次。这对风险偏好投资者来说有些令人失望,因为它降低了投资者抛售固定收益资产的动机。不过,美联储主席杰罗姆·鲍威尔强调,劳动力市场和价格稳定仍将是货币政策决策的关键驱动因素。

On June 12, the Federal Reserve published interest rate forecasts, with four officials predicting that interest rates will not change by the end of 2024. The remaining 15 officials disagreed, with an expected interest rate of one to two by the end of the year.

美国劳工部6月13日报告称,上周美国首次申请失业救济人数飙升至24.2万人,创10个月新高。Pantheon Macroeconomics高级美国经济学家奥利弗·艾伦对雅虎财经表示:“长期利率高企、信贷条件紧缩以及需求逐渐疲软,开始给企业,尤其是小企业带来更大压力。”

The United States Department of Labor reported on 13 June that the number of first applications for unemployment relief in the United States jumped to 242,000 last week, reaching a 10-month high. Oliver Allen, Senior American Economist Pantheon Macroeconomics, said to Yahoo: “The high long-term interest rates, tight credit conditions and the gradual weakening of demand began to put greater pressure on businesses, especially small businesses.”

疲软的宏观经济指标通常对以太币等风险资产有利,因为如果经济疲软持续,它们可能会迫使美联储考虑提前降息。然而,在充满挑战的经济环境下,投资者是否会转向加密货币等另类资产并不确定,而美国现货以太币交易所交易基金 (ETF) 的缺乏只会增加不确定性。

Weak macroeconomic indicators tend to favour risky assets, such as e-currency, because if the economy is weak, they may force the Fed to consider early interest reductions. In a challenging economic environment, however, it is uncertain whether investors will turn to alternative assets, such as crypto-currency, and the absence of a US spot e-exchange transaction fund (ETF) will only increase uncertainty.

据福克斯商业新闻记者埃莉诺·特雷特 (Eleanor Terrett) 报道,美国证券交易委员会主席加里·根斯勒 (Gary Gensler) 表示,批准单个以太币 ETF 的S-1 申请可能需要长达三个月的时间。这种延迟是投资者对购买看涨的 ETH 衍生品越来越谨慎的部分原因,此外还有去中心化应用活动减少等其他因素。

According to Eleanor Trett, the Chairman of the United States Securities and Exchange Commission, Gary Gensler, reported that approval of the single ETF S-1 application may take up to three months. This delay is partly due to the increased caution of investors in purchasing the elevated ETH derivatives, as well as other factors such as reduced applications to centralize.

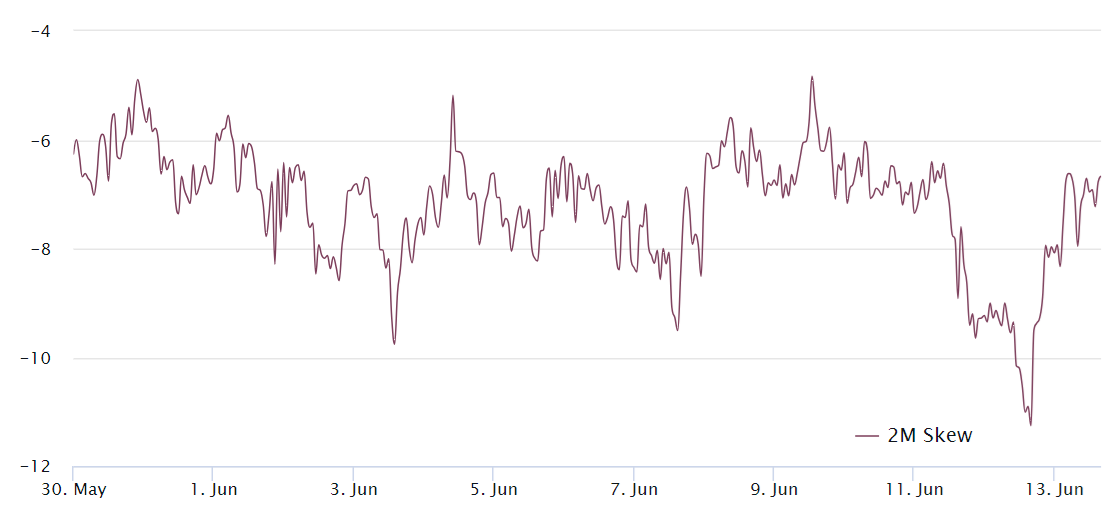

德尔塔倾斜度衡量看涨期权与看跌期权的相对需求。负倾斜度表示对看涨期权(买入)的需求较高,而正倾斜度则表示对看跌期权(卖出)的偏好。中性市场通常表现出从 -7% 到 +7% 的德尔塔倾斜度,表示看涨期权和看跌期权之间的定价平衡。

Delta tilt measures the relative demand for options to increase. Negative slopes represent a higher demand for options to increase (purchases), while positive slopes indicate a preference for options to fall (sales). Neutral markets often show a bias from -7% to +7% of Delta tilt, reflecting a price balance between options to increase and to see options to fall.

6 月 11 日至 6 月 12 日期间,以太币 25% 的 delta 偏差跌破 -7%,进入看涨区域。然而,这种乐观情绪在 6 月 13 日消退,因为以太币未能守住 3,600 美元大关,导致交易员对 ETH 价格正向和负向变动的概率进行了类似的定价。

Between June 11 and June 12, 25% of delta's deviations fell by -7% in the Tai currency, and entered the rising areas. However, this optimism subsided on June 13 because of the failure of the Ether to hold the $3,600 threshold, which resulted in a similar pricing by traders of the probabilities of positive and negative changes in ETH prices.

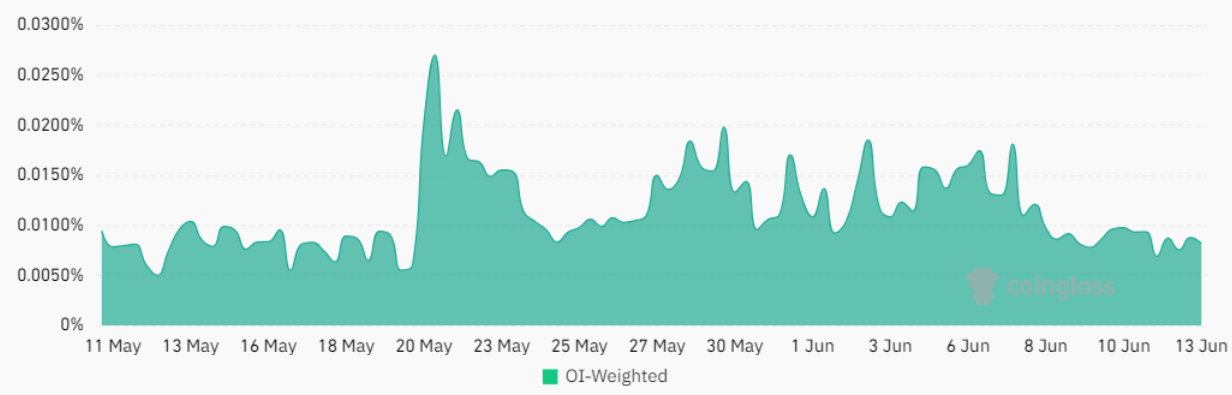

散户交易者通常会选择永续期货,这是一种密切跟踪基础现货市场价格走势的衍生品。为了管理平衡的风险敞口,交易所每八小时收取一次费用,称为融资利率。当买家(多头)要求更多杠杆时,该利率变为正数,而当卖家(空头)需要更多杠杆时,该利率变为负数。

In order to manage a balanced risk exposure, the exchange charges an eight-hour fee called a financing interest rate. When buyers (many) require more leverage, the interest rate becomes positive, and when sellers (empty) require more leverage, the interest rate becomes negative.

目前,以太币永续融资利率已稳定在每八小时 0.01%,相当于每周 0.2%。这一利率通常被认为是中性的,特别是因为在交易活跃的时期,杠杆多头仓位的每周成本可能会高达 1.2%。值得注意的是,6 月 6 日的融资利率为每周 0.035%,这表明过去一周市场情绪有所恶化。

At present, the interest rate for sustainable financing in tae currency has stabilized at 0.01% per eight hours, equivalent to 0.2% per week. This rate is generally considered neutral, especially since the weekly cost of leveraging multiple warehouses may be as high as 1.2% during a period of active trading, and it is worth noting that the financing rate on 6 June was 0.035% per week, indicating a deterioration in market sentiment over the past week.

尽管即将推出的美国现货 ETF 和宏观经济数据表明就业市场疲软,但以太币衍生品仍无法维持较高的乐观水平,因此 ETH 在短期内突破 3,700 美元的可能性似乎有所减弱。

Despite the impending launch of the United States spot ETF and macroeconomic data, employment markets are weak, but the potential for ETM derivatives to break through US$ 3,700 in the short term seems to have diminished.

发表评论