作者 | Day

Author Day

出品|白话区块链

It's a white-talking block chain.

随着以太坊转PoS经过一年多的发展,以太坊链的质押赛道也逐渐衍变成千亿市值的赛道,截止目前,以太坊锁仓量达到4180万枚,占比超35%,而锁仓量的上升,让以太坊上涨变得更加容易。

With the development of the Etherm to Poss over more than a year, the Etherm chain pledge track has gradually become a 100 billion-dollar market track, with the current capacity of the Etherms locking up to 41.8 million units, or more than 35 per cent, making it easier for the Etherms to rise.

另外,近期质押相关项目不断冒出,TVL数亿甚至数十亿美元的项目开始出现,像BN、a16z等顶级机构也开始广撒网,进一步导致质押项目扎堆出现,而普通投资者,为了项目方的Airdrop预期,也会积极参与质押。今天,白话来给大家梳理下近期热度较高的一些质押项目。

In addition, recent pledge-related projects have emerged, while TVL projects of hundreds of millions or even billions of dollars have begun to emerge, and top institutions such as BN, a16z and others have begun to spread their networks, further leading to a massing of pledge projects, while ordinary investors, expected by Airdrop of the project, will be actively involved in the pledge.

区块链行业发展至今,已经历经好几轮牛熊交替,虽然每轮都会冒出新叙事、新的玩法,但其中却有一些相似的地方。为了更好的理解质押,以及其为什么能火起来,我们先来了解下这个行业出现了哪些资产发行方式:

The block chain industry, which has evolved to date, has undergone several rotations of cattle and bears, and although each round has new narratives and new games, there are some similarities. In order to better understand the pledge and why it is on fire, let's first look at the way assets are distributed in the industry:

区块生产—— 代表项目:比特币、以太坊

block production - on behalf of project: Bitcoin, Etheria

任何人在维护区块链网络安全以及去中心化的同时,获得Token奖励,随着行业的发展,门槛逐渐变高,区块生产也逐渐成为一种产业。

Anyone who, while maintaining block chain network security and decentralizing it, receives the Token reward, as the industry grows, the threshold gradually increases and block production becomes an industry.

公开出售 —— 代表项目:EOS、BTT

. - On behalf of item: EOS, BTT

最初“简单粗暴”的直接出售筹码,也是随着行业发展,衍生出不同的模式,门槛不断加高,比如需要有项目方指定的Token才能获得资格和筹码。

The initial direct sale of “simple and rough” chips has also been accompanied by industry developments that have produced different models with increasing thresholds, such as Token, designated by the project party, for eligibility and chips.

流动性挖矿 —— 代表项目:Uniswap

mobile mining -- on behalf of project: Uniswap

用户通过提供流动性来获得Token奖励,可以说目前链上交易能有如今的发展,与此机制息息相关。早期很多项目方将其作为筹码分发的主要手段,筹码过于分散,导致Token价格波动极大,很容易出现死亡螺旋,项目直接死掉,目前只是作为交易市场的辅助手段。

Users receive Token incentives by providing liquidity, and it can be said that today’s developments in the chain of transactions are closely linked to this mechanism. Many of the early projects used them as the main means of distribution of chips, spread them too thinly, causing Token’s price volatility, prone to death spirals, and the project’s direct death, currently only as an aid to the trading market.

Airdrop —— 代表项目:Uniswap dydx

根据用户参与应用的不同程度免费分发Token作为奖励,早期区块链用户较少,作为使用其产品一种奖励,现在逐渐发展为吸引用户使用其产品,反向给项目方提供业务数据的一种方式,并且出现了“反撸”这个词。

Token was distributed free of charge, depending on the degree of user participation in the application, and there were fewer early block chain users, and as an incentive to use its products, it has evolved into a way to attract users to use its products, to reverse the provision of business data to project parties, and the word “reverse” has emerged.

铭文 —— 代表项目:ORDI、Sats

- on behalf of item: ORDI, Sats

多数项目Token属于100%释放,任何人都可参与,完全处于公平分发,随着整个赛道变热,开始内卷,最大获利方变为比特币矿工。

Most of the projects, Token, were 100 per cent released, anyone could participate, were fully distributed fairly, and as the entire track became hot and the inner volume began, the maximum profit was turned into a bitcoin miner.

质押 (积分)—— 代表项目:friend tech、blast

pledge (centres) - on behalf of item: triend tech, blast

质押,只需将主流的加密资产参与质押(增加项目方TVL相关数据),在获得质押收益的同时,可以获得项目方积分(作为后续Token分发凭证),因为Airdrop预期的存在(有机构投资的项目更受欢迎的原因),仅仅只是占用资金,风险相对较小,属于白嫖,并且积分的分发具有即时性的特点,使得大家更乐于参与。

A pledge requires only the participation of the mainstream encrypted assets in the pledge (additional data relating to the project party TVL) and the acquisition of the pledged proceeds together with the project credits (as a follow-up document distributed to Token), since the anticipated presence of Airdrop (for a more popular reason for projects with institutional investments) merely consumes funds, is relatively low risk, belongs to white clients and is distributed in a timely manner, making it easier for everyone to participate.

刚开始时,质押只集中在以太坊的节点质押,只是为了赚取年华收益,但发展到现在,不再局限以太坊那点利息,其他项目也开始模仿,只要有积分拿,项目不错,大家也会适当参与,目前,积分已经是吸引用户使用其产品的重要手段之一,但对于用户来说就不那么美好了,各种各样的交互任务,存在被项目方持续PUA的可能。

At the beginning, the pledge was concentrated only on the Ethernomy node for the purpose of earning an old-age gain, but now it's no longer limited to the taupulega interest, and other projects are starting to imitate, and as long as there are points, the project is good, and you will be properly involved.

可以看出,由于区块链的特性,行业内的筹码分发方式,尤其那些短期引领行业发展的方式,是低门槛、易于参与的。

It can be seen that, because of the characteristics of the block chain, the mode of distribution of chips within the industry, especially those that lead to the development of the industry in the short term, is low-threshold and easy to participate.

质押项目,最重要的一点当然是安全性:项目方背景清晰可靠、有机构背书、跑路风险低,不然就变成“你惦记别人利润,别人惦记你本金”。

The most important aspect of the pledge project is, of course, security: the project has a clear and reliable background, has an institutional endorsement and has a low risk of running, or it becomes “you think about profits and others about your capital”.

目前主要从以下个三个方向来考虑:

资金量:当前项目质押资金量多少,资金量大意味着参与人多,相对安全;

Amount of funds: What is the amount of funds pledged by the current project, the amount of which means that the number of participants is large and is relatively safe;

机构背书:是否有顶级机构加持,有机构加持相对会有一定的保障;

(b)

团队背景:项目方的成员是否公开,是否做过其他知名项目。

team background: project participants are publicly available and other well-known projects have been undertaken.

- EigenLayer

EigenLayer 是一个基于以太坊的 Restake 协议,主要服务包括 LSD 资产的 Restake、节点运营和 AVS 服务(主动验证服务),旨在提供加密经济中的安全性和奖励机制。它允许用户重新质押原生ETH、LSDETH和LP Token,为第三方项目提供了一个安全的平台,使其能够在享受以太坊主网的安全性的同时获得更多的奖励,总体目标是促进整个生态系统的发展。

EigenLayer is a Restake agreement based on the Ether, whose main services include a Restake for LSD assets, node operations and AVS services (proactive certification services) designed to provide safety and incentives in the encryption economy. It allows users to re-mortize the original ETH, LSDETH, and LP Token, providing a secure platform for third-party projects that can receive more incentives while enjoying the safety of the Ethernomy network, with the overall objective of promoting the development of the ecosystem as a whole.

TVL:119亿美元

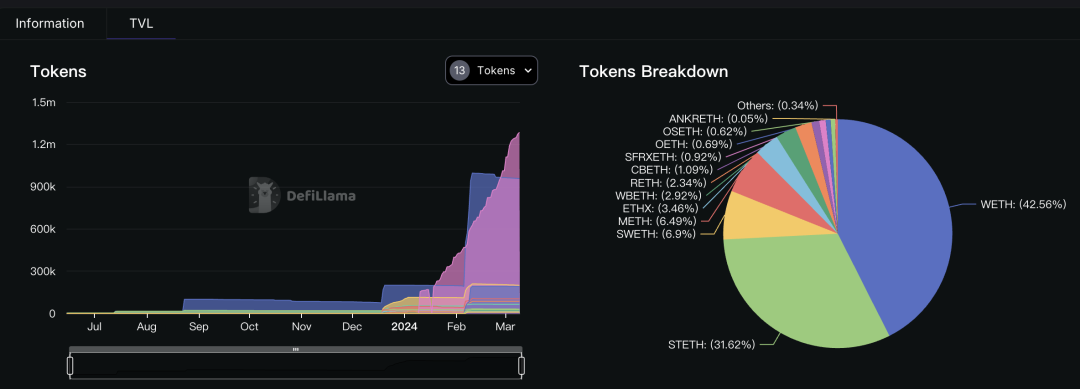

据Defillama 数据,截止3月10日,EigenLayer 总 TVL 为 119 亿美元(下图左边红色区域),金库中占比前三的 ETH 及其衍生品分别为:WETH(42.56%)、STETH(31.62%)、SWETH(6.9%),可以看出,EigenLayer质押资产都是与以太坊相关,完全服务于以太坊。

According to Devillama, as at 10 March, EigenLayer had a total TVL of $11.9 billion (the red area on the left of the figure below), and ETH and its derivatives in the Treasury were: Weth (42.56 per cent), STETH (31.62 per cent) and SWETH (6.9 per cent). As can be seen, EigenLayer's pledged assets are related to Etheria and serve it entirely.

投资机构:

Investment Agency:

目前共完成四轮融资,投资机构有a16z、Coinbase Ventures、Polychain Capital等,其中a16z在今年2 月 22 日,向其投资 1 亿美元。

Four rounds of financing have been completed, with investment institutions a16z, Coinbase Ventures, Polychain Capital and others, of which a16z invested $100 million in 22 February this year.

- Merlin Chain

Merlin Chain是一个整合了ZK-Rollup网络、去中心化预言机和链上BTC防欺诈模块的比特币 L2 解决方案。Merlin Chain的目标是提高比特币交易的效率和可扩展性,使比特币生态系统更加活跃。

Merlin Chain is a Bitcoin L2 solution that integrates the ZK-Rollup network, the decentralised pronunciation machine and the BTC fraud prevention module on the chain. Merlin Chain aims to increase the efficiency and scalability of Bitcoin transactions and make the Bitcoin ecosystem more active.

Merlin Chain背后团队是Bitmap Tech,已经成功推出了一系列具有高价值的NFT资产,包括Bitmaps、Goosinals NFT以及BRC-420蓝盒子等比特币NFT,且在去年均有不错的表现。

The team behind Merlin Chain, Bitmap Tech, has successfully launched a range of high-value NFT assets, including Bitmaps, Goosinals NFT and BRC-420 Blue Box, and has performed well last year.

投资机构:

Investment Agency:

今年2月,Merlin Chain 背后团队Bitmap Tech获得ABCDE、OKX Ventures的投资,具体金额未知。

In February of this year, the team behind Merlin Chain, Bitmap Tech, received investments in ABCDE, OKXVentures for unknown amounts.

TVL:30亿美元

TVL: $3 billion

官推数据显示,截止3月2日,Merlin Chain 主网上线23天,TVL就突破30亿美元,其中Bitcoin占比58%、Ordinals占比33% ,项目方比较注重社区声音以及与比特币生态之间的合作。

According to official push data, as at 2 March, the Merlin Chain main web line had broken 3 billion dollars, of which 58 per cent was Bitcoin, 33 per cent were Ordinals, and projecters focused more on community voices and collaboration with Bitcoin ecology.

- Blast

Blast是由Blur团队推出的一个基于以太坊的 L2,旨在为用户提供原生收益功能。它是第一个将原生收益纳入其设计的L2网络,让用户的资产在Blast上获得增值。Blast通过在以太坊上进行质押和实物资产(RWA)协议来产生收益。相比其他L2链上的利率为0%,Blast为存入的ETH提供4%左右的利率。Blast的目标是让L2网络具备收益能力,用户存入资产后,Blast会定期发放收益。

The Blast was introduced by the Blur team as an original income-generating function based on the Taiwan L2. It was the first L2 network to incorporate the original proceeds into its design, allowing the user's assets to add value on Blast. Blast generates the benefits by undertaking pledge and real asset (RWA) agreements in Tai Pa. Blast provides an interest rate of around 4% for deposited ETHs as compared to the interest rate of 0% on the other L2 chains. Blast aims to provide the L2 network with revenue capacity, and after the user has deposited the assets, Blast distributes the proceeds on a regular basis.

Blast主打口号是“可以帮您赚钱的L2网络”。用户将资金存入Blast的L2网络,然后Blast将这笔资金在以太坊的Layer1进行质押,通常是通过Lido进行质押。然后,Blast将获得的利息返回给用户,实现所谓的“赚钱”。与用户直接使用Lido进行质押相比,使用Blast还可以获得一些额外的Blast积分。

Blast's main slogan is "L2 network that can help you make money." Users deposit the money into the L2 network in Blast, and then Blast pledges the money to Layer1 in Ethio, usually via Lido. Then Blast returns the interest earned to the user, making the so-called "profit."

TVL:28.6亿美元

官网显示,截止3月9日,Blast TVL 28.6亿美元,总用户数42万。

According to the Network, as of 9 March, Blast TVL had a total of 420,000 users of $2.86 billion.

投资机构:

Investment Agency:

2023年11月Blast 2000 万美元融资,由Paradigm、Lido 战略顾问 Hasu、The Block CEO等参投。

Blast $20 million in financing in November 2023, with the participation of Paradigm, Lido Strategic Adviser Hasu, The Block CEO, etc.

- ether.fi

ether.fi是一个去中心化的非托管质押协议,用户可以在该平台上质押他们的以太坊(ETH)并获得相应的流动性质押Token(eETH)。这些质押Token可用于参与DeFi活动,并产生额外的收益。它的主要特点是让质押者可以控制自己的密钥,从而确保了资金的安全。Ether.fi还创建了一个节点服务市场,允许用户注册节点并提供基础设施服务。这进一步促进了去中心化,增加了质押者和节点运营商的选择和灵活性。近期ETHFI已经发Token,因为孙哥的原因,被大家诟病为大户提款机。

Other.fi is a decentralised, non-trusted pledge agreement on which users can pledge their ETH and receive the corresponding mobile escort to Token (eETH). These pledges can be used to participate in DeFi activities and generate additional benefits.

TVL:22 亿美元

Defillama 数据显示,截止3月10日,ether.fi TVL 达 22 亿美元。

Devillama data show that, as of 10 March, each of the other.fi TVLs amounted to $2.2 billion.

投资机构:

Investment Agency:

完成2轮融资,总共融资3200 万美元,由Bankless VC、OKX Ventures、Consensys、BitMex 创始人 Arthur Hayes 等参投。

Two rounds of financing, totalling $32 million, were completed with the participation of Banks VC, OKX Ventures, Consensys, Arthur Hayes, founder of BitMex.

- Puffer

Puffer是基于EigenLayer构建的无需许可的原生流动性再质押协议,它的目标是为节点运营者(NoOps)、再质押运营者(ReOps)和ETH质押者提供服务。

Puffer is based on a non-licensed original liquidity re-prising agreement built by EigenLayer, which aims to provide services to nodal operators (Noops), re-prising operators (ReOps) and ETH pledgeers.

在Puffer中,节点运营者扮演着重要角色,他们可以以低成本参与节点验证和AVSs的运行。Puffer采用了独特的抗罚没技术,使得节点能够安全地参与验证过程,并积累PoS奖励。同时,节点还可以通过AVSs的运行获得再质押奖励,增加他们的收益。Puffer的设计旨在提供更加灵活和高效的流动性再质押过程。

In Puffer, node operators play an important role by participating in node validation and AVSs operations at low cost. Puffer uses unique anti-reprising techniques that enable nodes to participate safely in the validation process and accumulate PoS incentives.

TVL:14亿美元

据官网数据,截止3月10日,TVL 达 14 亿美元,已产生 80 亿 Puffer 积分、2.4亿 Eigenlayer 积分以及超 3.3% 的综合 APY。

As of 10 March, TVL reached $1.4 billion, yielding 8 billion Puffer credits, 240 million Eigenlayer credits and a combination of over 3.3 per cent APY.

投资机构:

Investment Agency:

完成三轮融资,早期获得以太坊基金会的拨款,后由Bankless Ventures、Animoca Venture以及Eigen Layer 创始人、神鱼、Coinbase 质押业务主管等众多KOL参与投资, 今年最新一轮融资由 Binance Lab 投资,Puffer 短期内 TVL 的飙升与Binance Labs 的投资密切相关。

Three rounds of financing were completed, with an early allocation from the Ether Foundation, with the participation of a large number of KOLs, including Bankless Ventures, Animoca Venture, and the founder of Eigen Layer, the fish, Coinbase pledge manager. The latest round of financing this year was financed by Binance Lab, and the Puffer TVL surge in the short term is closely linked to the investment of Binance Labs.

- Renzo

Renzo是EigenLayer上的原生再质押协议,引入了一种叫做ezETH的流动性再质押Token。用户可以将以太坊或EigenLayer的Token存入Renzo来铸造ezETH Token。这样的操作使用户能够参与流动性再质押,并将ezETH用于其他DeFi协议以获取更多收益。

Renzo is the original re-prising agreement on EigenLayer, which introduces a mobile re-prising to Token called ezETH. Users can put Token from Taiku or EigenLayer in Renzo to forge ezETH Token.

Renzo的目标是降低用户参与的门槛,让他们能够轻松地参与EigenLayer生态系统的流动性再质押。

Renzo's goal is to lower the threshold for user participation and to enable them to participate easily in the mobility re-multation of the EigenLayer ecosystem.

TVL:9亿美元

Defillama 数据显示,截止3月10日,Renzo TVL 突破 9 亿美元

Devillama data show that, as of March 10, Renzo TVL had broken through $900 million.

投资机构:

Investment Agency:

目前完成两轮融资,由OKX Ventures、Binance Labs等机构参投。

Two rounds of financing have been completed, with the participation of such institutions as OKX Ventures, Binance Labs and others.

- Ethena

Ethena是基于以太坊的合成美元(USDe)协议,旨在提供加密原生解决方案,通过Delta对冲和互联网债券等策略来创建稳定的合成美元USDe,并为用户提供收益机会。

Ethena is based on the Taiku Synthetic United States dollar (USDE) agreement, which aims to provide an encrypted primary solution, create a stable synthetic dollar (USDE) through strategies such as Delta hedges and Internet bonds, and provide revenue opportunities for users.

- Ethena USDe 通过两种主要策略产生其 USD 价值和收益:

- 利用 stETH 及其固有收益;

- 采取 ETH 空头头寸以平衡 Delta,并利用永续/期货资金率。

官网数据显示,目前USDe年年化109%。

Data from the Network show that USDe is currently annualized at 109 per cent.

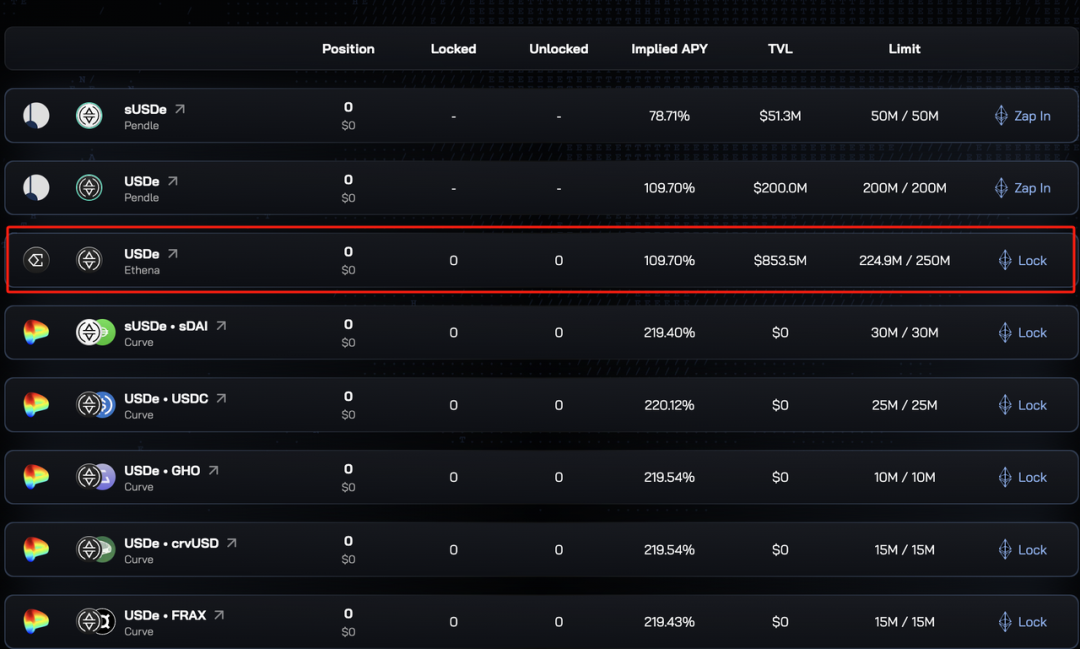

TVL:8.5 亿美元

官网数据显示,截止3月10日,USDe 池 TVL 达 8.5 亿美元

According to official network data, as of March 10, USD Pool TVL amounted to $850 million.

投资机构:

Investment Agency:

完成2轮融资,总融资 2000 万美元,投资机构有Dragonfly、PayPal Ventures、Binance Labs、OKX等。

Two rounds of financing were completed, totalling $20 million, with investment institutions such as Dragonfly, PayPal Ventures, Binance Labs, OKX, etc.

- Babylon

Babylon是一个基于Cosmos SDK开发的Layer1,目标是将比特币的安全性扩展到更多的去中心化应用(DApp)和区块链网络。为了实现这一目标,Babylon引入了BTC资产,并允许用户将比特币质押在Babylon网络上,并获得相应的奖励。

Babylon is a Layer1 based on Cosmos SDK, whose goal is to extend the security of Bitcoin to more decentralised applications (DApp) and block chain networks. To achieve this goal, Babylon has introduced BTC assets and allows users to pledge bitcoin to the Babylon network, with corresponding incentives.

Babylon利用了比特币的一些核心特性来增强安全性:

Babylon uses some of the central characteristics of Bitcoin to enhance security:

首先,它使用比特币的时间戳服务,确保Babylon网络的时间戳与比特币网络保持同步,提供更高的安全性和可靠性;

First, it uses the Bitcoin time stamp service to ensure that the time stamp of the Babylon network is synchronized with the Bitcoin network and provides greater security and reliability;

其次,Babylon利用比特币的区块空间,将比特币的安全性扩展到其他基于权益证明机制的区块链网络,从而形成一个更加统一和强大的生态系统;

Second, Babylon developed a more unified and powerful ecosystem by using bitcoin block space to extend the security of bitcoin to a network of blocks based on other evidence-of-interest mechanisms;

最后,Babylon将比特币作为资产价值的基准,实现与比特币的互操作性,使得比特币在Babylon网络中的质押和流动性更加便捷。

Finally, Babylon used Bitcoin as a benchmark for asset values, and

前几天测试网刚结束,主网还没上线,所以没有 TVL 相关数据,但作为比特币生态的质押项目,有 EigenLayer 珠玉在前,所以值得重点关注。 The test network at 投资机构: Investment Agency: 目前完成两轮融资,第一轮融资1800万美金,第二轮未知,投资机构有Binance Lab、Polychain Capital、ABCDE Capital、Polygon、OKX Ventures 等。 Two rounds of financing have been completed, with $18 million for the first round and unknown for the second. Investment institutions include Binance Lab, Polychain Capital, ABCDE Capital, Polygon, OKXVentures, etc. 以上便是质押赛道目前热门项目的盘点,需要注意的是,虽然大多项目有各种光环加持,但并不代表不会携款跑路,所以在参与前还是要注意风险,做好调研。 This is the inventory of the pledge track's current popular projects, and it is important to note that while most of the projects have various photorings, it does not mean that they do not run with money, so risk-sensitive and research is required before participating.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论