从比特币概念的诞生到如今的市场波动,比特币经历了许多起伏,给人们带来了无数的惊喜和失望。

From the birth of the Bitcoin concept to today's market volatility, Bitcoin has experienced a lot of ups and downs that have given people countless surprises and disappointments.

首先,让我们回顾一下比特币的起源。在2008年金融危机爆发的时候,中本聪通过一篇名为《比特币:一种点对点式的电子现金系统》的论文,提出了比特币的概念。这篇论文被称为比特币白皮书,标志着比特币的诞生。

First, let us look back at the origins of Bitcoin. At the onset of the 2008 financial crisis, China introduced the concept of Bitcoin through a paper called Bitcoin: A Point-to-Point Electronic Cash System. This paper, known as the Bitcoin White Paper, marked the birth of Bitcoin.

在2009年1月3日,比特币的第一个区块被挖出,这标志着比特币网络的启动,也开启了加密资产和区块链的时代。最初的两年里,比特币并没有在交易市场上流通,而是以程序员之间的赠送和奖励的形式流转。

On 3 January 2009, Bitcoin’s first block was excavated, marking the start of the Bitcoin network and the beginning of an era of encrypted asset and block chains. For the first two years, Bitcoin did not circulate in the trading market, but in the form of gifts and rewards among programmers.

那么,让我们来看看比特币在过去十年的价格波动。其中,最为标志性的事件莫过于2010年的比特币披萨事件。一个程序员用1万枚比特币交换了两块披萨,当时比特币的价格仅为0.0025美元。从那时起,比特币的价格开始逐渐上涨,一步步走到了今天的位置。

So, let's look at the price fluctuations in bitcoin over the last decade. There is no more iconic event than the 2010 Bitcoin pizza. A programmer exchanged 10,000 bitcoins for two pieces of pizza, which at that time was only US$ 0.0025.

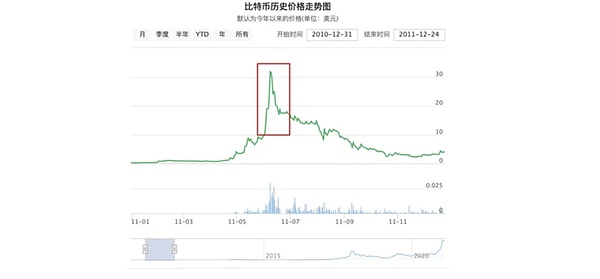

1、比特币第一次大涨

在2010年7月18日,比特币的价格已经达到了0.06美元,较初始价格上涨了23倍。随着比特币价格的水涨船高,交易所也纷纷涌现。当时最大的交易所是门头沟交易所(Mt.Gox)。2010年11月,比特币价格一度达到了0.5美元,相较于最初的披萨价格,翻了近200倍。

By 18 July 2010, the price of Bitcoin had reached US$ 0.06, a 23-fold increase over the initial price. As the price of Bitcoin rose, the exchange emerged.

然而,好景不长。2011年6月到11月,比特币价格从高点32美元下跌至2美元,跌幅达94%。这是因为Mt.Gox交易平台遭受黑客袭击,再加上当时市场深度不足,价格无法支撑。尽管这次巨幅震荡吓退了一些人,但更多的投资者认识到了比特币的潜力,坚定了继续投资的信念。

Between June and November 2011, the price of Bitcoin fell from a high of $32 to $2, a 94% decline. This was due to the hacking of the Mt.Gox trading platform, coupled with the insufficient depth of the market at the time, which made the price unsustainable.

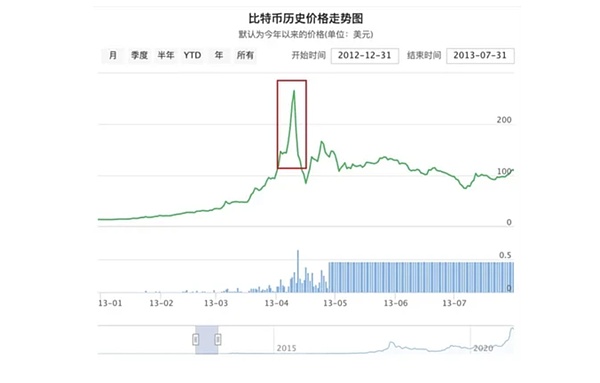

经过一年多的蛰伏,比特币在2013年2月再次突破了30美元。而在2013年,比特币的属性被发掘,被认为是一种“避险资产”。这一年,塞浦路斯爆发了严重的债务危机,导致民众对银行安全性产生了质疑。一些人发现了比特币的独特性,认为比特币或许是应对危机的不二选择。在一个多月的时间里,比特币价格从33美元上涨至235美元,但很快又回落到80美元附近。

After more than a year of ambushes, Bitcoin broke 30 dollars again in February 2013. In 2013, the properties of Bitcoin were discovered as a “risk-free asset.”

然而,这次事件让更多的用户认识到了比特币的价值。2013年年底,比特币价格再次飙升,从106美元最高飙升至1177美元,超过了1盎司黄金的价格。然而,由于Mt.Gox被盗大量比特币后宣布破产,再加上政策性利空的影响,比特币价格再次震荡下跌,市场进入比特币的十年价格走势是一个备受关注的话题。从比特币的诞生到如今的市场波动,比特币经历了许多起伏,给人们带来了无数的惊喜和失望。

By the end of 2013, the price of bitcoin rose again, from $106 to $1177, exceeding the price of one ounce of gold. However, the collapse of the price of bitcoin after the theft of a large amount of bitcoins, combined with the impact of policy gains, led to a reshuffling of bitcoins, and the ten-year price movement of the market into bitcoins was a topic of great concern. From the birth of bitcoins to the current volatility of the market, Bitcoins experienced numerous swings, bringing numerous surprises and disappointments.

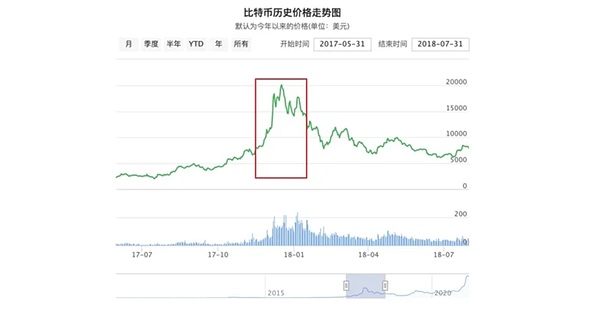

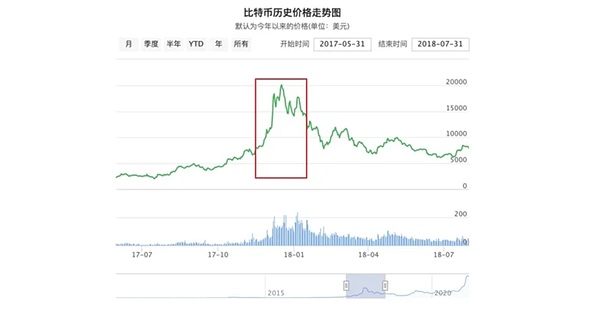

时间是最好的良药,经过两年时间的调整,比特币的交易市场逐渐恢复。2016年,比特币迎来了第二次减半,再加上以太坊的崛起,区块链行业又一次引起了人们的关注,投资者数量出现明显增长,比特币也开启了第三轮上涨之路。

Time is the best medicine, and after two years of adjustment, Bitcoin’s trading market is gradually recovering. In 2016, Bitcoin reached its second half, and, with the rise of Etheria, the block chain industry has once again been a source of concern, with a marked increase in the number of investors and a third round of upturns in Bitcoin.

即使期间经历了比特币第一次分叉以及9·4暴跌事件,但投资者们的热情依旧不减。从2017年11月开始,比特币一路高歌猛进,价格也飙涨到了近2万美元的历史高位。回顾这一年,比特币价格从789美元涨至近2万美元,最高涨幅达到了24倍。比特币跻身千亿市值的行列,也获得了更多主流金融市场及媒体的关注。

This year, the price of Bitcoin rose from $789 to almost $20,000, a 24-fold increase. Bitcoin’s participation in the hundreds of billions of dollars in market value also received more attention from mainstream financial markets and the media.

但由于后续利好支撑不足,如区块链应用仅停留在初级阶段,尚未大规模落地,加上市场并不完善,投资工具较少,因此比特币由牛转熊,开启了长达两年的震荡下跌,最低触底3000美元,相较最高点跌幅约83%。

However, due to insufficient follow-up profitability, such as the fact that block chain applications are only in the early stages and have not yet landed on a large scale, coupled with imperfect markets and fewer investment instruments, Bitcoin was set off by a two-year shock drop of $3,000 at the bottom, a decline of about 83 per cent compared to the highest point.

2019年市场回暖,比特币逐渐被机构和大众所熟知。到了2020年,新冠疫情席卷全球,全球市场经济再次出现不确定性,美股多次熔断,经济疲软,以欧美为首的多国央行采用宽松的货币政策刺激经济,面对通货膨胀和美元购买力可能逐步削弱的担忧,投资者们再次将目光落在了具有抗通胀性的比特币身上。

By 2020, the new crown had engulfed the world, the global market economy had resurfaced in uncertainty, the United States stock had smelt, the economy had weakened, the multinational central banks, led by Europe and the United States, had adopted liberal monetary policies to stimulate the economy, and investors had once again turned their eyes on bitcoins, which were anti-inflationary, in the face of fears that inflation and dollar purchasing power might gradually weaken.

与以往不同的是推动此次比特币走牛的投资者不再是散户投资者,而是机构们。自灰度比特币基金信托开启“买买买”模式后,比特币价格不断攀升,再加上各大上市公司的涌入,以及投资工具的日益完善,比特币交易价格不断攀升,轻松越过2017年前高,一路来到了6万美元附近。虽然目前比特币仍处于高位震荡区,但多数投资者认为牛市仍将持续。

Unlike in the past, the investors who pushed the bitcoin out were no longer bulk investors, but institutions. Since the Greytime Bitcoin Trust began the “buy-for-buy” model, Bitcoin prices have been rising, together with the influx of major listed companies and the growing sophistication of investment instruments, Bitcoin trading prices have been rising, easily going up over 2017, reaching around $60,000.

新生事物的发展总是曲折的,但也是不可战胜的。比特币在仅有的12年历史中,经历了被怀疑——被认同——被给予新的希望——被失望——再次被认同的发展过程,且该过程在每一次打破重塑后变得更加坚固,而这一认知反映到比特币价格和市值上就是高点不断抬升,规模日益庞大。

In the only 12 years of history, Bitcoin has gone through a process of development that has once again been recognized — recognized — given new hope — and which has become more solid after every break-up, a recognition that bitcoin prices and market values are rising and growing in size.

过回顾比特币历史价格的变化,我们发现其走势有以下特性:

Looking back at the historical price changes in bitcoin, we find that its trends are characterized by the following:

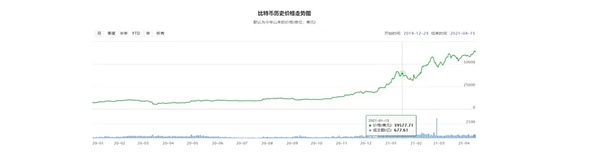

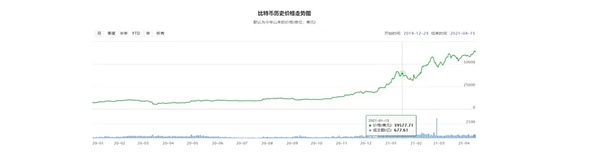

我们把时间维度拉长,以年为单位来看比特币的价格,可以看出,比特币历史价格处于上升趋势。通过观察比特币历史价格发现比特币经历了四次大涨,第一次最高涨到31.90美元,相比上次0.50美元的高点,涨幅达6280%;第二次大涨的高光时刻达到了1177.19美元,相比上次31.90美元,上涨了3590%;第三次大涨,比特币价格达到了19764.51美元,与上次高点相比,上涨了1579%;第四次牛市还在继续,我们以截至目前的最高点64846.90美元计算,跟上次最高点相比涨幅达到了228%。

The historical price of Bitcoin is on the rise, as can be seen from the length of time we have taken to the price of bitcoin in annual units. The historical price of bitcoin was observed to have experienced four major increases, the first up to $31.90, an increase of 6280 per cent compared to the previous peak of $0.50, the second upturn in the light hour of $1177.19, an increase of 3590 per cent compared to the previous one of $31.90, the third up, the price of bitcoin of 19764.51, an increase of 1579 per cent compared to the previous high point, and the fourth up in the cattle market, a rise of 228 per cent compared to the previous peak of $6484.90.

虽然比特币历史上出现过几次明显的价格巨幅波动,但如果把时间线拉长,你会发现这几次涨跌波动幅度在历史的长河中不过如此,实际上,如果我们把比特币的历史高点对应起来,会发现长期持有仍是获利的。比特币一路乘风破浪,不断被市场认同、质疑、修复,其价格也在不断走向新高,刷新着人们的认知。

Although Bitcoin has experienced a number of significant price fluctuations in its history, if you stretch the time line, you will find that these increases and falls are not the same in history. Indeed, if we match the historical heights of Bitcoin, we will find that long-term holdings are still profitable.

之所以说比特币是一个值得长期投资的品种,除了其历史价格走势呈上升之态外,我们不妨拿比特币的走势与标普500、道琼斯指数、黄金、白银、原油的投资收益对比一下。

This is why Bitcoin is a species worth long-term investment, and in addition to the historical upward trend in prices, let us compare the movement of Bitcoin with the return on investment in Puppe 500, Dow Jones Index, gold, silver and crude oil.

上图可以看出,2021年初到3月中旬,原油下跌10%,黄金和白银分别上涨了44%和72%,但比特币再次期间却上涨了754%,收益惊人,远远把其他投资品种甩在了身后。

As can be seen from the above figure, crude oil fell by 10 per cent between the beginning of 2021 and mid-March, while gold and silver rose by 44 per cent and 72 per cent, respectively, while Bitcoin rose again by 754 per cent, yielding impressive returns, leaving other types of investment far behind.

在全球经济充满不确定的情况下,比特币凭借自身价值优势走出了自己独特的行情,欧易官方平台显示比特币最高现货价格达64846.9美元,让人们重新认识其价值,再一次见识到比特币投资的魅力。

In the midst of uncertainty in the global economy, Bitcoin has emerged from its own unique business by virtue of its own value advantage, and Euro-official platforms have shown that the highest spot price of Bitcoin is $64846.9, giving people a fresh sense of its value and once again of the charm of Bitcoin investment.

历史是我们最好的老师,通过回顾比特币的十年价格走势,我们可以从中获得一些对投资者有启发的观点。

History is our best teacher, and by reviewing the ten-year price trends of Bitcoin, we can get some thought-provoking ideas for investors.

首先,长期持有是比特币投资的关键。尽管比特币价格在短期内存在波动,但长期来看,比特币的价格持续上涨。许多投资者意识到了比特币的价值,并选择长期持有。这就提醒我们,在投资比特币时,要有耐心和长远的眼光。

First, long-term holding is the key to Bitcoin investment. Despite the volatility of bitcoin prices in the short term, bitcoin prices continue to rise in the long run. Many investors are aware of the value of bitcoins and opt for long-term holding.

其次,比特币价格的剧烈波动也给投资者带来了风险。通过观察比特币历史价格的涨跌周期,投资者可以更好地把握市场风险。当比特币经历了剧烈的拉升之后,往往会面临下跌的风险。这就提示我们,在投资比特币时,需要时刻关注市场情况,合理把握买入和卖出的时机。

By observing the cycle of historical price increases and falls in bitcoins, investors can better grasp market risks. When bitcoins experience sharp pull-ups, they often run the risk of falling.

此外,即使投资者在比特币价格高点入场,也不必过分担心。根据比特币价格走势来看,只要耐心等待下一个新高的出现,就有机会获得回报。这种观点告诉我们,在投资比特币时,要有耐心和信心,相信未来的机会会出现。

Moreover, even when investors enter at bitcoin price heights, there is no need to worry too much. According to the price trends in bitcoin, there is a chance to pay back if you wait patiently for the next new height.

当然,与以往不同的是,本次比特币牛市的推动力量不再是散户投资者,而是传统金融机构和知名投资人。他们对比特币的未来持积极态度,这也为比特币的发展带来了更多的信心和动力。

Of course, unlike in the past, the driving force of the city of Bitcoin is no longer the investor in the diaspora, but the traditional financial institutions and well-known investors. Their positive attitude towards the future of Bitcoin has also given more confidence and impetus to the development of bitcoin.

据统计,目前有33个机构持有比特币,其中包括17家上市公司、4家非上市公司和12支基金。此外,一些国际互联网巨头也已经支持比特币支付,如微软、PayPal、overstock和万事达卡等。这些力量的加入进一步壮大了比特币的影响力。

According to statistics, 33 institutions currently hold Bitcoin, including 17 listed companies, 4 non-listed companies, and 12 funds. In addition, a number of international Internet giants have supported Bitcoin payments, such as Microsoft, PayPal, Overstock, and MasterCard.

在这样的背景下,投资比特币可能是一个不错的选择。当然,事物的发展总是曲折而前进的。通过回顾比特币的历史价格走势,我们可以看到加密资产投资环境日益合规,投资工具日渐完善,上市公司和大型机构纷纷进场。这让我们相信,比特币正在逐步走向主流。历史总是惊人的相似,但绝不会重演。只要我们在操作上把握得当,就有机会获得远超传统股市的投资回报率。

In this context, investment in bitcoin may be a good option. Of course, things are always going up and down. By looking back at historical price trends in bitcoin, we can see that the investment climate for encrypted assets is becoming more compliant, investment tools are becoming more sophisticated, and listed companies and large institutions are entering the market.

因此,让我们相信比特币的未来十年将会更加精彩!

So let's believe that Bitcoin's next decade will be even better!

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论