php小编苹果币圈blast是近期备受瞩目的话题,它到底是什么?为何能引起如此大的关注?本文将对blast的起因、原因与争议进行解读。blast是一种新兴的加密货币,它以其独特的机制和创新的应用场景而备受推崇。然而,与此同时,blast也引发了一系列争议和质疑。通过对blast的全面解析,我们将揭示其背后的秘密,帮助读者更好地了解这一现象。

The php apple-coins blast is a recent high-profile topic, and what is it? Why so much attention can be drawn to it? This paper will explain the causes, causes and disputes of blast. Blast is an emerging , which is highly appreciated by its unique mechanisms and innovative applications. At the same time, however, blast has given rise to a series of disputes and questions. By providing a comprehensive analysis of blast, we will reveal the secrets behind it and help readers to better understand the phenomenon.

Blast爆火的原因主要有: Pacman在Blur上的成功形成社区效应、机构加持、Blast的裂变玩法以及空投预期。

The main causes of the Blast fires were the community effects of Pacman's success on Blur, institutional hold-ups, Blast's fission play methods and airdrop expectations.

Blast的风险主要体现在技术层面和潜在金融设计层面。

Blast's risks are mainly at the technical level and at the potential financial design level.

Blast是一个Layer2平台,为Layer2账户内的资金提供 passively earning interest (被动生息) 的功能,这对于许多闲置在Layer2上的资金具有很大吸引力。在加密市场中,加密货币可以从代币模式上分为两大类。一类是以比特币为代表的通缩型加密货币,它们的代币数量有固定上限,不会增发。另一类是以以太坊为主的通胀型加密货币,每年会按照固定比例增发,这使得ETH具有3%-4%的稳定质押收益率。而Blast的生息收益正是来自于这一特性。

Blast is a Layer2 platform that provides the function of passive income interest (passive interest) for funds in the Layer2 account, which is attractive for many idle funds on Layer2. In an encrypted market, encrypted currency can be divided into two main categories: representing a deflationary currency with a fixed ceiling on the number of their indents, which does not increase. The other type is

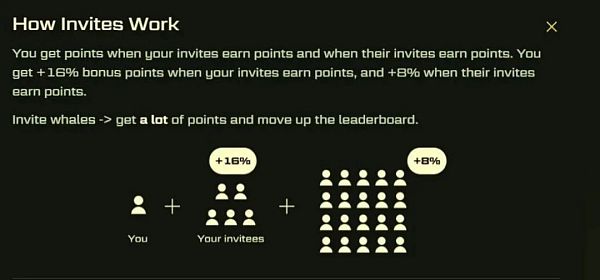

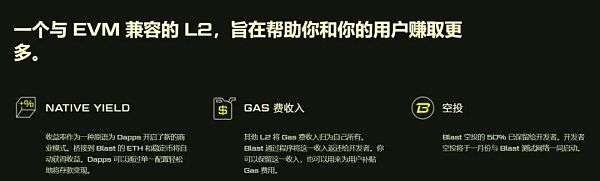

具体而言,当用户将资金存入 Blast 后,Blast 随即将把锁定于 Layer 1 网络上的对应 ETH 用于网络原生质押(目前主要是在Lido上),并将所获得的 ETH 质押收益自动返还给 Blast 之上的用户。除了可参与原生质押的 ETH 之外,Blast 还支持稳定币的被动生息。具体的运作机制为,当用户将稳定币(如 USDC、USDT 和 DAI)桥接至 Blast 后,Blast 随即将把锁定于 Layer 1 网络上的对应稳定币存入 MakerDAO 等美债类 DeFi 协议,并以 USDB(Blast 原生稳定币)的形式将收益自动返还给 Blast 之上的用户。根据Pacman的介绍,Blast 的愿景并不仅仅是为 Blur 服务,而是希望支持所有类型的 Dapp,比如 DEX、借贷、衍生品交易、NFTFi,甚至 SocialFi。 Specifically, when the user deposits the funds into Blast, Blast will then use the corresponding ETH on the Layer 1 network (currently mainly on Lido) for the network's original pledge and will automatically return the proceeds of the ETH pledge to the users above Blast. In addition to the ETH that can be involved in the original pledge, Blast will also support . The operational mechanism is that, when the user connects the stable currency (e.g. USDC, USDT and DAI) to Blast, Blast will then lock up the network < https://www.php.cn/zt/94259.html >, the counterpart currency on the network is deposited into the US debt, such as MankerDIO. 目前,Blast已经完成了由Paradigm和Standard Crypto共同投资的2,000万美元融资。 At present, Blast has completed $20 million in financing co-invested by Paradigm and Standard Crypto. 根据Blast发布的积分图,他们计划在2024年5月进行空投发放,并设立了相应的积分排行(Blast Points)。积分的数量将直接影响参与者在空投中的贡献。空投将分为两个部分,其中早期成员将占总空投量的50%,而开发者则占另外50%。具体的比例分配如下图所示。 The number of points will have a direct impact on the contribution of the participants in the drops. The drops will be divided into two parts, of which the early members will account for 50% of the total, while the developers will account for another 50%. 对于普通用户而言,获得Blast积分主要有两种途径。一是只要资产存入Blast L2网络,二是邀请更多用户参与Blast L2网络。另外,Blast还将根据成功用户推荐的好友数量进行奖励根据Blast官网的信息,用户在成功推荐一段时间将额外获得16%的积分,如果被推荐的人再次邀请其他人,推荐者填写额外获得8%的积分。 For ordinary users, there are two main ways to get a Blast score. First, as long as assets are posted on the Blast L2 network, and then more users are invited to participate in the Blast L2. Furthermore, Blast will reward the number of friends recommended by successful users on the basis of the Blast official network information. Users will receive an additional 16% over a period of time of successful recommendation, and if the recommended person invites others again, the recommended person will fill out an additional 8%. 对于这种空投的期望,很可能是目前 Blast 粉丝追捧的主要原因之一,因为更多的积分意味着未来更多的空投奖励。例如,许多知名人物现在都在积极利用自己的社交平台邀请用户越多,就能提高他们的积分。 Expectations of such drops are likely to be one of the main reasons for the current Blast fans, because more credits mean more air-drop awards in the future. For example, the more users many prominent people are actively using their social platforms to invite. 然而,通过当前的积分排行也可以看出另一个问题,即爆炸的这种玩法似乎有可能逐渐演变成大V/鲸鱼们的天下。对于普通的小散户来说,他们能够拥有多少社交关系(另外参与了,面对这些大V和鲸鱼们的竞争,他们能够获得多少积分呢? However, another problem that can be seen through the current numeric rows is that this explosive game seems likely to evolve into the world of large V/Walfs. How many social relationships do they have for ordinary small swarms (and how many points do they get in the face of competition between these big Vs and whales? 当然,除非你是一名开发者,可以选择复制一些项目的代码并部署到Blast网络上,毕竟有50%的空投额度是分配给开发者的,这方面的竞争可能相对较小。 Of course, unless you are a developer, you can choose to copy some of the project codes and deploy them on the Blast network, after all, 50 per cent of the drop is allocated to developers, where competition may be relatively small. 除了空投自我奖励之外,Blast另一个吸引人关注的重点是其定位能够为用户创造收入的Layer2网络。如下图所示。 In addition to airdrop self-incentives, another interesting focus of Blast is its positioning of the Layer2 network, which can generate income for users. As shown in the figure below. 然而,目前 Blast 中的大部分 ETH 实际上都已存入 Lido 进行质押。换句话说,Blast 的核心功能主要包括以太坊质押和以太。 However, most of the ETHs in Blast are currently in fact placed on bail in Lido. In other words, the core functions of the Blast are mainly the tata pledge and the Ether. 简单来说,Blast当前的核心玩法是:用户将资金存入Blast,然后Blast主要利用Lido平台将这些资金用于在以太坊主网(Layer1)上进行质押。通过这种方式,用户不仅可以获得质押收益,还能获得 Blast 的奖励。不过,从本质上来看,这种质押与用户直接在 Lido 平台上进行质押并没有什么独特的区别。 Simply put, the core of Blast’s current game is that users deposit funds into Blast, and then Blast uses the Lido platform mainly to use these funds for pledge on the Layer 1. In this way, users can receive not only pledge proceeds, but also Blast rewards. However, in essence, there is no unique difference between a pledge and a pledge made directly by users on the Lido platform. 因此,Blast采取这一策略的根本目的似乎是为了提高其总锁仓价值(TVL),吸引更多的用户参与。而用户之所以选择参与,更多地看起来是为了获得额外的Blast奖励。 The underlying purpose of Blast’s strategy, therefore, seems to be to increase its total lockup value (TVL) and to attract more users. Users choose to participate, more often than not, to obtain additional Blast awards. 从金融市场的本质来看,流动性往往会流向那些能够提供最高收益的地方。而Blast正是抓住了这个关键点,目前Blast L2似乎正在引领这种流动性潮流。对于用户而言,即使将加密资产过渡到 Blast 链,稳定币和其他代币(例如 ETH)仍将保留其原有的煤炭,同时还能获得额外的 Blast 奖励,这无疑是一种双重后果。 It seems that Blast L2 is leading the flow of liquidity. For users, even if encrypted assets are transferred to the Blast chain, stabilizing currencies and other tokens (e.g., ETH) will retain their original coal, with additional Blast incentives, a double consequence. 总的来说,用户通过将资产存入Blast,实际上间接参与了ETH的质押,而Blast会直接将质押收益回馈给这些用户和dapp(开发者)。同时,存入Blast的资产余额会自动进行恢复,并且还能从 Blast 的奖励中获得额外的肌肉。 In general, users actually participate indirectly in the ETH pledge by depositing assets in Blast, and Blast returns the pledged proceeds directly to those users and dapp (developmenters). At the same time, the balance of assets deposited in Blast is automatically restored and additional muscles can be obtained from Blast incentives. 另外,除了将 ETH 存入可以获得收益外,将稳定币存入也是一种收益收益的方式。具体来说,当你将 USDC、USDT 和 DAI 等稳定币桥接到 Blast 时,Blast 会增加这些资产存入MakerDAO等协议中,并通过Blast的自动基础稳定币USDB将产生的收益返还给Blast用户。 In addition, depositing a stable currency is also a way of earning the proceeds, in addition to the benefits that can be obtained by depositing an ETH. Specifically, when you receive Blast from a stable currency bridge such as USDC, USDT, and DAI, Blast will increase the amount of these assets in agreements such as MakerDAO and return the proceeds to the Blast user through the Blast's automated base stabilizer USDB. 值得注意的是,参与Blast存入资产的用户将被锁定3个月,直到2024年2月Blast主网正式启动状态。 It is noteworthy that users involved in the Blast deposit of assets will be locked in for three months until the official launch of the Blast main network in February 2024. 不管怎么看,目前 Blast 策略在短期内确实相当有吸引力,从其快速增长的 TVL 数据中可以明显看出。随着越来越多的知名人物开始推广,并且早期参与用户能够获得空投奖励,必然会继续引发更多用户对Blast的FOMO浪潮。至于Blast这种策略和玩法的持续性,以及未来平台是否会面临大量垃圾项目等问题,目前还难以预测,我们将继续关注发展动态! However, the current Blast strategy is quite attractive in the short term, as can be seen from the fast-growing TVL data. As more and more prominent people begin to spread, and as early participants receive air-drop incentives, it will certainly continue to trigger a wave of FOMOs from more users to Blast. 11 月 21 日, Blur 创始人 Pacman 宣布将启动新项目 Blast;截止11月28日,Blast上的质押资金已超5.8亿美元,Blast爆火的原因主要有以下几个方面: On November 21, the founder of Blur Pacman announced that he would launch a new project, Blast; as of November 28, the pledged funds on Blast had exceeded $580 million and the Blast fires were due mainly to the following: 1.Blur的成功为Blast积累了广泛的社区基础。据官方介绍:Blur是目前以太坊上最大的 NFT 市场协议之一,拥有超过33万名用户和价值70亿美元的 NFT 交易。 The success of Blur has built up a broad community base for Blast. According to official sources, Blur is one of the largest NFT market agreements in the Pacific, with more than 330,000 users and $7 billion worth of NFT transactions. 2.机构加持,助推Blast赢得广泛信任。伴随着 Blast 的上线,Pacman 亦宣布该项目已获得了 2000 万美元融资, Paradigm 、 Standard Crypto 、 eGirl Capital 以及 Mechanism Capital 联创 Andrew Kang 、 Lido 战略顾问 Hasu 、The Block CEO Larry Cermak 等若干天使投资人参投。 With Blast on the line, Pacman also announced that the project had received US$ 20 million in funding, with several Angel investors, including Paradigm, Standard Crypto, eGirl Capital and Mechanism Capital, Andrew Kang, Lido Strategic Advisor Hasu, The Block CEO Larry Cermak. 3.Blast自身的裂变玩法和空投预期也促使其快速吸金。参与者可以通过邀请获得积分,被邀人获得积分时,邀请人同样可以获得积分。在第一层邀请关系下,邀请人将获得+16%的奖励积分,在第二层邀请关系下,邀请人可以获得+8%的奖励积分。关于积分的描述,官方表示 Blast 计划于明年 2 月 24 日上线主网并开发提款, 5 月 24 日开放 Blast Points 的“赎回”。 Blast's own fission game and airdrop expectations also contribute to its rapid infusion of gold. Participants can obtain credits by invitation, and invitees can obtain credits. Under the first-tier invitation, invitees will receive +16% of the credits, and under the second-tier invitation, invitees will receive +8% of the credits. With regard to the description of the credits, the official indication is that Blast plans to go to the main network next February 24 and to develop a withdrawal, and the “foreclosure” of Blast Points will be opened on May 24. Blast的风险目前整体看主要是体现在技术层面的多签等问题和潜在金融设计风险两方面。多签等技术问题团队目前也在积极努力,这个有待主网上线后进一步观测;金融设计风险在于,Blast的生息设计基于以太坊原生应用Lido以及MakerDao等,这体现出以太坊应用的积木效应,但是一旦底层应用发生风险,那么无可避免将发生系统性风险。 The risk of Blast as a whole is now mainly reflected in issues such as oversigning at the technical level and potential financial design risks. The task force on technology issues, such as signing, is also working actively, and this is yet to be further observed on the main web line; the risk of financial design is that Blast’s interest-generating design is based on the indigenous applications of Lido and MakerDao, which reflect the build-up effect of the application, but if there is a risk at the bottom, systemic risks are inevitable. 在技术层面,目前市场对Blast争议比较大的就是多签等技术问题。L2Beat 指出,尽管 Blast 合约(0x5f…a47d)被称为 LaunchBridge,但其实际并不是一个 Rollup Bridge,而是一个由 3/5 多签地址保护的简单托管合约;Blast 还不具备 L2 状态根所必须附有的有效性证明,或者必须有一个防欺诈机制。Polygon 开发者关系工程师 Jarrod Watts 也进一步指出,Blast 多签合约的 5 名签名者都是新地址,身份未知;Blast 并不是 L2,没有测试网、交易、bridge、回滚和将交易数据发送至 Ethereum;以及该合约批准任意的「mainnetBridge」合约花费其 Lido 和 DAI 的最大可能数量。 At the technical level, the market is currently more controversial with Blast than with multiple signatures. L2Beat points out that although the Blast contract (0x5f...a47d) is known as Launchbridge, it is not actually a Rollup Bridge, but a simple hosting contract protected by three-fifths of multiple addresses; Blast does not have the proof of validity that the L2 status root has to accompany, or must have a fraud-prevention mechanism. Polygon Developer relationship engineer Jarrod Watts further states that the five signatures to the Blast contract are new and unknown; Blast is not L2, and there is no test network, transaction, Bridge, rollback and transmission of transaction data to Etheum; and the contract approves an arbitrary "mainnetbridge" contract to spend the largest possible number of Lido and DAIs. 对于技术派的质疑,Blast开始发声辩解。27日,Blast在X平台发文表示,安全是多方面的,涉及智能合约、浏览器和物理安全维度。不可变的智能合约通常被认为更安全,但可能会带来更大的风险,尤其是在复杂的协议中。当涉及可升级的智能合约时,具体的升级机制非常重要。具有时间锁的可升级智能合约可能存在漏洞。在很多情况下,避免漏洞被利用的唯一方法是在恶意行为者之前执行链上操作。在这些情况下,时间锁会使智能合约的安全性降低。这就是为什么每个L2都有直接升级的途径。此外,Blast强调了多重签名安全性的有效性,Arbitrum、Optimism和Polygon等其他L2项目也使用多重签名机制。 In many cases, the only way to avoid loopholes is to operate on chains before malicious actors. In these cases, time locks reduce the security of smart contracts. That is why every L2 has a direct way of upgrading. Moreover, Blast stresses the effectiveness of multiple signatures security, and other L2 projects, such as Arbitrum, Optimism and Polygon, also use multiple signature mechanisms. 从金融设计维度看,Blast其实是将L2的安全性建立在两个项目上(Blast拿L1上的以太坊质押在Lido上生息;Blast的原生稳定币希望通过MakerDAO的渠道获得美国国库券的收益)。11月22日,Lido DAO贡献者发文表示:意识到一个早期平台漏洞,该漏洞影响了在过去几个月中使用以太坊上Lido的活跃节点运营商InfStones。该漏洞由dWallet Labs于2023年7月向InfStones披露。目前该节点运营商已宣布该漏洞得到解决。除了技术问题,MakerDao还要面临监管问题,如果发生这会连带把Blast拖下水。 In terms of financial design dimensions, Blast actually built the security of L2 on two projects (Blast took L1 as a stake in Lido; Blast’s raw stabilizer wanted to get the US Treasury bill through MakerDAO’s channel). On November 22, Lido DAO’s contributor wrote that it was aware of an early platform gap that affected the use of InfStones, an active node operator at Lido’s in the past few months. The gap was revealed to InfStones by dWallet Labs in July 2023. The current node operator had announced that the gap had been resolved. In addition to technical problems, MakerDao was facing regulatory problems, which could lead to Blast being dragged down by it. 从创新维度看,Blast确实有一定金融创新,其提出的无风险利率确实可以为闲置资金找一个“好去处”。但是,Blast显得过于着急,其目前确实很难称之为Layer2。正如,Paradigm批评的那样: “(Blast)给其他项目开了一个很不好的先例,且过度的营销也有损于团队的严肃形象”。从金融设计层面看,Blast与Lido和MakerDao绑定较深,这虽然带来了明显的好处,但也无形中增加了潜在且自身不可控的金融风险。 As Paradigm has criticized: “(Blast) sets a bad precedent for other projects, and excessive marketing undermines the serious image of the team.” At the financial design level, Blast is tied to Lido and MakerDao more deeply, which, while providing obvious benefits, increases the potential and inherent uncontrollable financial risk. 以上就是币圈Blast是什么?一文解读Blast爆火之下的原因与争议的详细内容,更多请关注php中文网其它相关文章! What is this, Blast of the Currency Circle? Read the details of the cause and controversy under the Blast fire, and focus more on other relevant articles in php in Chinese!

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论