作者| 黑米,白澤研究院

Hemi, Baekzawa Institute.

DeFi 正在通過對房地產、藝術品等實物資產進行代幣化來改變格局。

DeFi is changing the pattern through the monetization of real-estate goods such as real estate, art, etc.

真實世界資產(RWA) 代幣化是一個將有形資產轉換為代幣或NFT 的過程,使它們能夠在鏈上進行交易。

Real world assets (RWA) monetization is a process of converting tangible assets into tokens or NFTs, allowing them to trade on the chain.

這為投資者開闢了新的機會,因為RWA 有可能提供與加密市場無關的可持續收益,對於尋求多元化投資的投資者來說,這是一個很有吸引力的選擇。而鏈上資本正是要尋求這樣可持續、安全的收益機會,因此RWA 代幣化能夠成為下一次DeFi 牛市的催化劑。

This opens up new opportunities for investors, because RWA may provide sustainable benefits that have nothing to do with the encryption market, which is an attractive option for investors seeking diversified investment. And the chain capital is looking for sustainable and safe returns, so RWA intergenerationalization can be a catalyst for the next DeFi cow market.

RWA 代幣化也有助於釋放流動性,讓資金從傳統市場自由流入加密領域,提升DeFi 的潛在價值。

RWA monetization has also helped to free the flow of funds from traditional markets into encrypted domains and enhance the potential value of DeFi.

如今,各個資產提供商開始走上RWA 代幣化敘事的舞台,在房地產、貴金屬、奢侈品、氣候、私人/公共固定收益、新興市場和貿易融資等行業創造出對代幣化的需求。

Today, various asset providers have begun to move to the RWA monetization arena, creating demand for monetization in real estate, precious metals, luxury goods, climate, private/public fixed revenues, new markets and trade finance.

例如,房地產代幣化——將房地產的部分所有權代幣化,使投資者能夠輕鬆投資,持有者不僅擁有了部分比例的所有權,還可以獲得房地產租金收入。同時房主也籌集到了資金。

For example, real estate monetization – the monetization of part of real estate ownership – allows investors to invest easily, not only with a share of ownership, but also with income from real estate rental.

隨著DeFi 基礎設施項目的成熟,RWA 代幣化獲得了進一步發展和創新。

With the maturity of the DeFi infrastructure project, RWA monetization has been further developed and innovative.

MakerDAO、Aave 和Chainlink 等開創性項目正在帶頭探索DeFi 領域內RWA 的潛力。

Creative projects such as MakerDAO, Aave and Chainlink are leading the search for RWA potential in the DeFi domain.

雖然對RWA 的監管尚不確定,但這一敘事的長期潛力仍然很大,能夠重塑DeFi 格局並為加密市場和傳統市場帶來價值。因此,請密切關注這個敘事的後續發展。

Although there is no certainty about RWA’s supervision, the long-term potential of this conversation is still great, allowing it to reshape the deFi pattern and bring value to the encrypted market and traditional market. Therefore, follow closely the continuation of this conversation.

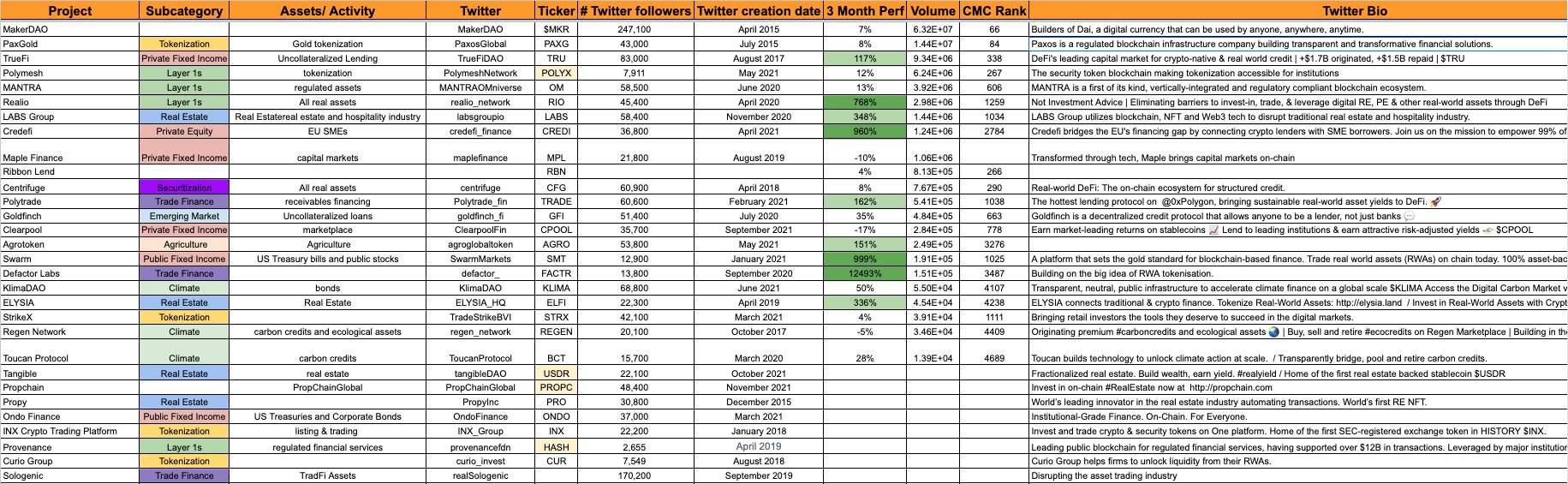

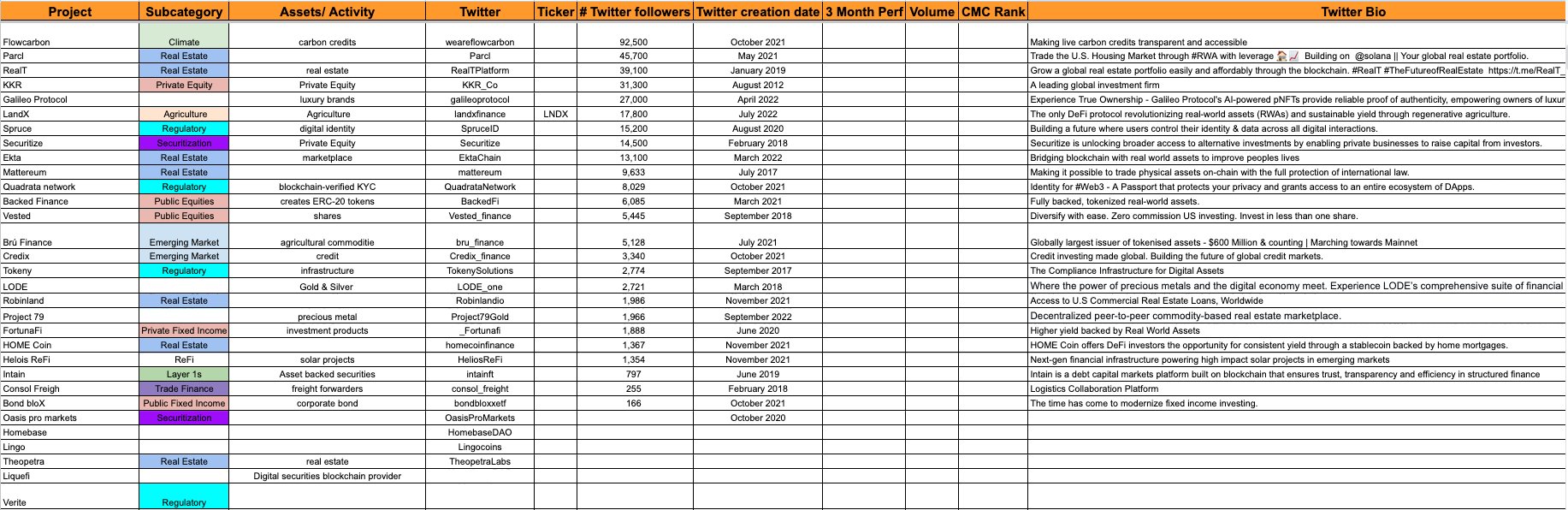

根據加密研究員Crypto Koryo 的整理和匯總,目前市面上的RWA 項目超過50 個,一些項目的原生代幣,例如$CREDI、$SMT 和$FACTR 在過去3 個月內上漲了10 倍以上。不過,大多數項目還沒有推出代幣。因此,這一敘事目前還有哪些機會?下面讓我們進一步探索。

According to encryption researcher Crypto Koryo, there are currently more than 50 RWA items on the market, and some items, such as $CREDI, $SMT and $FCTR, have increased more than 10 times over the last three months. Most of the items, however, have not yet been introduced. So, what are the opportunities for this to happen?

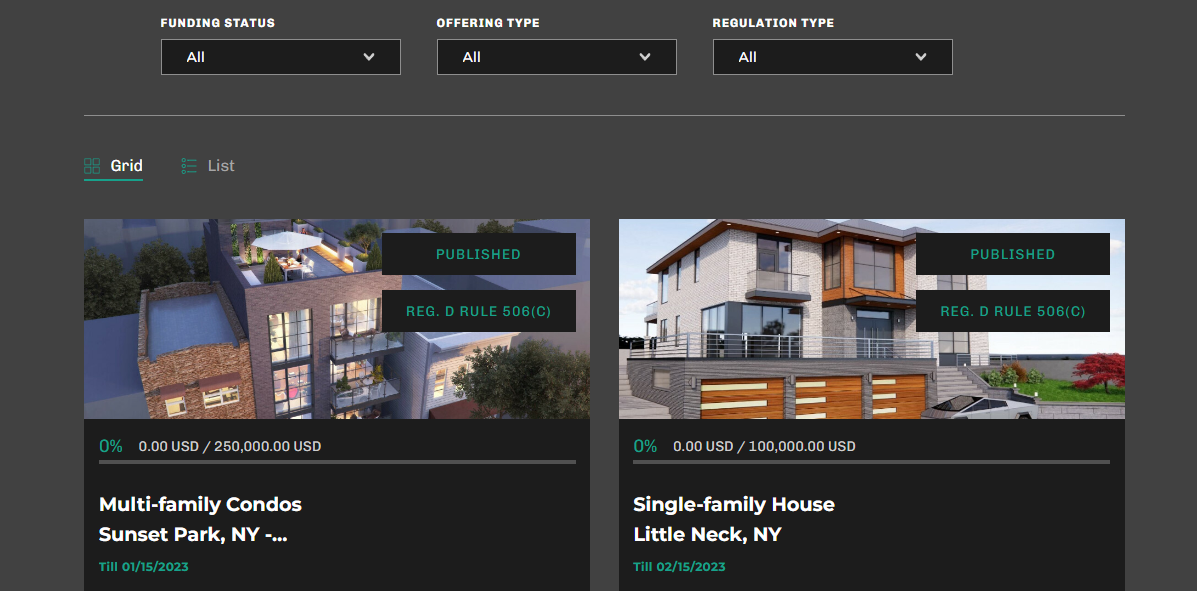

LABS Group ($LABS)

LABS Group 是一個房地產代幣化平台,允許房主將自己的房屋代幣化以在沒有中介的情況下籌集資金,投資者也能通過二級市場接觸到其他更高流動性的房地產代幣。

LABS Group is a real estate monetization platform that allows landlords to monetize their houses to raise funds without intermediaries, and investors can access other more fluid real estate coins through the second-tier market.

此外,LABS Group 還推出了一個Web3 度假平台Staynex,使度假村、酒店和別墅能夠代幣化為NFT——Staynex 通行證。 Staynex 通行證為持有人提供了實用性,不僅可以使他們能夠靈活地進行全球旅行,隨時住店,還可以從房間租賃中獲得收益。

In addition, LABS Group has launched a Web3 vacation platform, Staynex, which allows resorts, hotels, and villas to be monetized as NFT-Staynex passes. Staynex passes provide users with practical benefits, not only to enable them to travel lively around the world, to stay in shops at any time, and to benefit from room rentals.

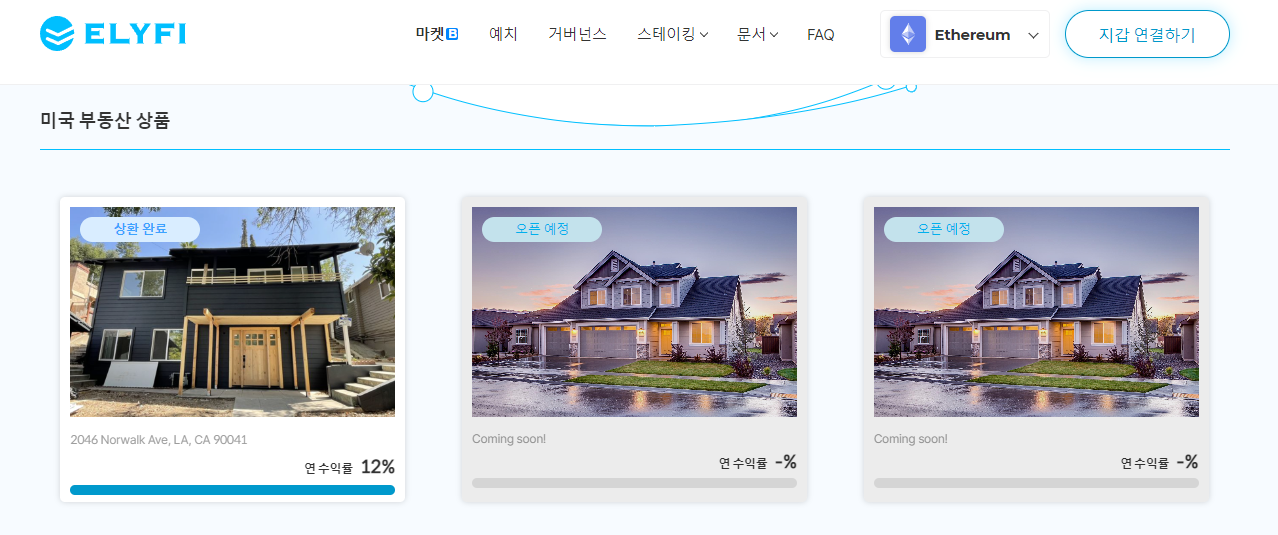

ELYSIA ($ELFI)

ELYSIA 是一種將RWA 代幣化的協議,使RWA 更容易在區塊鏈上變現。用戶可以將自己的RWA 創建為代幣,然後在ELYSIA 的DeFi 平台ELYFI 上出售,或作為抵押品借出其他加密資產。

ELYSIA is an agreement to monetize RWA, making it easier for RWA to become a part of the chain. Users can create their RWA as a currency and then sell it on ELYFI at ELYSIA's DeFi platform, or lend other encrypted assets as collateral.

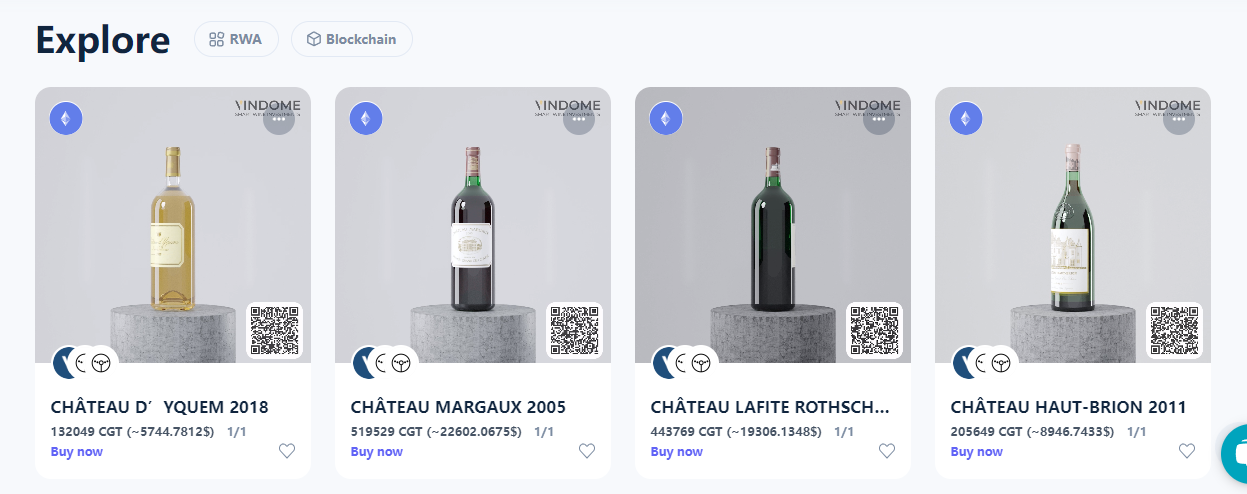

Tangible($TNGBL)

Tangible 是一個RWA 代幣化生態系統。通過推出一個由房地產支持的原生收益穩定幣Real USD,為用戶提供了接觸RWA 代幣化的途徑。

Tangible is an RWA monetic chemosynthetic system. Real USD provides users with access to RWA monetization by introducing a real-estate-supported primary revenue stabilization currency.

在Tangible 上,任何人都可以使用Real USD 從世界領先的供應商處購買有價值的實物商品,包括但不限於藝術品、高檔葡萄酒、古董、手錶、奢侈品。

On Tangible, anyone can use Real USD to purchase valuable goods from world-led suppliers, including but not limited to art, high-quality wine, antiques, watches, luxury goods.

當用戶購買在Tangible 上列出的RWA 後,將鑄造TNFT(“Tangible non-fungible token”),代表實物。 Tangible 會將實體物品存入實體保險庫中,並將TNFT 發送到買家的錢包。 TNFT 可自由轉賬、交易。

When users buy RWAs listed on Tangible, they make TNFT (“Tangible non-fundible token”) to represent the reality. Tangible will deposit the physical items in the physical vault and send TNFT to the buyer’s wallet. TNFT can freely transfer accounts, transactions.

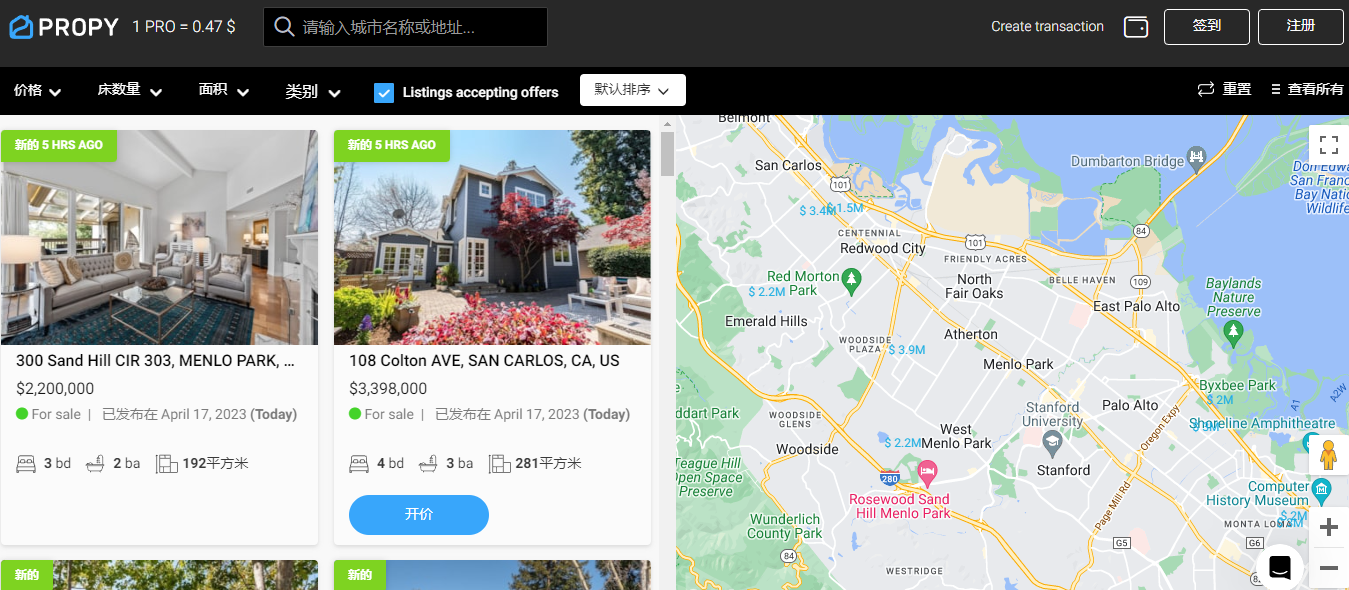

Propy ($PRO)

Propy 為買家、賣家、代理人提供了一個基於區塊鍊和智能合約的房地產交易平台,有助於即時交易,減少欺詐。目前,該平台與分佈在美國各地的房地產合作夥伴處理了超過40 億美元的交易。

Proppy provides buyers, sellers, and agents with a real-estate trading platform based on chains and smart contracts, which helps to trade instantaneously and reduce fraud. Currently, the platform handles over $4 billion in transactions with real-estate partners located across the United States.

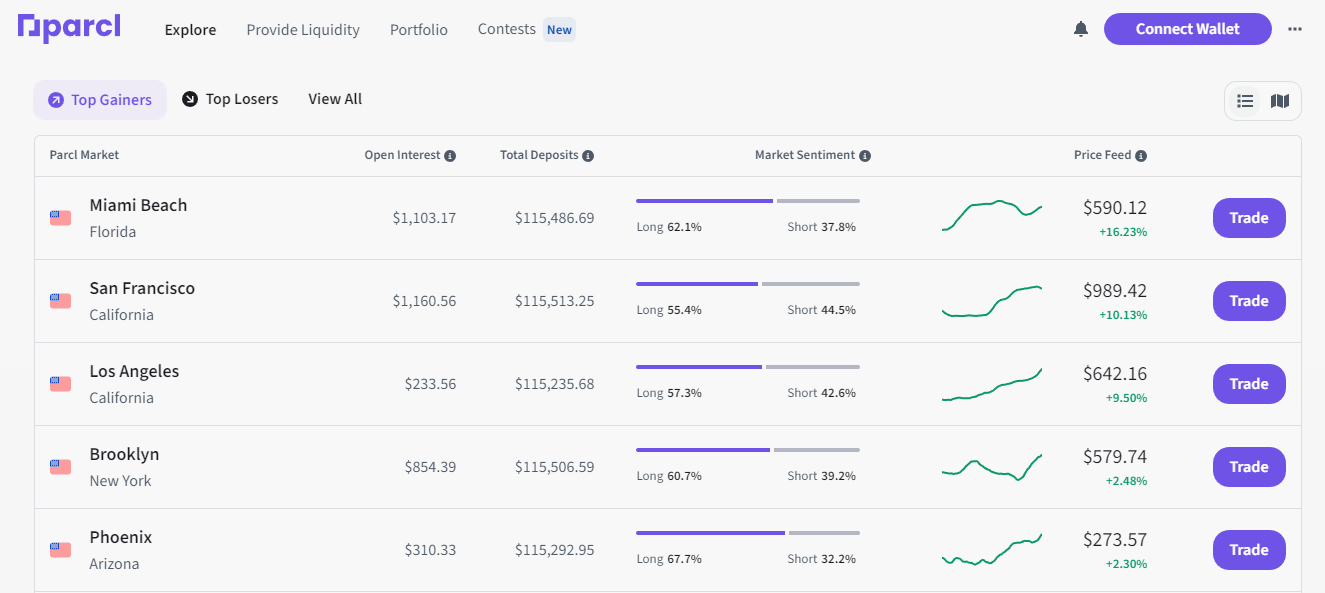

Parcl

Parcl 是一個專注於房地產的合成資產交易平台,提供了可投資於全球房地產市場的價格走勢,用戶可以瀏覽全球房地產市場,並根據他們認為房地產價值的漲跌來做多或做空。

Parcl, a synthetic property trading platform focused on real estate, provides price movements that can be invested in the global real estate market, allows users to browse at the global real estate market and to do more or less nothing according to what they consider to be a rise in the value of real estate.

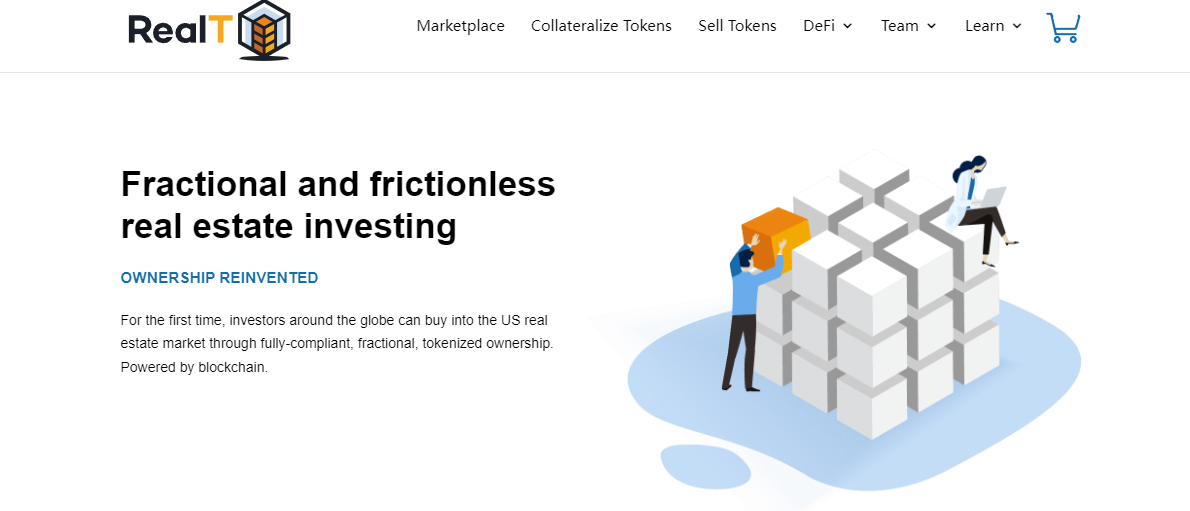

RealT

RealT 成立於2019 年,在此後3 年多的時間裡,該平台已經處理了超過5200 萬美元的房地產代幣化,投資者可以簡單的購買RWA 代幣。已經有970 多個房屋在RealT 平台上代幣化,位置分佈在美國底特律、克利夫蘭、芝加哥、托萊多和佛羅里達等州。

RealT was founded in 2019, and more than three years after that, the platform has dealt with more than $52 million in real estate monetization, and investors can simply buy RWA. More than 970 houses have been monetized on the RealT platform in Detroit, Cleveland, Chicago, Toledo and Florida.

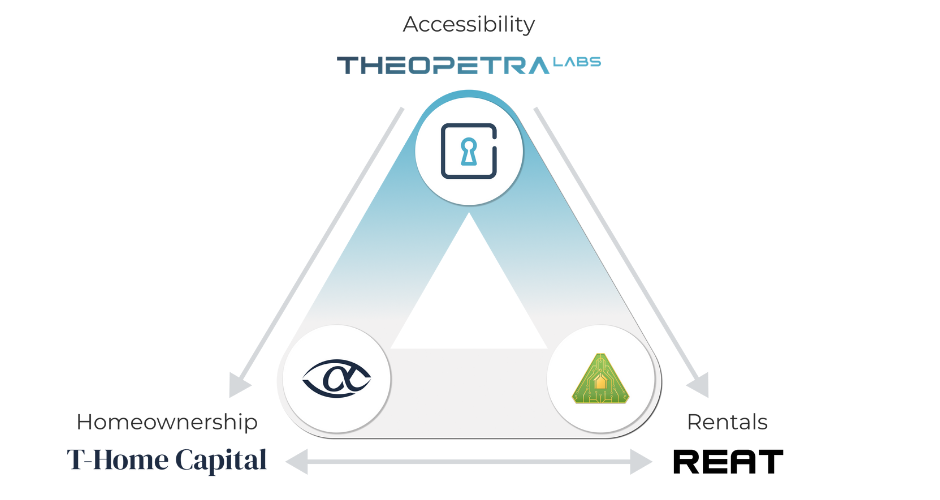

Theopetra

Theopetra 及其合作夥伴T-Homes、REAT 將圍繞$THEO 代幣構建一個房地產生態系統,旨在讓美國底層人租得起住宅。

Theopetra and its partners T-Homes, REAT, will construct a premises generation system around $THEO in order to make the United States sub-classes affordable.

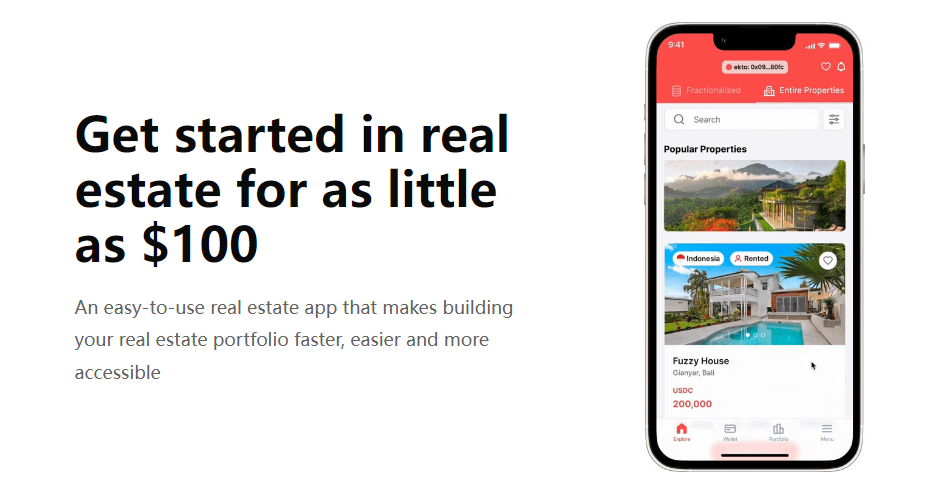

EktaChain

EktaChain 是一個基於區塊鏈的去中心化房地產交易平台,旨在讓每個人更快、更容易地從事房地產業務。該平台允許所有人以低至100 美元的金額交易房地產。

Ektachain is a sector-based decentralised real estate trading platform designed to make it easier for everyone to do real estate business faster and easier. The platform allows everyone to trade real estate at a value of up to $100.

Mattereum

Mattereum 是一個可以將RWA 代幣化為NFT 的平台,包括奢侈品、藝術品、房地產。每筆NFT 交易背後都包含有一個簡易的法律框架來處理出現的任何爭議,並且它適用於160 多個國家法律。

Mattereum is a platform that can convert RWA moneys into NFTs, including luxury goods, artifacts, and real estate. Each NFT transaction, behind its back, contains an easy legal framework to deal with any disputes that arise, and it applies to more than 160 national laws.

Robinland

Robinland 的使命是為房地產行業搭建一個TradFi 和DeFi 之間的橋樑。通過對高質量、可產生租金的商業房地產資產進行代幣化,可讓其從個人投資者或MakerDAO 等機構貸方那裡獲取流動性。

Robinland’s mission is to build a bridge between TreadFi and DeFi for real estate. By monetizing high-quality, rent-generating commercial real estate properties, it can gain fluidity from individual investors or institutional lenders like MakerDAO.

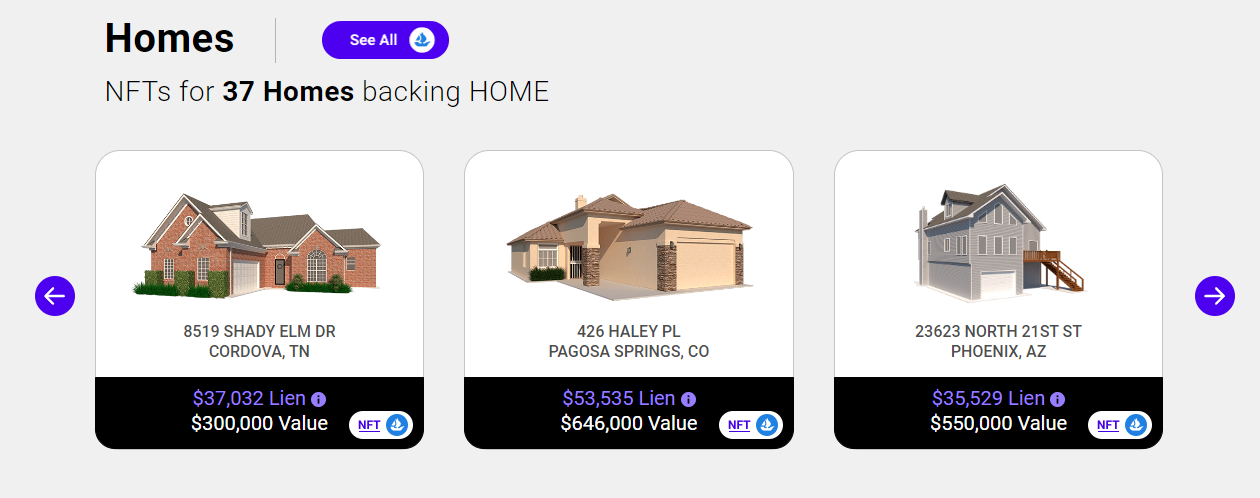

HOME Coin Finance

HOME Coin Finance 為投資者提供了通過住房抵押貸款支持的穩定幣$HOME 中獲得穩定收益的機會。

HOME Coin Finance provides investors with the opportunity to secure a steady return from a stable dollar of HOME supported by mortgage loans.

Paxos ($PAXG)

Paxos 是一個區塊鏈金融基礎設施平台,為企業客戶提供資產代幣化、託管、交易、結算等服務,使任意資產在任何時候都能夠實現可信和即時的轉移。

Paxos is a chain-based financial infrastructure platform that provides corporate clients with services such as monetization, trusting, trading, accounting, etc., so that at any given time any asset can be reliably and immediately transferred.

雖然美國監管機構在今年2 月份迫使Paxos 停止鑄造美元穩定幣$BUSD,但該平台仍在推廣其黃金錨定幣$PAXG (PAX Gold)。 Paxos 早在2019 年就發行了$PAXG,在此後的三年多里,它已經悄然增長到約5 億美元的市值。與代表黃金的ETF 不同的是,$PAXG 代表了持有者持有著實物黃金,並且可以隨時贖回1:1 的實物黃金。

Although US surveillance agencies forced Paxos to stop molten dollar-fixing $BUSD in February this year, the platform continues to promote its golden anchor $AXG (PAX Gold). Paxos issued $PAXG as early as 2019, and over the next three years, it has dramatically increased its market value to about $500 million. Unlike the ETF, which represents gold, $AXG represents holders holding real gold and can at any time redeem 1:1 gold.

值得一提的是,Paxos 是融資最多的區塊鏈公司之一,總融資額超過5 億美元,主要投資者包括OakHC/FT、Declaration Partners、Mithril Capital 和PayPal Ventures。

It is worth mentioning that Paxos is one of the most heavily financed chain companies in the region, with more than $500 million in total, with major investors including OakHC/FT, Development Partners, Mithril Capital and PayPal Ventures.

Tokeny Solutions

Tokeny 提供企業級的代幣化基礎設施,允許企業合規地發行、轉移和管理區塊鏈上的資產,使他們能夠提高資產流動性。

Tokeny offers corporate-level monetized infrastructure that allows companies to systematically release, transfer and manage assets on the chain, enabling them to increase their productivity.

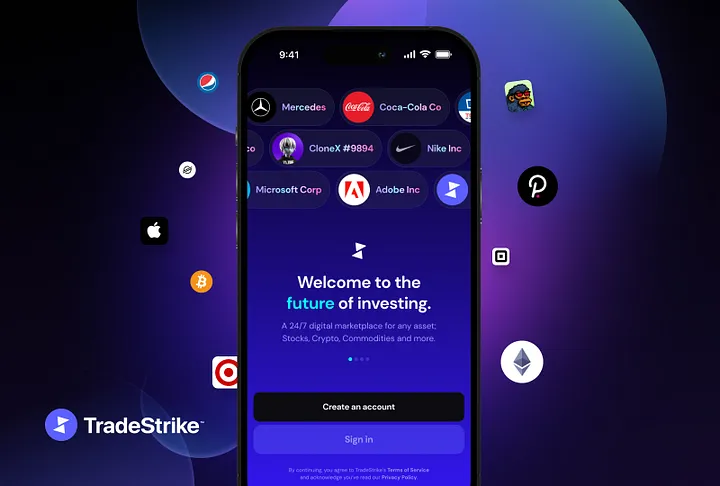

StrikeX ($STRX)

StrikeX 是一個RWA 代幣化生態系統,產品包括:

StrikeX is an RWA monetic chemistry system that includes:

? TradeStrike(RWA 代幣中心化交易平台,CEX)

♪ TradeStricke (RWA Money Centralized Trading Platform, CEX)

? Stock Token Bridge(RWA 代幣創建平台)

♪ Stock Token Bridge

? StrikeX 錢包

♪ StrikeX Wallet

? TradeX(RWA 代幣去中心化交易平台,DEX)

♪ TradeX (RWA decentralised trading platform, DEX)

? Xchain(服務於StrikeX 生態系統的私有區塊鏈)

♪ Xchain (private chain for StrikeX ecosystem)

? $STRX(StrikeX 生態系統原生代幣)

$STRX.

INX ($INX)

INX 為RWA 代幣和加密貨幣提供了一個符合美國SEC 監管的交易平台。

INX provides RWA tokens and encrypted currency with a trading platform consistent with US SEC supervision.

Curio ($CUR)

Curio 是一個RWA 代幣化生態系統,產品包括:

Curio is an RWA monetic chemistry system, which consists of:

? Rollapp(RWA 代幣創建平台)

♪ Rollapp ♪

?CurioInvest(將限量版汽車代幣化,用戶可共同投資,分享利潤)

#CurioInvest

? $CSC(瑞士法郎穩定幣)

♪ $CSC (Swiss franc steady)

? CapitalDEX(RWA 代幣去中心化交易平台,DEX)

♪ CapitalDEX (RWA decentralised trading platform, DEX)

? Wrapped Fractional Physical-NFTs(所有權、知識產權代幣化)

♪ Wrapped Fractional Physical-NFTs

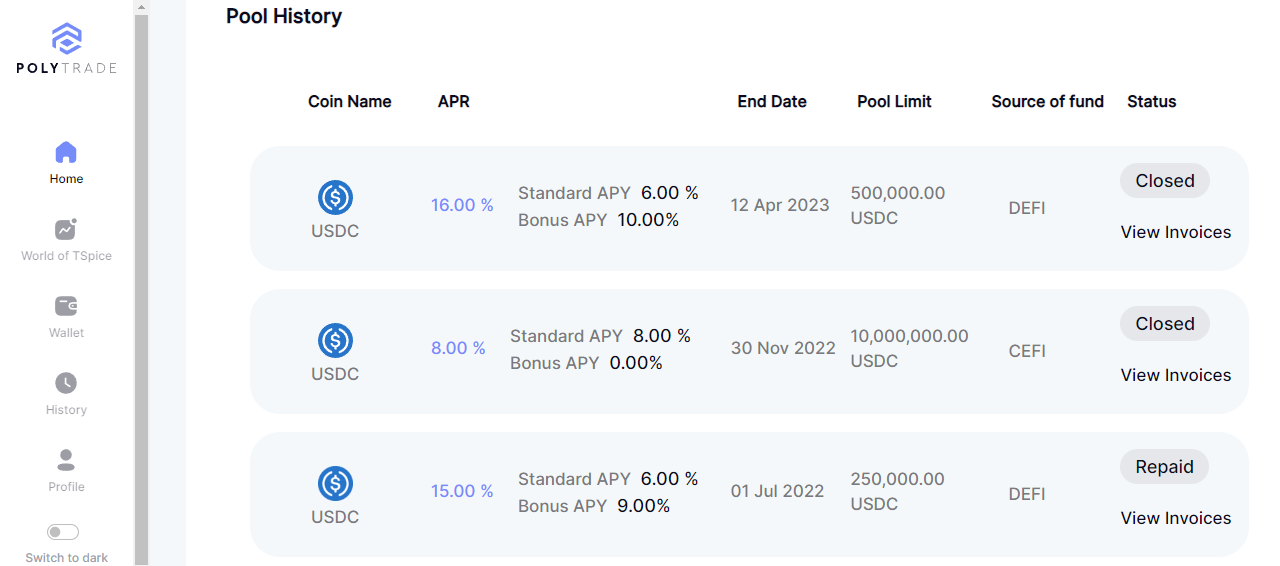

Polytrade ($TRADE)

Polytrade 構建了一個去中心化貿易融資平台,旨在為多個行業的企業提供無縫貸款。

Polytrade has built a decentralised trade finance platform designed to provide seamless loans to a number of businesses.

Defactor ($FACTR)

Defactor通過將傳統融資與DeFi 聯繫起來,旨在為企業提供融資機會和流動性。

The aim of Defactor is to provide opportunities and mobility for companies by linking traditional financing to DeFi.

Sologenic

Sologenic 是一個RWA 代幣化生態系統,產品包括:

Sologenic is an RWA monetic chemistry system that consists of:

? Sologenic Asset Tokenization(RWA 代幣中心化交易平台,CEX,將對40,000 多隻股票、ETF 和商品進行代幣化)

♪ Sologenic Asset Tokenization (RWA Monetized Trading Platform, CEX, will monetize more than 40,000 stocks, ETFs and commodities)

?Sologenic DEX(RWA 代幣去中心化交易平台,DEX,也可交易上述代幣化資產)

♪ Sologenic DEX (RWA Decentralized Trading Platform, DEX, also trading in the above-mentioned monetized assets)

?Sologenic NFT 市場

♪ Sologenic NFT market

?Sologenic 錢包

♪ Sologenic wallet

ConsolFreight

ConsolFreight 是一家專注於航運業數字化轉型的區塊鏈平台,提供貿易融資和貨物保險服務。

ConsolFreight is a link platform dedicated to the digital transformation of the shipping industry, providing trade and cargo insurance services.

Polymesh Network ($POLYX)

Polymesh 是專門為RWA 代幣而構建的機構級許可區塊鏈。亮點:

Polymesh is an institutional permit chain built specifically for RWA tokens. Highlights:

?將治理、身份、合規性、機密性納入區塊鏈的核心。

♪ Put governance, identity, regularity, confidentiality at the core of the chain. ♪

?所有參與者——無論是代幣發行商、投資者、節點運營商,都必須先通過去中心化的KYC 驗證。

#All those involved – money issuers, investors, nodes, must first pass the decentralised KYC test.

? 節點運營商必須是金融實體。

♪ Node operators must be financial entities. ♪

? 原生代幣$POLYX 被瑞士法律歸類為實用型代幣。 (根據瑞士金融監管機構FINMA 的指導)

# The original currency $POLYX is classified by Swiss law as a real-use currency. (Under the guidance of the Swiss Financial Supervisory Authority FINMA)

MANTRAO ($OM)

MANTRA Chain 是一個基於Cosmos SDK 構建的L1 區塊鏈,旨在成為一個企業之間相互協作的網絡,吸引企業、開發人員構建從NFT、遊戲、元宇宙到合規的DEX 等任何應用程序。

ManTRA Chain is an L1 chain based on Cosmos SDK, designed to be a network of firms working together to attract firms, developers and developers to build any application from NFT, games, meta-cosmos to a regular DEX.

MANTRA Chain 上的第一個dApp 是MANTRA Finance,其目標是成為一個全球監管的DeFi 平台,將DeFi 的速度和透明度帶到不透明的TradFi 世界,允許用戶發行、交易RWA 代幣。

The first dApp on ManTRA Chain is ManTRA Finance, which aims to be a globally supervised DeFi platform, bringing the speed and transparency of DeFi to the opaque TreadFi world, allowing users to issue and trade RWA coins.

Realio Network ($RIO)

Realio Network 是一個可互操作的L1 區塊鏈,專注於RWA 代幣的發行和管理。

RealioNetwork is an interoperable L1 chain focused on the issuance and management of RWA coins.

Provenance ($HASH)

Provenance 是一個創建於2018 年,基於Cosmos SDK 構建的L1 區塊鏈,旨在使金融機構和金融科技公司能夠無縫、安全地發行、交易金融資產代幣。

Provenance is a chain of L1 built from Cosmos SDK in 2018, designed to enable financial institutions and financial technology companies to issue and trade financial assets in a seamless and safe manner.

在此後的發展中,該鏈使60 多家金融機構、金融科技公司、DeFi 以及銀行、信用合作社能夠大規模發行、管理和交易金融資產代幣。截至2023 年,Provenance 處理了超過120 億美元的金融資產交易。

Since then, the chain has enabled more than 60 financial institutions, financial technology companies, DeFi, and banks and credit unions to issue, manage, and trade in financial assets. As of 2023, Provence handled more than $12 billion in financial assets.

Intain

Intain 是一個專注於融資、信貸的L1 區塊鏈。

Intain is a chain of L1 that focuses on capital, credit and credit.

KlimaDAO ($KLIMA)

KlimaDAO 為個人和組織提供了通過其基礎設施和由真實碳資產支持的$KLIMA 代幣直接參與碳信用市場的機會。

KlimaDAO provides individuals and organizations with the opportunity to participate directly in the carbon credit market through its foundation-based and real carbon-supporting $KLIMA tokens.

KlimaDAO 旨在解決碳信用市場的關鍵問題:

KlimaDAO aims to address key issues in the carbon credit market:

?流動性不足:碳信用有許多不同的種類;不同的中介,分割碳市場的總流動性。

There are many different types of carbon credits, and different intermediaries, which divide the general flow of the carbon market.

?不透明

♪ It's not transparent

?效率低下

♪ Inefficiency

Regen Network ($REGEN)

Regen 旨在使用區塊鏈、DeFi 和其他Web3 工具成為全球可再生生態系統的催化劑。用戶通過購買、交易碳信用代幣和生態信用,為可再生項目提供資金。

Regen aims to use sector chains, DeFi and other Web3 tools as catalysts for the global renewable ecosystem. Users finance renewable projects by buying, trading carbon in foreign currency and living credit.

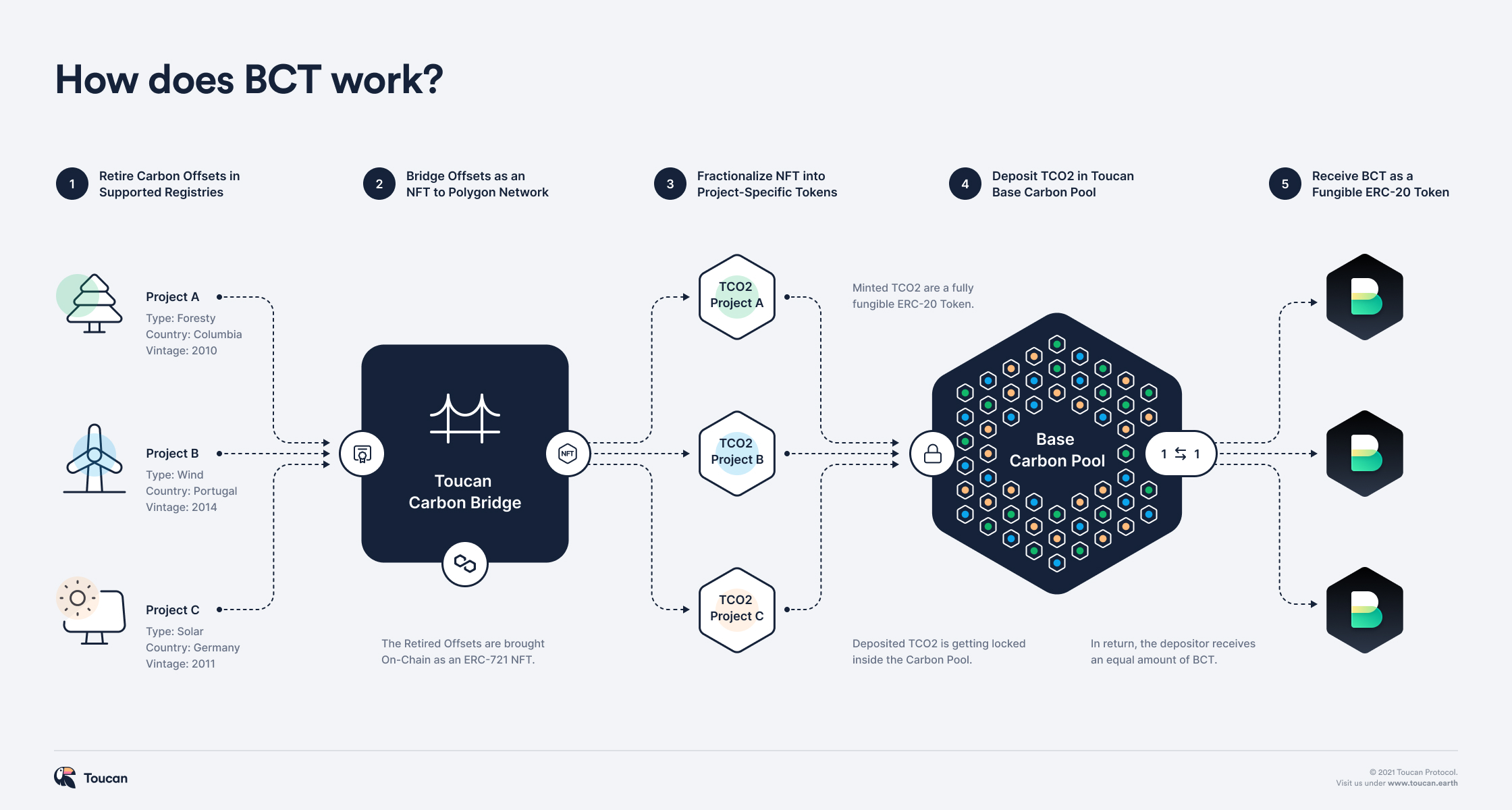

Toucan Protocol ($BCT)

個人、企業可以通過使用Toucan 的基礎設施將碳信用額轉化為代幣,擴大對地球的保護。

Individuals and businesses can expand the protection of the planet by converting carbon credits into tokens using the Toucan infrastructure.

Flow Carbon

Flow Carbon 是一個將碳信用額代幣化的平台,有助於提高透明度和流動性,幫助擴大碳信用市場。

Flow Carbon is a platform for monetizing carbon credits, helping to increase transparency and mobility and to expand the carbon credit market.

Agro Global Token ($AGRO)

Agro Global Token 是一個加密貨幣,旨在為農業問題提供解決方案並進行大量投資。

Agro Global Token is an encrypted currency designed to provide solutions to agricultural problems and to invest heavily in agriculture.

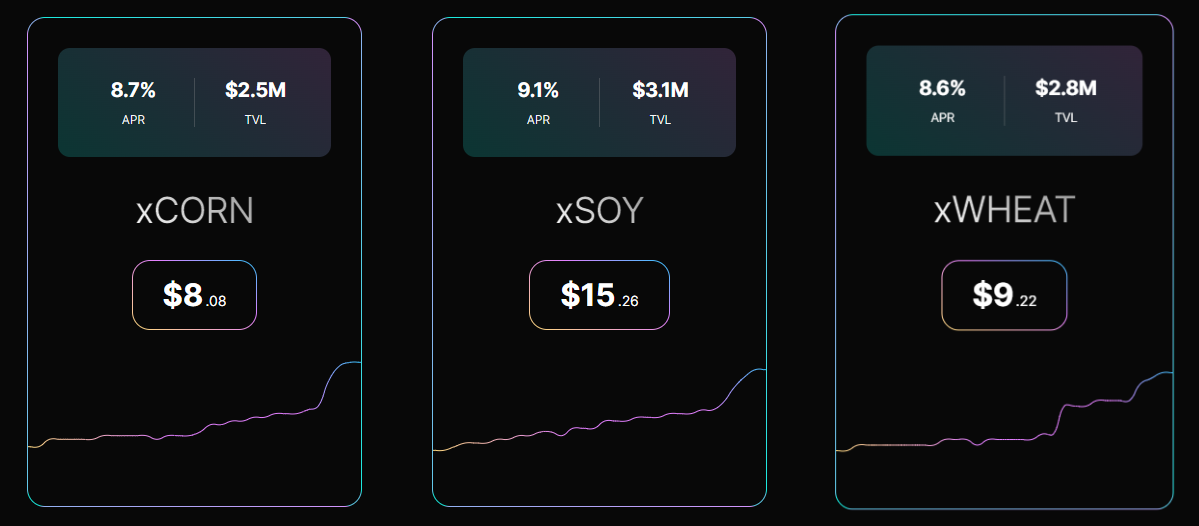

LandX Finance ($LNDX)

LandX 是一個去中心化協議,旨在縮小農民和投資者之間的距離。

LandX is a decentralised agreement designed to narrow the gap between small farmers and investors.

LandX 協議使借款人(農民)和投資者之間達成協議,投資者為農民提供資金來換取土地的部分未來收益,而農民則解決了用於購買新土地、新設備的融資難題。

The LandX agreement led to an agreement between borrowers (farmers) and investors, who provided farmers with funds to exchange part of their land for future gains, while farmers solved the problem of financing new land purchases and new equipment.

SpruceID

SpruceID 是一家專注於去中心化身份和Web3 身份驗證的公司,其開發的身份工具包SSX 使用戶能夠在不依賴第三方的情況下管理和控制自己的數字身份。

SpruceID, a company focused on decentralizing identity and Web3 identification, has developed an identity toolkit, SSX, which enables users to manage and control their digital identity without relying on third parties.

Quadrata

Quadrata 是一個去中心化身份系統,企業和消費者可以通過身份證/護照生成一個數字護照(SBT,不可轉移),在隱私保護的基礎上無縫訪問整個Web3 dApp 網絡。

Quadrata is a decentralised identity system that allows businesses and consumers to generate a digital passport (SBT, non-transferable) through identification/passport, with uninterviewed access to the entire Web3 dApp network on the basis of privacy protection.

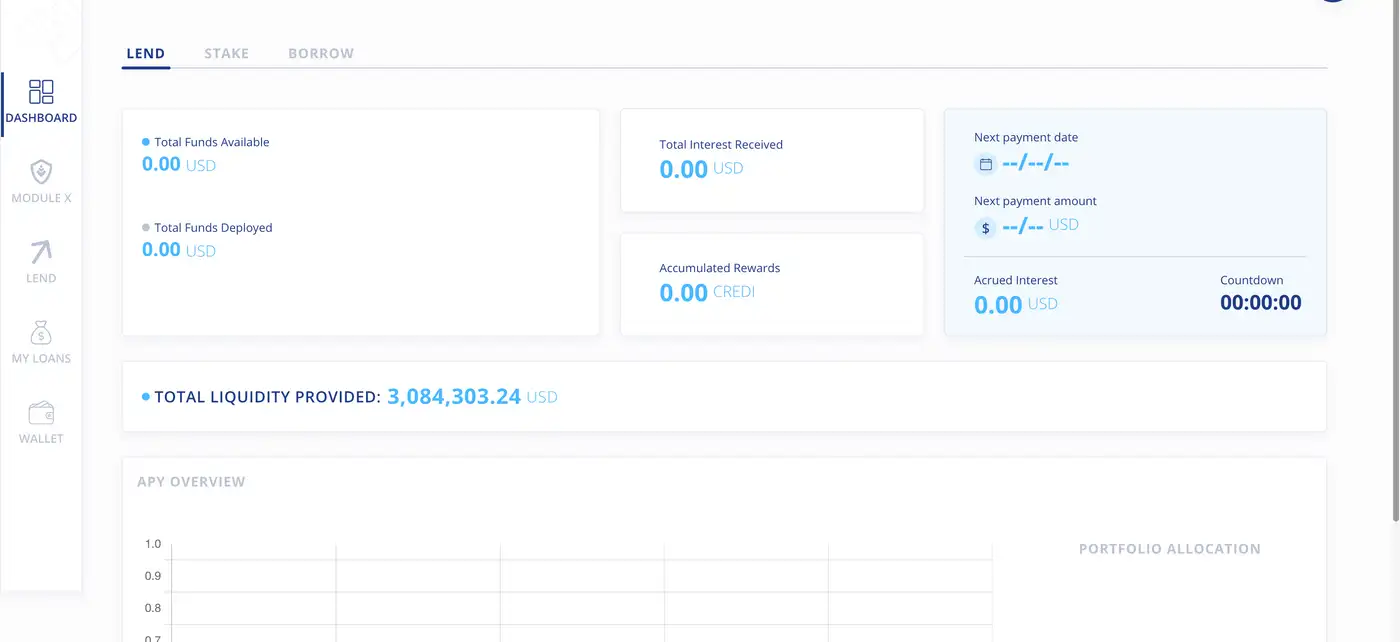

Credefi Finance ($CREDI)

Credefi 將加密貨幣投資者與中小企業借款人聯繫起來,旨在向現實世界企業提供去中心化和安全的貸款,同時為貸方提供與加密市場波動無關的固定收益。

Credefi connects encrypt investors with small and medium-sized business borrowers, aiming to provide decentralised and secure loans to real-world businesses, while also providing secured benefits to lenders that have nothing to do with the encrypt market.

KKR

管理著價值約4710 億美元資產的投資巨頭KKR,已將醫療健康支線基金在Avalanche 區塊鏈上代幣化,以增加個人投資者的可及性。大型機構投資者和超高淨值個人參與KKR 基金的門檻要求通常是數百萬美元,而個人投資者通過這個“代幣化”的支線基金,投資的最低門檻降到了10 萬美金。

KKR, an investment giant with an investment value of approximately $47.1 billion, has already monetized the medical and health sub-funds on the Avalanche chain to increase the accessibility of individual investors. Large institutional investors and ultra-high-value individuals are usually required to participate in the KKR fund in millions of dollars, and individual investors have reduced their minimum investment base to $100,000 through this “intergenerational” sub-fund.

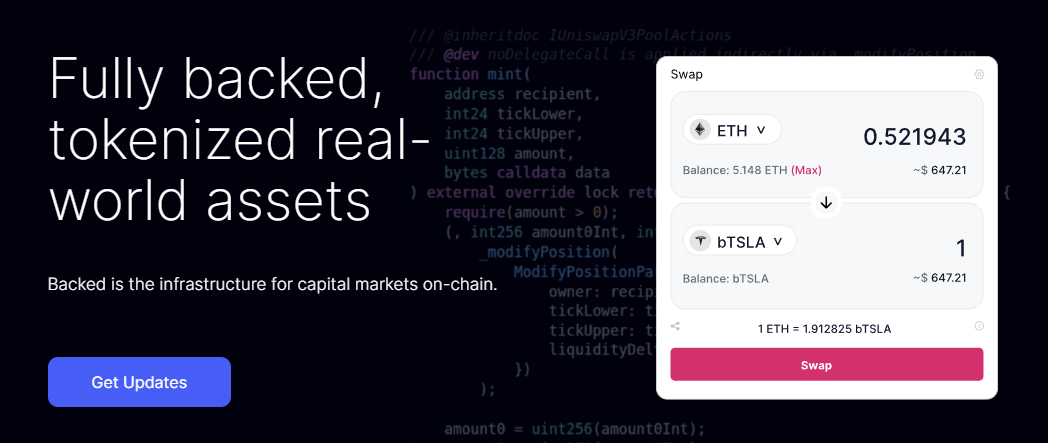

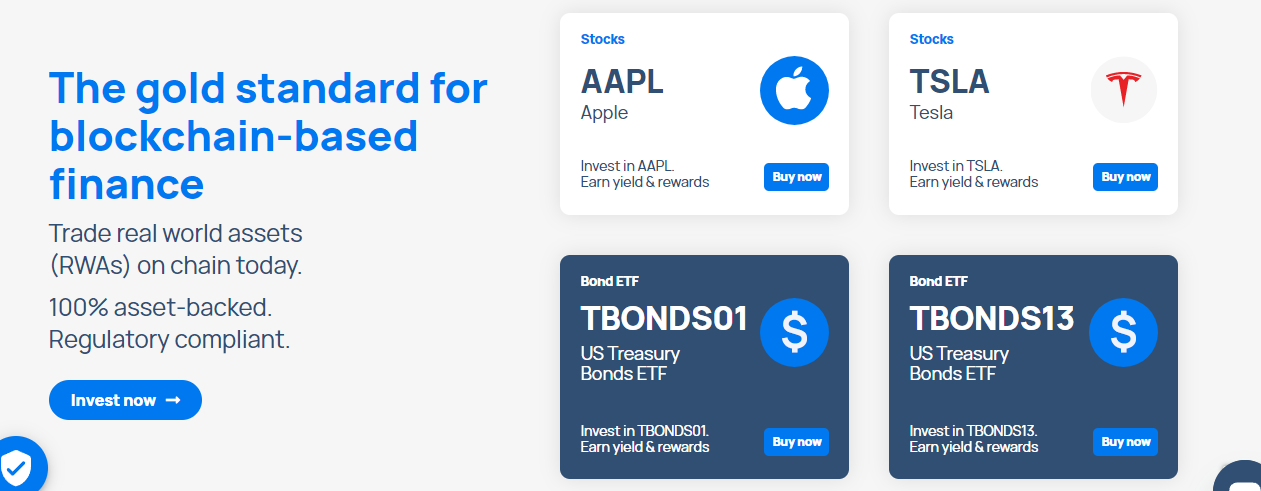

Backed Finance

Backed Finance 是一個RWA 代幣交易平台,其中,股票、ETF 等RWA 被代幣化為可跟踪市場價格的ERC-20 代幣。代幣可在不同錢包間自由轉移,並100% 由RWA 儲備支持。

Backed Finance is a RWA money trading platform in which shares, ETFs, etc. are converted into ERC-20 coins that track market prices. The currency can be freely transferred in different wallets and is supported by 100% RWA reserves.

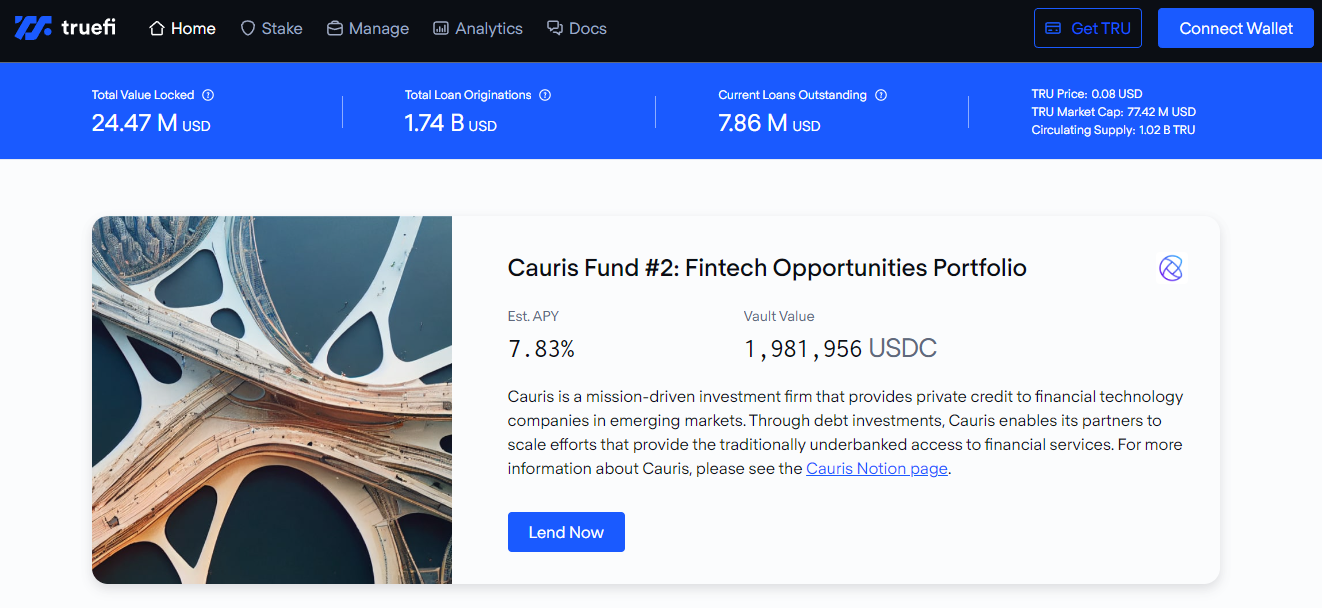

TrueFi ($TRU)

TrueFi 是一個去中心化信貸協議,使機構能夠以固定利率獲得信貸,從而以資本高效的方式對其業務進行再投資。投資者可以將USDC/USDT/TUSD/BUSD 選擇對應的貸款資金池為其添加流動性,從而放貸生息賺取收益。 TrueFi現階段主要聚焦在向加密原生的交易類投資機構提供穩定幣的無抵押借貸服務,未來將逐步探索向公司和個人發放無抵押貸款。

TrueFi is a decentralised credit agreement that allows institutions to obtain credit at fixed interest rates and reinvest in their businesses efficiently and effectively from capital. Investors can use the USDC/USDT/TUSD/BUSD to select a matching loan pool to add liquidity and generate profits from lending.

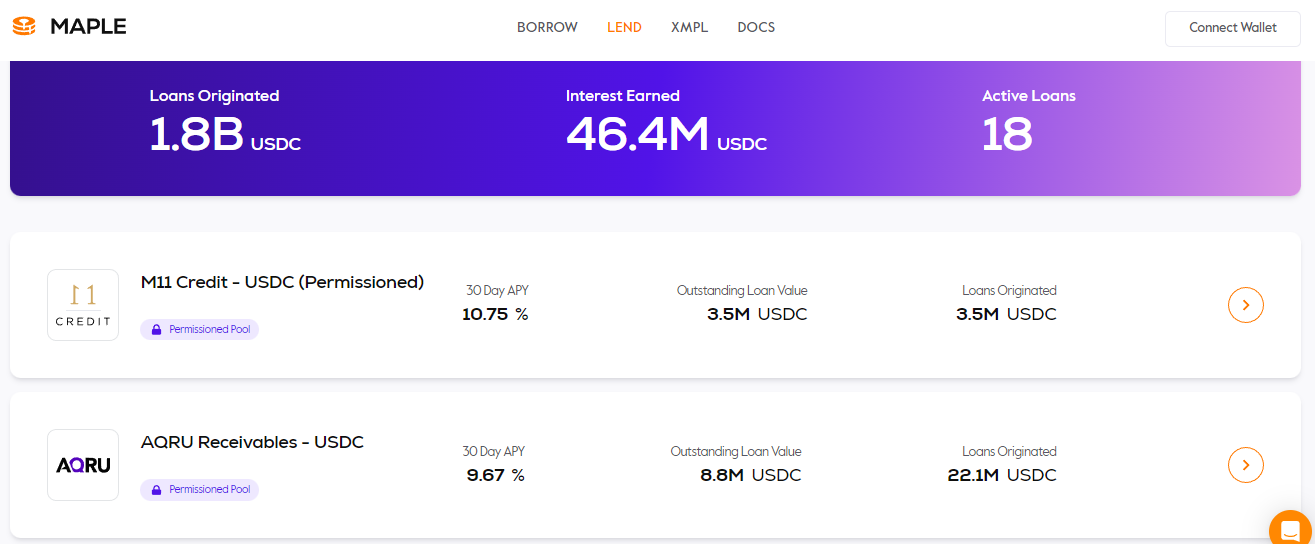

Maple Finance ($MPL)

Maple 是一個去中心化信貸協議,為機構提供無抵押貸款。投資者可以作為流動性提供者將資金($USDC 和$MPL)存入貸款資金池,為貸款提供資金並賺取收益。

Maple is a decentralised loan agreement that provides non-collateral loans to institutions.

Clearpool ($CPOOL)

Clearpool 是一個去中心化信貸協議,為機構提供無抵押貸款。 (放貸者只能向他們受邀加入的機構資金池提供流動性)

Clearpool is a decentralised loan agreement that provides non-collateral loans to the institution. (Lenders can only provide fluidity to the institutional pool they are invited to join.)

FortunaFi

Fortunafi 是一個去中心化信貸協議,為企業提供無抵押貸款,而企業會把每月的生意收入的一定比例作為還款利息。

Fortunafi is a decentralised loan agreement that provides businesses with non-collateral loans, and businesses use a percentage of their monthly business income as interest on repayment.

Swarm Markets ($SMT)

Swarm Markets 為RWA 代幣發行、流動性和交易提供合規的DeFi 基礎設施,並受到德國監管機構的監督。

Swarm Markets provides a standard DeFi infrastructure for RWA currency issuance, movement and transactions and is supervised by the German supervisory authority.

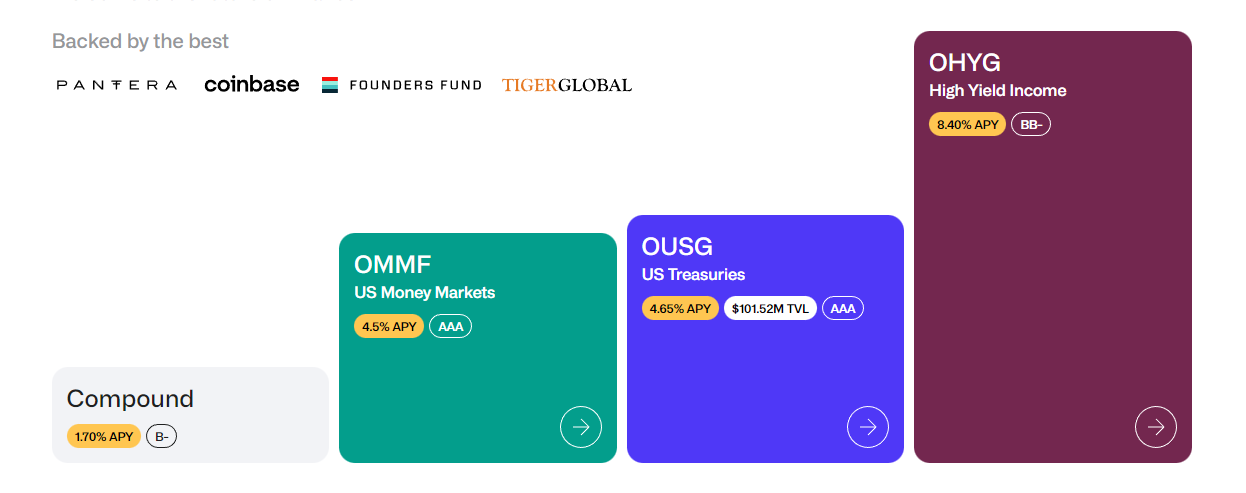

Ondo Finance ($ONDO)

DeFi 協議Ondo Finance 推出了一個基於美國國債和公司債券的代幣化基金。

DeFi agreed on Ondo Finance to launch a monetized fund based on US national and corporate bonds.

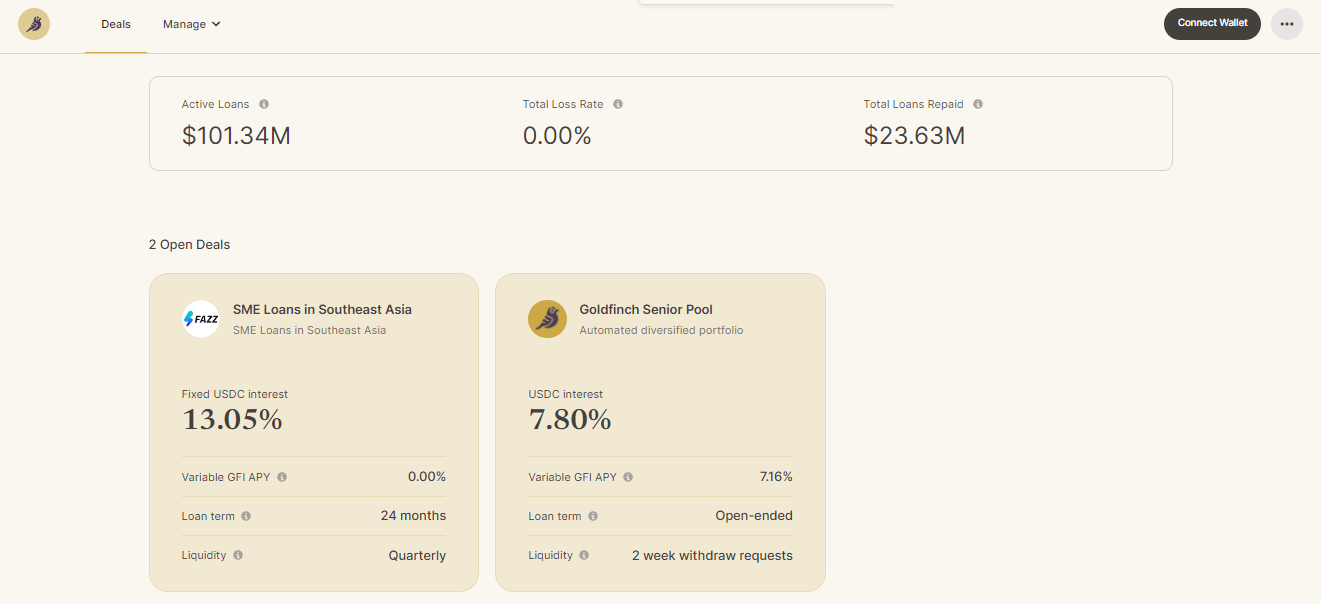

Goldfinch ($GFI)

Goldfinch 是一個面向真實世界債務基金和金融科技公司的去中心化信貸協議,目前貸款總額已超過1 億美元。投資者可以向貸款公司資金池提供資金,以賺取利息。

Goldfinch, a decentralised loan agreement for real world debt funds and financial technology companies, is now more than $100 million in loans. Investors can provide money to a loan company pool to earn interest.

Brú Finance

Brú Finance 是一個專注於農產品的去中心化信貸協議,農民可以將他們的農業商品代幣化,並抵押在鏈上,以獲得貸款,而農業商品則被存放在實體倉庫中。由於農產品價格波動仍然很低,因此也很好的保護了借款人和貸款人的利益。

Brú Finance is a decentralised loan agreement focused on agricultural products that allows farmers to monetize their agricultural commodities and mortgage them on chains to obtain loans, while agricultural goods are stored in real estate warehouses. As farm prices remain low, they also protect the interests of borrowers and lenders.

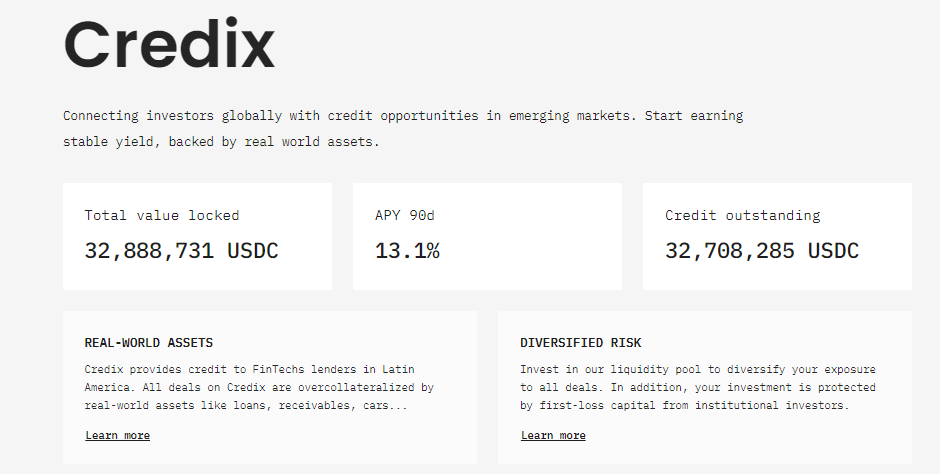

Credix Finance

Credix Finance 是一個去中心化信貸協議,專注於為新興市場提供無抵押貸款。

Credix Finance is a decentralised loan agreement focused on providing mortgage-free loans for the new market.

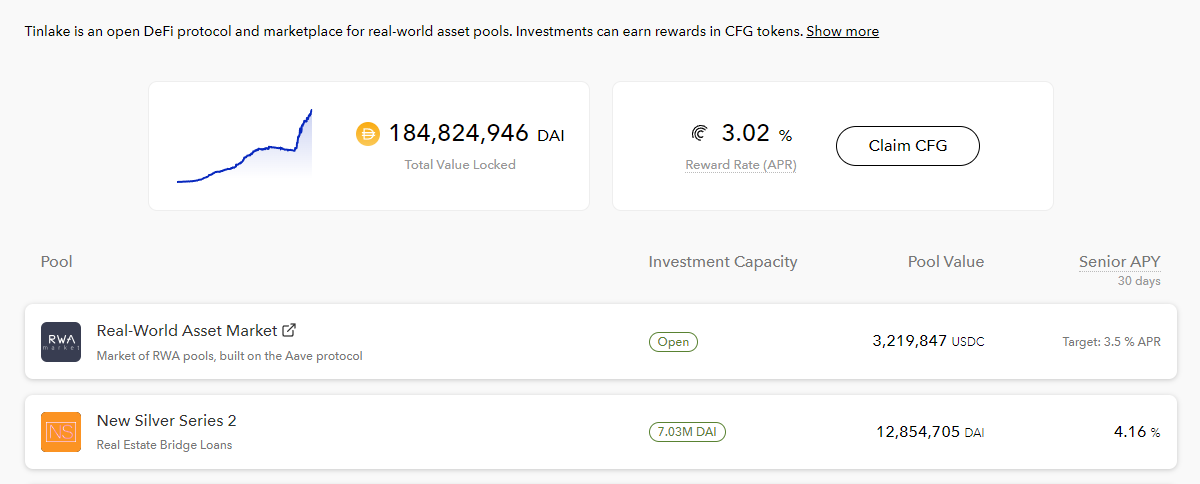

Centrifuge

Centrifuge 是一個鏈上信貸生態系統,旨在為中小企業主提供一種將其資產抵押在鏈上並獲得流動性的方式。

Centrifuge is a chain-based credit system designed to provide small and medium-sized entrepreneurs with a way to mortgage their assets on the chain and gain mobility.

Centrifuge 於2017 年推出,並已在其市場上為總計3.17 億美元的資產融資。

Centrifuge was launched in 2017 and has been marketed for a total of $317 million.

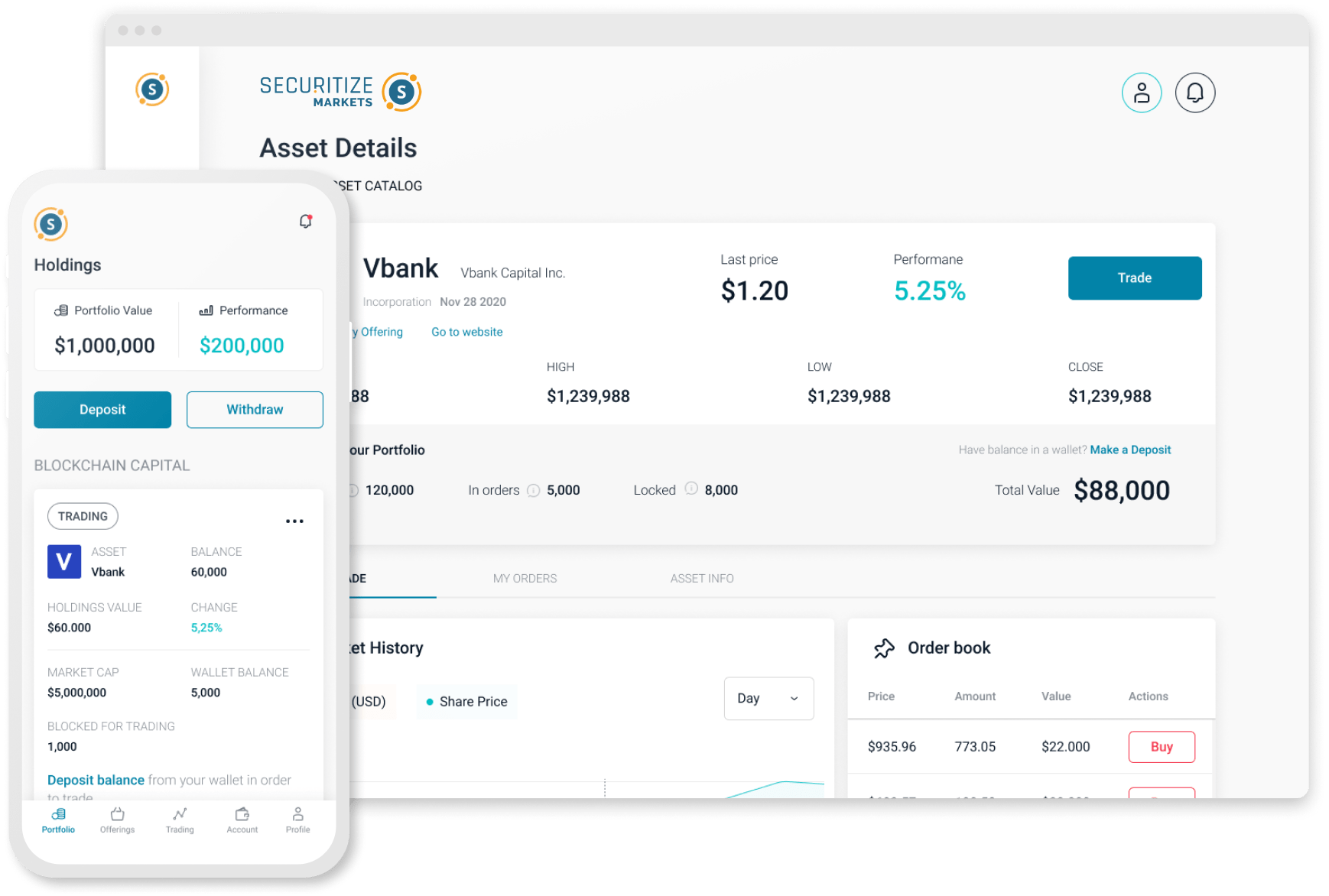

Securitize

Securitize開創了一個完全數字化的一體化平台,用於發行、管理和交易符合現有美國監管框架的數字資產證券。

Securitize has created a fully digitized, monolithic platform for issuing, managing and trading digital certificates that are consistent with the current United States regulatory framework.

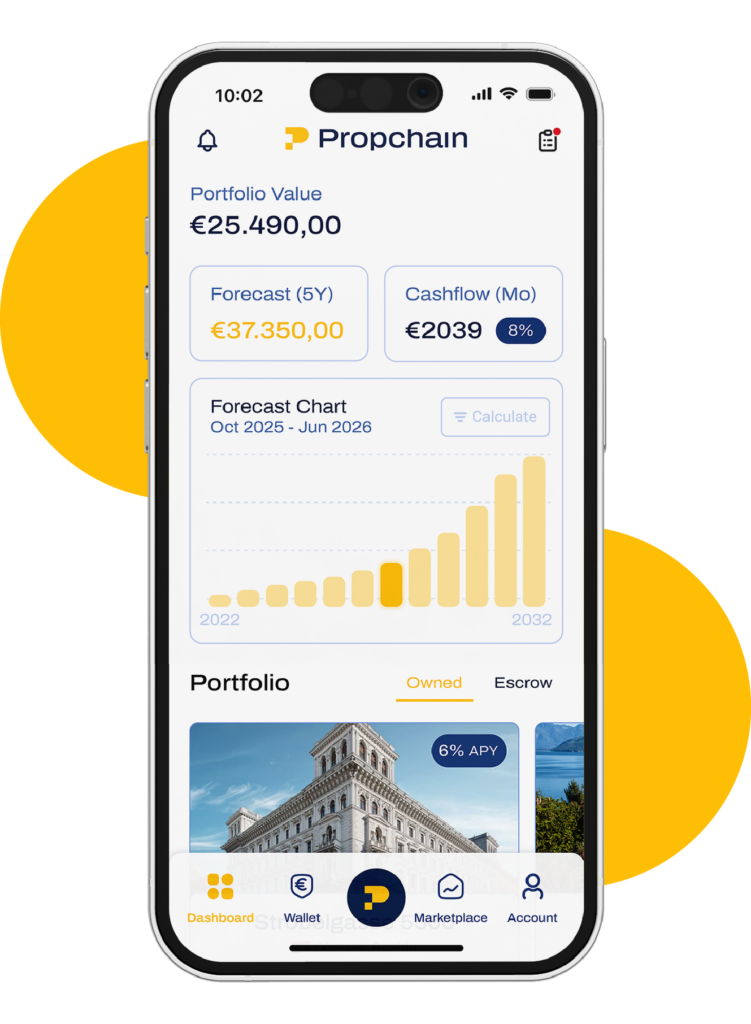

PropChain ($PROPC)

Propchain 是一個基於區塊鏈的房地產代幣投資市場,為用戶提供了投資全球房地產市場的渠道,以及各種性質、規模、估值的工具。 Propchain 解決了房地產投資者在傳統市場中遇到的許多問題,該平台不斷採購新房產,在盡職調查後上市代幣,以確保平台上永遠不會缺少投資選擇,也保證了房產的安全性和可持續性。

Propchain, a sector-based real-estate investment market, provides users with a channel to invest in the global real-estate market, as well as tools of a variety of nature, scale, and valuation. Propchain solves many of the problems that property investors face in traditional markets, and the platform buys new properties, puts them on the market after a full-time investigation to ensure that there is no lack of investment options on the platform, as well as the security and sustainability of the property.

Propchain 允許投資者的投資門檻低至1000 歐元。所有房產均由Propchain 的物業管理團隊團裡,投資者只需從房產中收取租金即可。

Propchain allows investors to invest up to 1,000 Euros. All properties are owned by Propchai’s property management team, and the investors simply charge rent from the property.

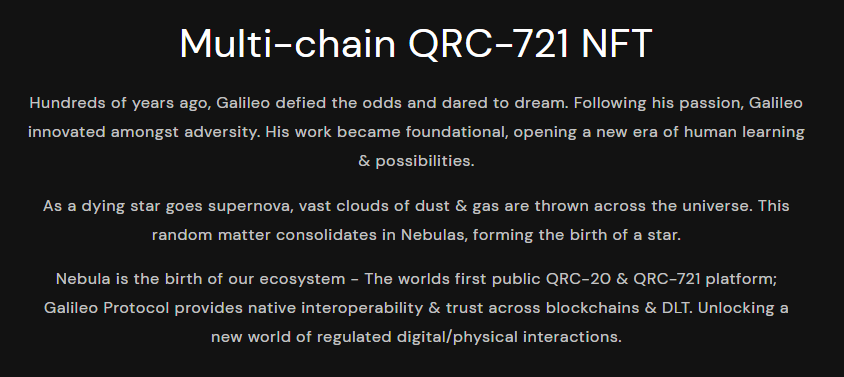

Galileo Protocol

Galileo Protocol 是一個將RWA 代幣化為NFT 的平台,NFT 支持多鏈轉移。目前該平台主要提供奢侈品的代幣化服務。

Galileo Protocol is a platform for converting RWA moneys into NFTs, which supports multi-chain migration. The platform currently provides mainly for the monetization of luxury goods.

LODE

LODE 是專注於黃金和白銀的代幣化市場,它創建了代表了白銀的代幣$AGX 和代表了黃金的代幣$AUX,以便於投資者快速投資、交易、轉移。黃金和白銀實體100% 被存放在LODE 的實體金庫中。

LODE is a monetized market focused on gold and silver, and it has created a coin representing silver and silver at US$AGX and a coin representing gold at US$AUX to enable investors to invest, trade, and transfer quickly. Gold and silver are 100% stored in the real bank of LODE.

Project 79

Project 79 是一個專注於黃金、礦業、貴金屬倉庫、貴金屬精煉廠、土地所有權的代幣化交易市場。

Project 79 is a monetized trading market focused on gold, mining, precious metal warehouses, precious metal refiners, and land ownership.

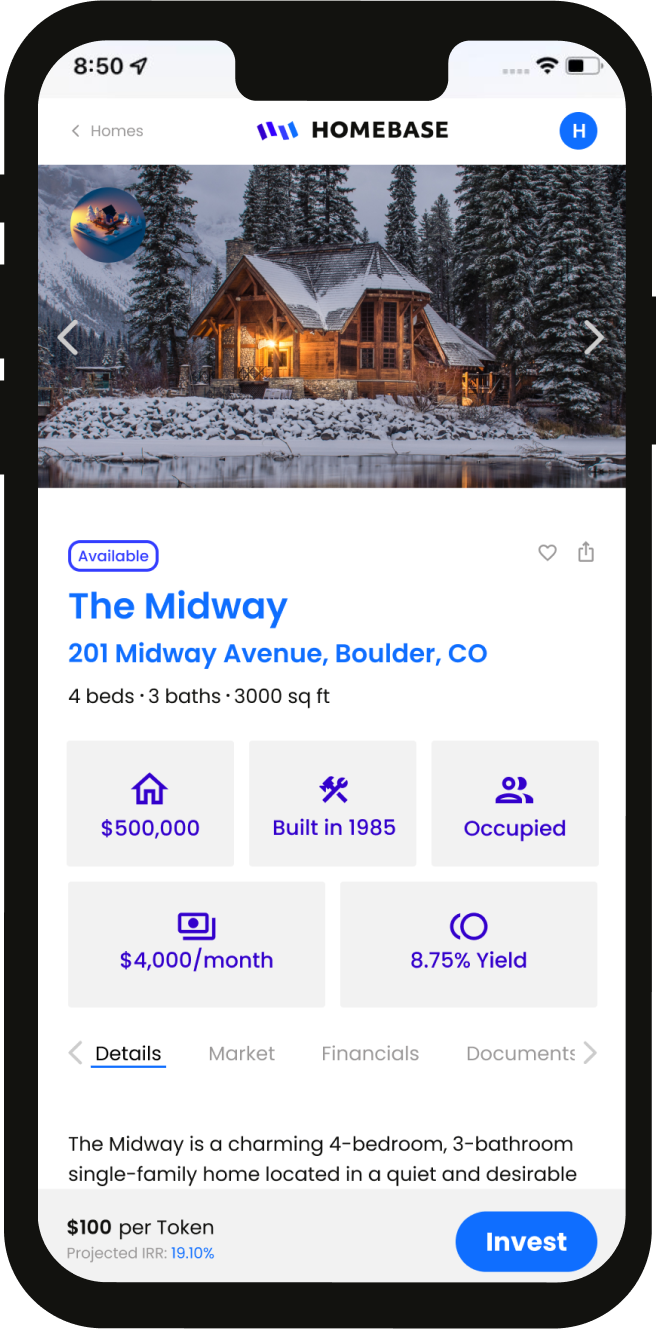

Homebase

Homebase 是一個房地產代幣化平台。通過Homebase,用戶可以以低至100 美元的價格投資於產生租金的住宅房地產。

Homebase is a real-estate monetization platform. Through Homebase, users can invest up to $100 in rent-producing residential properties.

Lingo

Lingo 是一個酒店房地產代幣化平台,代幣持有人不僅可以獲得收益,而且也可以根據持有時長,獲得世界各地酒店的免費住房機會。

Lingo is a platform for the monetization of hotel properties, and its holders not only have access to revenue, but also to free housing opportunities in hotels around the world, depending on the length of time they hold them.

?

?

?

風險提示:

Risk Note:

根據央行等部門發布的《關於進一步防範和處置虛擬貨幣交易炒作風險的通知》,本文內容僅用於信息分享,不對任何經營與投資行為進行推廣與背書,請讀者嚴格遵守所在地區法律法規,不參與任何非法金融行為。

According to the circular issued by central banks and others on the risks of further prevention and virtual currency trading, this document is used only for information-sharing, does not promote or endorse any business or investment activity, and invites readers to strictly comply with the laws and regulations of the region in which they are located and not to engage in any illegal financial activity.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论