文|显微故事 小北

Xiaobei's microcosm story

编辑|卓然

He's the editor.

比特币,这个产生不过12年的币种,正变得让人越来越疯狂。

Bitcoin, a currency that has not been born for more than 12 years, is becoming more and more crazy.

它是第一个加密的数字货币,2008年,极客中本聪提出了这一概念,2009年1月3日正式发行。

, the first encrypted digital currency, was introduced in 2008 by Bints-in-Chief and officially released on 3 January 2009.

它具备货币的基本属性:能交易,能储蓄,同时能作为一种价值尺度而存在。

It has the basic attributes of money: it can be traded, it can save, and it can exist as a measure of value.

但与各国法定货币不同的地方在于,它不是依靠特定的货币机构发行,而是基于算法产生。

, but unlike national legal currencies, it is not issued by a particular monetary institution, but is based on algorithms.

交易也不是经由一个中心化机构总控,而是运用密码学的方式加密交易信息,将信息嵌入到一个又一个的区块链中。

The transaction is not controlled by a centralised agency, but rather encrypts the transaction information by cryptography and embeds it into a chain of blocks and blocks.

它和现行法币的形态、使用和交易方式都不同,且数量有限,具有稀缺性,这使得很多人在购入比特币时,不仅考虑它的货币属性,同时考虑它的投资属性。

It differs from the form, use and mode of dealing of the current legal currency, and it is limited in number and scarcity, which makes it possible for many people to buy in bitcoin to consider not only its monetary attributes but also its investment attributes.

在2021年的第一个月,比特币迎来了一波快速上涨,1月9日,比特币上涨到近4.1万美元,市值超过了,市值超过了7654亿美元的Facebook。这和它最开始被当作货币来使用相比,价格已经累计上涨1200多万倍。

In the first month of 2021, Bitcoin picked up a wave of rapid increases, and on 9 January, Bitcoin rose to nearly $41,000. The market value exceeded that of Facebook, which was over $76.54 billion. This represents a cumulative increase of over 12 million times as much as it was first used as a currency.

但比特币也并不会一直持续地上涨上去,在本次稿件成稿发布的前夕,比特币暴跌,24小时爆仓接近100亿,18万人成为爆仓受害者。

but Bitcoin is not going to keep going up. On the eve of the release of this draft, Bitcoin fell sharply, approaching 10 billion in 24 hours, and 180,000 people became victims of the explosion.

本期显微故事讲述的是一群购入比特币的人,他们之中:

The micro story of this issue is about a group of people buying bitcoin, among them: .

有人购入比特币是觉得物以稀为贵,看着别人买就跟风,没想到因为比特币多挣了5年的工资;

Some people buy bitcoin because they think it's rare, and they watch others buy it, and they don't think they've earned five more years' wages because of bitcoin;

有人因为看美剧而对科技革新感兴趣,愿意为比特币更底层的区块链技术进行价值投资,她以一种早期股权投资人的眼光看比特币,认为它未来可期;

She looks at Bitcoin in the eyes of an early equity investor and thinks it's a promising future;

有人用估值模型估值比特币,认为它是一种完美投资,手里除了一辆车和生活费外,99%的资产都投入了比特币;

the valuation model was used to value bitcoin as a perfect investment, with 99 per cent of assets invested in bitcoin, with the exception of a car and living expenses;

有人被老板拉上车,用10万人民币买币,开了10倍杠杆,2个月时间,10万变成了200万……

Someone got pulled into the car by the boss, bought it for 100,000 yuan, leveraged it 10 times, and in two months, 100,000 became 2 million...................................................................................................................

以下是关于他们的真实故事:

The following is a true story about them:

2个月,10万变成200万

买币让我买车买房改善生活

Key 某数字货币交易所从业者

Key Some Digital Currency Exchange Practitioner

2018年,我入职了国内某数字货币交易所。当时为了熟悉整个交易所的流程,我开始炒币,不过并没指望靠币赚多少钱。

In 2018, I joined a digital currency exchange in the country. In order to get to know the entire exchange, I started to collide, but I didn't expect much money from it.

早期我玩的最多的是空气币(一种没有实体项目支撑的虚拟币)。

Early on, I played with air money most often (a virtual currency that is not supported by physical projects).

很多热门的空气币,在上所时,价格都会被一些人炒到很高,可能是乌龙指(股票交易员、操盘手、股民等在交易时,不小心敲错价格、数量、买卖方向等信息),也可能是市场上的买方热情太过高涨。

A lot of hot air coins are fired up by a number of people at a very high price, which may be the ulong finger (stock traders, handlers, stockholders, etc. who accidentally mistook information on prices, quantity, direction of sale, etc.) or the market buyer's enthusiasm is too high.

当时我基本上随便拿1~2千美元,都能赚到3~4千美元,甚至更多。

I basically took $1 to $2,000, and I could make $3 to $4,000, or even more.

赚得最多时,我曾在一次私募大户乌龙指中用7块钱的成本,捡到了30多万人民币的筹码。不过,项目方跑路了,最后只赚了一两万。

When I made the most of it, I spent seven dollars on a private fund-raiser 'til I found over 300,000 yuan in chips. However, the project ran off and ended up earning only 12,000.

2019年4月,我开始重仓玩比特币。当时我们交易所老板知道后,还特意跑到我工位,激动地说,“你一定要试试合约交易。”

In April 2019, I started playing bitcoin again. When our exchange owner knew, he came to my place and said, "You have to try the contract deal."

出于对老板的信任,我在比特币价格4000美元时,出了10万元人民币、开10倍杠杆做多,到了季度末,也就是2019年6月底,10万变成了200万。

Out of trust in the boss, at the price of $4,000 in bitcoin, I gave 100,000 yuan and leveraged more than 10 times, and by the end of the quarter, that is, at the end of June 2019, 100,000 became 2 million.

这一次合约让我积累了本金,后来我又陆续通过合约、现金买入,积累了一定量的比特币。

This contract made me accumulated the principal, and then I built up a certain amount of bitcoin through contracts, cash purchases.

但投资比特币的过程也不是一帆风顺。

But the process of investing in bitcoin was not easy.

2019年3月份,我经历了一次比特币的合约爆仓。当时比特币的价格从1万美元左右直接跌到3000多美元,爆仓点是在4000多美元,我止损了40万,占整个仓位的10%。

In March 2019, I went through a bitcoin contract explosion, when the price fell directly from about $10,000 to over $3,000, and the blast was over $4000, and I stopped losing 400,000, or 10 per cent of the entire warehouse.

那段时间,我连续几天精神状态都很不好,整个人处于差点被爆全仓的危险中,现在想想都很后怕。

During that time, I was in a bad mental state for a few days, and the whole human being was in danger of almost being blown to the ground, and now I'm afraid.

当时比特币价格跌到谷底,但我出于稳妥的考虑,没敢抄底,当然也没卖。

At that time, bitcoin prices fell to the bottom of the valley, but I didn't dare to copy them, and of course I didn't sell them.

我之前也做过一些波段,在2020年10月时,比特币的价格基本横盘,在1~1.1万美元之间来回调整,本来想做点波段赚点小钱,但没想到踏空了,后来又买了回来,损失了几万。

I had done a few waves before, and in October 2020, Bitcoin's prices were basically across the board, adjusted back and forth between US$ 11 million and US$ 11 million, and wanted to make a little bit of money, but I didn't think I'd emptied it, then bought it back and lost tens of thousands.

这都是之前的投资尝试。现在资金量比较大了,不想承担太高的风险,所以现货拿着不动,小资金合约开仓赚生活费,享受比特币带来的红利的状态。

These are all previous investment attempts. Now that the amount of money is larger and does not want to take too high a risk, the spot is still in place, small-scale capital contracts are set up to earn a living and enjoy the dividends of bitcoin.

在这个过程中,我经历过很多人的爆仓,也见证过很多人的暴富。

In the process, I have experienced a lot of bangs and witnessed a lot of rich people.

比如某交易所大佬,宣布关闭交易所,用户可以提走资金。因为他实现了真正的财务自由,不想再为公司操劳。

For example, some big exchange guy announced that he would close the exchange and that users would be able to raise the money. Because he had achieved real financial freedom, he didn't want to work for the company anymore.

还有人500人民币,一两个小时变成了不到100万,然后瞬间被爆仓。

There are also 500 yuan, which becomes less than 1 million in one or two hours, and which is then exploded in an instant.

比如某大佬,被定向扎针,爆仓8000万美元(约合人民币5.1亿元)。

For example, some big guy, who was targeted with needles, blew up $80 million (approximately $510 million).

比如交易所被连锅端,连实习生都配合调查去喝茶。

For example, the exchange has been put on pots and even interns have cooperated with the investigation to drink tea.

在我看来,合约交易其实和赌博没有太大的区别,没钱的时候还可以想想搏一搏单车变摩托,有钱了,就不想冒那么大的风险了。

As far as I'm concerned, there's no big difference between a contract deal and a gambler.

我还是长期看好比特币的价格、价值,准备跌破的时候加仓,加仓现货就不怕。其实现在看来,大跌的可能性不是很大,我觉得不太会再看到跌破2万美元以下了。

I'm still looking at the price and value of bitcoin for a long time, and when I'm ready to crash, I'm not afraid. It seems that the possibility of a big fall is not so great, and I don't think I'm going to see a drop of less than $20,000.

大家的共识增强了,再加上现在做空的资金远低于做多。在不出现大的黑天鹅事件下,很难跌破。

The consensus has been strengthened, and now the money is far short of what is available. Without a big black swan, it's hard to break down.

我现在不太在意每天的涨跌幅,涨了,开心开心;跌了,做点别的事忘记它,过一会儿再看,应该又回来了。

I don't care now about every day's increases and falls, rises, rejoices, falls, forgets about it, looks back in a while.

赚了一些钱以后,心态确实会变化,找工作不会再因为薪资的问题考虑去不去了,因为现在不靠工资改善生活,工资只用于日常的吃喝。

When some money is earned, the mentality does change, and finding a job is no longer a matter of pay, since it is not a wage that is now used to improve life, but only for daily food and drink.

买东西也不大会看价格了,车厘子草莓之类的东西,十斤十斤的买也没有肉痛的感受。现在手边有一辆车,是通过合约赚钱买的,房子虽然不是靠比特币买的,但也有了。

There's no price, no strawberries, no meat pain. Now there's a car on hand that's paid for by contract, and the house isn't bought by bitcoin, but it's also there.

在经历了之前比特币的快涨快跌后,我现在的投资策略越来越谨慎,因为有了家庭,有了小孩,所以整体会诉求稳妥。

After the pre-bitcoin booming and falling, my investment strategy is becoming increasingly cautious, as families and children make the whole claim sound.

但是我不会再卖掉了。

But I won't sell it again.

自己挖矿,自己买币,对比特币进行价值投资

我不会卖,直到我感受到成就感

卡卡 一级市场基金从业者

card level market funder

2017年,我在一级市场做融资顾问,身边有同事做区块链项目,那是我第一次听说比特币。

In 2017, I worked as a finance consultant in the first-tier market, with colleagues working on block chain projects, the first time I heard of Bitcoin.

2018年,经济环境下行,我发现市场里的钱在变少、此外很多创业项目开始拿钱困难,我开始反思行业的问题,学习金融和货币知识、了解经济周期,这才意识到,区块链是个颠覆性的技术。

In 2018, in the economic environment, I realized that the market was getting less money and that many start-up projects were starting to take money, and I began to think about the industry, learning about finance and money, learning about the economic cycle, and realizing that the chain was a subversive technology.

于是我在2018年下半年试水,买了100块钱的比特币,外每个月进行一次定投,缝低买入。同时,我也开始挖矿。

So I tried water in the second half of 2018, and I bought $100 in bitcoin, and I dropped it once a month, and I started digging mine.

2017年左右,比特币价格升高,很多人投资做了矿场主。但随后比特币价格下跌,矿场主难以回本,就做了一个决定:出租算力。

By 2017, the price of bitcoin had risen, and many had invested in the mine owner. But then the price of bitcoin had fallen and the miner had difficulty returning, and a decision had been made: renting arithmetic.

当时出了一个180天的算力包,告诉你可以挖到几个,我当时买到的算力包,每天可以挖到3、4块人民币的比特币,挖出之后它会配置到我的钱包里。

There was a 180-day computing bag that told you that you could dig up a few, that I had bought, that I could dig up three or four yuan of bitcoins a day, and that it would then be placed in my wallet.

但现在比特币大涨,这种算力包就被抢完了。

But now that bitcoin's up, the arithmetic bag's gone.

疫情期间,比特币有段时间跌得特别厉害,当时没有矿厂能回本,但买算力、买比特币却特别划算。可惜我当时胆子小,只购入了5000元的比特币,现在觉得真是亏大了。

Bitcoin fell particularly hard for some time during the epidemic, when there was no mine to return, but it was very good to buy the money and buy it. Unfortunately, I was a coward and bought only $5,000 in bitcoin, and now I think it's a real loss.

投资里有一句话:“你永远赚不到你认知以外的钱”,这在比特币上也是共通的。

There's a saying in the investment: "You'll never make money that you don't know." It's also common in bitcoin.

当你没有认知到比特币到底是什么、或没有认知到比特币的价值时,你没有办法赚这部分钱。

When you don't know what bitcoin is or you don't know what bitcoin is worth, you can't make that part.

我觉得比特币是一个新的经济体系,或迟或早,大家最终都会融入其中。

I think Bitcoin is a new economic system, and it's either late or early, and everybody's gonna end up in it.

比特币有两个风险:

Bitcoin has two risks:

一是监管上的风险;

One is the regulatory risk;

数字货币出现的早的国家,如德国或美国,已经有了一些相关的经验和流程,想方设法地把数字货币纳入监管流程,但目前中国还没有相关政策,国家会怎么做,会成为一个风险点。

Countries with early digital currencies, such as Germany or the United States, already have some relevant experience and processes to try to integrate digital currencies into regulatory processes, but there is currently no relevant policy in China, and what the country would do would be a risk point.

第二个风险是学术理论一直在讨论的:量子计算机;

The second risk is what academic theory has been discussing: quantum computers;

比特币的整个运作流程,都是基于数学运算的,但量子计算机的运算能力很强,这将颠覆区块链技术的整个底层逻辑。但这部分的讨论目前还停留在理论界,真要造出很成熟的量子计算机,得一百年以后。

Bitcoin's entire operating process is mathematically based, but quantum computers have great computing power, which will destabilize the whole bottom logic of block chain technology. But this part of the discussion is still in theory, and it really is going to be a mature quantum computer, 100 years later.

所以我觉得在20年内,产业技术革命都不能颠覆它。

So I don't think the industrial technology revolution can overturn it in 20 years.

短期内的波动很正常,因为现在华尔街开始入局,庄家会上下拉动这个盘,把小股东甩下去自己赚钱。

Volatility is normal in the short term, because now Wall Street is in the game and the estates pull the plate and dump the small shareholders to make their own money.

一个聪明的方法是:买着不动,几年后再看,肯定是涨的。

One smart way to do that is to buy it and watch it a few years later, it's definitely up.

目前我通过比特币赚得了90%的回报。

So far, I've earned 90% of the return through bitcoin.

以后即使比特币涨了,我也不会卖,我看好区块链和比特币的技术,希望看着它一步步壮大,等到我觉得有成就感后再出手。

I will not sell even if the bitcoin rises. I look at the block chain and the bitcoin technology, and I hope to see it grow and grow until I feel a sense of accomplishment.

99%的资产投入比特币

一个完美的投资,货币越贬值,比特币的价格越高

小A 某比特币基金从业者

Little A, some bitcoin funder

2018年,我和朋友吃饭聊起比特币,当时它的价格已经从几百美元涨到2万美元,这引起了我的兴趣。

In 2018, I had dinner with a friend to talk about Bitcoin, whose price had risen from several hundred dollars to 20,000 dollars, which was a source of interest to me.

随着认知升级,我开始加仓比特币,从2019年下半年开始,只要有闲钱,我就买一些比特币。

As my awareness rose, I began to build up a warehouse of bitcoin, starting in the second half of 2019, and as long as I had free money, I would buy some bitcoin.

比特币及其背后整个系统运作的逻辑非常完美。

Bitcoin and the whole system operating behind it is perfectly logical.

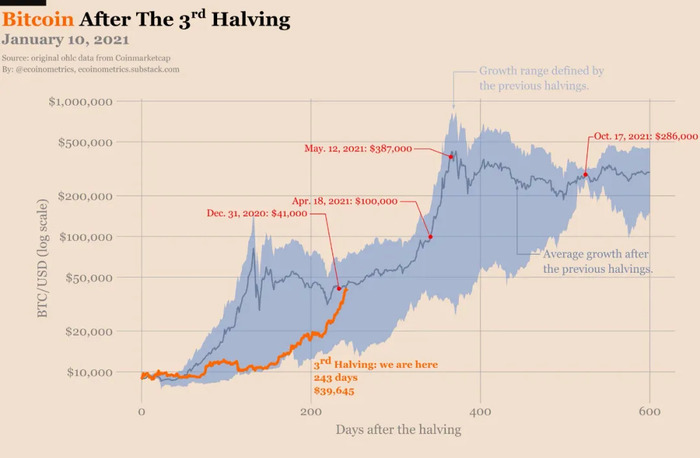

我们业内有一个估值模型,S/F模型,可以简单理解为存量与流量相比的一个模型。

We have a valuation model, the S/F model, which can be understood simply as a model of stocks versus flows.

图 | S2FX跨资产估值模型

chart S2FX cross-asset valuation model

当我们把比特币的价格与其稀缺性做对比时,我们会发现二者存在着很强的正相关关系,正相关系数非常接近1。

When we compare the price of bitcoin to its scarcity, we find that there is a strong positive correlation between the two, and the positive correlation coefficient is very close to 1.

也就是说,稀缺性波动一个单位,价格也会波动一个单位,且取值时间为10年。

In other words, the price fluctuates in a unit of scarcity and is taken for a period of 10 years.

比特币总共只有2100万个,它的稀缺性是确定的,且时间越长稀缺性越高,它未来的价格会不断螺旋上升。从过往10年的数据来看,也确实如此。

There are only 21 million bitcoins in total, and its scarcity is certain, and the longer it is, the more it is, the more its future prices will spiral. And so is the data from the last 10 years.

图 |第三次减半后价格运行通道

. >...........................................................................................................................................................................................

疫情以后,我和同事们有个判断,以美联储为代表的各国央行都会进行一轮大幅度的宽松,宽松的货币政策执行后会向市场投放大量的流动性。

In the aftermath of the epidemic, my colleagues and I have a judgement that central banks, represented by the Federal Reserve, will carry out a major round of easing and that the implementation of loose monetary policies will result in significant liquidity to the market.

2020年,美国的M1增长了50%以上,当时美联储向市场分发了全世界存量美元的21%,即全世界的美元里有21%的美元是在2020年这一年印出来的,这多可怕!

In the United States, M1 grew by more than 50 per cent in 2020, when the Fed distributed to the market 21 per cent of the world's United States dollar stock, or 21 per cent of the world's United States dollar, which was printed in the year 2020. How terrible!

美元和欧元都在放水,放出来的这些流动性很大一部分进入金融系统,让给金融资产膨胀。

Both the United States dollar and the euro are running water, and a large part of these liquiditys are being released into the financial system, causing financial assets to swell.

比特币抗通胀属性非常强,甚至高于黄金。

Bitcoin is very anti-inflational, even higher than gold.

黄金的稀缺性是基于物理层面的稀缺性,而黄金的开采会使黄金总量保持较高的增长态势。但比特币是基于数学层面的绝对稀缺,且随着减半的推进,未来比特币会更加稀缺。

The scarcity of gold is based on physical scarcity, while the extraction of gold keeps the gold stock growing at a higher rate. But Bitcoin is based on absolute scarcity of mathematics and will become even more scarce in the future as half is reduced.

现在这一阶段,投资最大的风险是持有现金的风险,法币购买力在缩水,而固定数量的比特币能很好地对冲货币超发。

At this stage, the greatest risk to investment is the risk of holding cash, the purchasing power of French currency is shrinking, and the fixed amount of bitcoins is a good hedge currency.

法币越超发,法币购买力越贬值,而我持有的比特币的购买力就会相应升值。

The higher the French, the more the French’s purchasing power depreciates, and the higher the purchasing power of the bitcoin I hold.

基于这个考虑,我身边除了一辆车,和一些基本的生活费之外,其余的钱全部投入了比特币,平均买入价格大概在七、八千美元。

On the basis of this consideration, with the exception of one car and some basic living expenses, all of my money was invested in bitcoin, with an average purchase price of approximately $7 to $8,000.

因为我入场晚,早期入场的人,投入成本比我低的大有人在。但未来我希望通过比特币的投资,实现财务自由。

Because I'm late, and I'm early, and I'm at a much lower cost than I am. But in the future, I want to be financially free through Bitcoin's investments.

提出S/F模型的分析师后来又提出了一个跨资产模型,通过这一模型观察比特币的主要几个阶段:第一次减半、第二次减半、在过去的2020年5月12日的减半,以此对比黄金、房地产的市值和稀缺性。

The analyst who presented the S/F model later presented a cross-assets model, through which the main phases of Bitcoin were observed: the first to halve, the second to halve and the previous 12 May 2020 to compare gold, real estate market value and scarcity.

分析后,我们发现他们相关性很高,未来单个比特币的估值应该接近30万美元。花旗银行也出过一份研报,认为比特币会到达31.8万美元。

After an analysis, we found that they were highly relevant, and that in the future the valuation of individual bitcoins should be close to $300,000. Citibank also published a study suggesting that bitcoins would reach $318,000.

但我们认为,长期来看,比特币的价格远不止30万美元。和中本聪一起开发系统的哈尔·芬尼,在去世前曾预估比特币对标的价值是全世界所有家庭财富的当量,大概在100万亿美元左右。

But we believe that, in the long run, the price of Bitcoin is far more than $300,000. Hal Finny, who worked with Nakamoto to develop the system, predicted before his death that the value of Bitcoin was the equivalent of the wealth of all families around the world, at around $10 trillion.

按这个预估,单个比特币的价格在1000万美元以上。况且因为央行的持续放水,比特币的价格还会增加,它的价格上限天花板就能非常高。

According to this estimate, the price of a single bitcoin is more than $10 million. And because the central bank continues to release water, the price of bitcoin will increase, and its price ceiling can be very high.

不过我不建议你马上急着买,资本市场永远都有赚钱的机会,但你的本金是有限的,建议想要入手的人还是多看看书,等认知到位了才好赚钱。

But I don't suggest that you buy it immediately, that capital markets always have a chance to make money, but your principal is limited, and that those who want to do it read more books and wait until they know what they're doing to make money.

买的时候也要注意一些坑,比如在出入金环节,资金粘连到某些不干净的钱,你可能会被冻结银行卡。

When you buy, you also have to be careful about pits, such as the entry and exit gold chain, where money is tied to some dirty money, and you may be blocked from your bank cards.

再比如保管风险,私钥是比特币资产的最高控制权限,如果私钥丢失,你的比特币也就没了。

And, for example, to keep the risk, the private key is the highest control of the Bitcoin asset, and if the private key is lost, your bitcoin is lost.

现在国内大部分人的私钥由交易所掌握,这就相当于别人在保管你的银行卡密码,非常危险。

Most people in the country now have their private keys in the hands of the exchange, which is the equivalent of someone holding your bank card code, which is very dangerous.

还比如期货的风险。很多交易所有关于比特币合约产品的衍生品,杠杆倍数非常高,高达100倍甚至1000倍,这种危险性极高。

For example, the risk of futures. A lot of transactions involving all derivatives from bitcoin contracts are highly leveraged, up to 100 times, or even 1,000 times, which is extremely dangerous.

2020年3月12日,全球金融市场大幅震动,很多机构首先补充流动性资产,加密货币市场成为第一个被砍的对象。

On 12 March 2020, the global financial markets were heavily shaken, with many institutions supplementing liquid assets first, and crypto-currency markets becoming the first targets to be cut off.

我们有一个客户,帮别人管理了2000多万的比特币期货,当天下午6点,他吃完饭去洗澡,洗澡前还好好的,洗澡出来后2000多万爆仓,价格一下子砸了下去,平仓都来不及。

We have a client who manages more than 20 million bitcoin futures for someone else. At 6 p.m. that same day, he went to the shower after dinner, before he took a bath, before he took a bath, and after the bath came out, more than 20 million went to the barn. The price was flattened and it was too late.

他开了20倍的杠杆,损失非常惊人。

He's got 20 times the leverage, and the losses are amazing.

比特币市场本身波动很高,在一个很大波动性的市场再加几十倍的杠杆,盈利肯定赚的多,但跌下来后亏得特别快,也一定要注意。

The Bitcoin market itself is highly volatile, with several dozen times more leverage in a highly volatile market, and profit will certainly be more profitable, but it will also have to be noted that the fall has been particularly rapid.

短期内我不会卖出手里的比特币,跌破2万美元的可能性不大,如果卖出很难再找到低价期购回。

I will not sell the bitcoin in my hand in the short term, and it is unlikely that I will fall by $20,000, and if I sell it, it will be difficult to find a low-priced buyback.

除非遇到家里急需用钱的紧急情况,那我可能会变现一些,但也不会全部抛掉,现在比特币实在是一个不错的资产。

Unless there is an urgent need for money at home, I may realize it, but I won't throw it all away, and now Bitcoin is a really good asset.

我靠比特币赚了5年工资

买了的都在涨,它的价格来自大家对它的共识

廷友 互联网员工

friend Internet employee

早在七年前,我就知道比特币了,但一开始不怎么感兴趣,只觉得是个诈骗的东西。

Seven years ago, I knew about Bitcoin, but at first it wasn't much of an interest, it was just a fraud.

2017年,我太太开始从事数字货币相关工作。正巧当时比特币也迎来一波牛市,我太太公司的人都跟风在买,我也跟风投了几万块钱买比特币。

In 2017, my wife started working on digital money-related work. It happened that Bitcoin was in the middle of a bull market, that my wife's company was buying from the wind, and I threw tens of thousands of dollars into the wind to buy bitcoins.

我和我太太都非常怕风险,没碰合约和杠杆,只敢拿比特币的现货。在那波牛市,尤其是12月底靠近顶峰的时候,比特币一天就能涨10~20%。

My wife and I are both very afraid of the risks, not of the contract, not of leverage, but of the bitcoin. By the end of December, when the bovine is near its peak, the bitcoin rises by 10-20% a day.

我还记得,有一天我下班路上顺手刷了刷币价,涨到了10万人民币一个,我高兴得不得了,感觉自己的口袋里已经躺着自己赚的1万块!

I remember one day on my way out of work, I brushed the price of my money up to RMB 100,000, and I was so happy that I already had $10,000 in my pocket!

不过到达顶点之后,比特币很快下跌到3000美元。因为不确定它能不能涨回去,我们没卖、也没继续再买,现在算来是踩空了。

But when it got to the top, bitcoin quickly fell to $3,000. We didn't sell it, we didn't buy it again, and now it's empty.

我太太的好几位同事在那段时间看好比特币的涨势,又买入很多。在后来几个月,比特币涨到13900美元,他们也因此赚了不少。

Several of my wife's colleagues watched Bitcoin rise during that time and bought a lot. In the next few months, Bitcoin went up to $13,900, and they made a lot of money.

有一位刚毕业一两年的同学,一直做合约,就在那一年的几个月内赚了上千万。

One of the students, who had just graduated a year or two, had been on a contract and had earned millions of dollars in a few months of that year.

有了这些人的成功案例,我开始乐意琢磨比特币了。它为什么会涨起来呢?

With these people's success stories, I'm beginning to wonder about bitcoin. Why does it go up?

我曾觉得比特币就是“空气”。人们平时买股票、买基金,都是跟公司业绩挂钩的,但比特币没有一个可以评估的实体。

I used to think that bitcoin was "air." People buy shares, they buy funds, they're tied to company performance, but bitcoin doesn't have an entity to assess.

它的价格是一种共识,我们认为它有价值,它的价格就会逐渐增加。

Its price is a consensus, and we believe it has value, and its price will increase gradually.

有些人认为比特币不像法币那样被不停地发行,数量恒定,有价值;有些人觉得比特币更底层的区块链技术有价值,有些人觉得加密数字货币这个概念有价值……

Some people think that bitcoin is not issued as unstoppablely as French, in constant numbers and of value; some think that bitcoin's lower block chain technology is valuable; some think that the concept of cryptographic digital currency is valuable...

大家有自己对比特币的一套解释,并因为相信这套解释而购买比特币。

You have your own set of interpretation of bitcoin and you buy bitcoin because you believe in it.

这些解释不断强化,更多人知道比特币,想买比特币,再加上通胀,比特币的价格越来越高,这些解释也就更进一步地自我强化。

These explanations are reinforced by the fact that more people know bitcoin and want to buy bitcoin, combined with inflation and the increasing price of bitcoins.

按现在的趋势看来,这些解释不能被证伪,这是它上涨的核心。

In the light of current trends, these interpretations cannot be authenticated, which is at the heart of its rise.

比特币很像之前风靡的荷兰郁金香,正是因为玩的人有共识,价格才会炒起来。

Bitcoin is a lot like the Dutch tulips that used to be, and it's because there's a consensus among the players that the price goes up.

但区别在于:郁金香是可以持续和大量生产的,当供应变多,郁金香就会越来越不值钱。

The difference, however, is that tulips can be produced continuously and in large quantities, and when supplies become larger, tulips become less and less valuable.

比特币新增数量却是越来越少的。

The number of new bitcoins is decreasing.

中本聪在创造比特币时,就考虑到了数量问题,每4年比特币被挖出来的数量会减半。可能最开始10分钟可以挖50个比特币,但4年之后,10分钟就只能挖25个比特币,再4年,12.5个,依次减下去。

When he created Bitcoin, he took into account the issue of quantity, and the number of bitcoins dug up would be halved every four years. It was probably possible to dig 50 bitcoins in 10 minutes at the very beginning, but four years later, only 25 bitcoins in 10 minutes, and four years in four, 12.5, with a reduction in the number of bitcoins.

整个比特币的数量是固定且确定的,只有2100万个左右。这是供给端,比特币的数量是固定的。

The entire number of bitcoins is fixed and fixed, with only 21 million or so. This is the supply end, and the number of bitcoins is fixed.

需求端上则有越来越多的人想买入比特币。现在有了交易所、电子钱包,大家购买比特币越来越容易,购买需求就能进一步被激发。

There are more and more people on the demand side who want to buy bitcoin. With an exchange, an electronic wallet, it is easier to buy bitcoin, and the demand can be stimulated further.

比如美国有一些信托基金拿着散户的钱帮买比特币,每年能坐收5亿美元的佣金。

For example, there are trust funds in the United States that buy bitcoin with money from the diaspora, and that can charge $500 million a year in commissions.

他们不需要做任何研究,每年就能有5亿美元的进账,这钱多好赚!

They don't have to do any research. They get $500 million a year. That's a lot of money!

所以美国大量的机构涌入进来,成立比特币的基金,帮散户购买。场外的机构、散户源源不断地进入,也让比特币的价格快速上涨。

So a lot of U.S. agencies came in, set up a bitcoin fund to buy it for the bulk. The out-of-the-horizon agencies, the bulk of the stock, keep moving, and the price of bitcoin rises fast.

比特币价格上涨之后,大家会更看好比特币的未来,坚定持有它的决心,这样共识就会越来越凝聚,而且凝聚得越来越快。

When the price of bitcoin rises, the future of bitcoin will be better looked at and its resolve firmly held, so that consensus will become more and more condensed.

2020年3月份,因为疫情的原因,比特币的价格快速下跌。

In March 2020, the price of Bitcoin fell rapidly because of the epidemic.

当时我们没有太多犹豫马上入手,平均算下来,当时购入比特币的均价不到4000美元,但赚的钱相当于我5年的工资收入。

We did not hesitate to do so immediately, on average, when the average price of the bitcoin was less than $4,000, but the money earned was equal to my five-year salary income.

未来我也依然看好比特币,一般情况下我也不会放弃持有,除非是家庭需要大额支出,比如买房,可能会卖掉一部分。

I'm still looking at bitcoin in the future, and usually I don't give up holding it unless the family needs a lot of money, for example, to buy a house, and may sell a part of it.

比特币现在的涨幅和价格已经有些风险了。如果让我现在花20万以上人民币去买一个比特币,我还是比较心虚的。

Bitcoin's current increase and prices are already at some risk. If I were to spend more than 200,000 yuan now to buy a bitcoin, I'd still be a bit disheartened.

但我认为,如果家庭有余钱的话,可以配置一个或多个比特币,作为家庭投资。以后比特币的价格我认为会越来越高,上车只会越来越难。

But I think that if the family had more money, one or more bitcoins could be set up to invest in it. Later, I think the price of bitcoins would get higher, and getting in the car would only get harder.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论