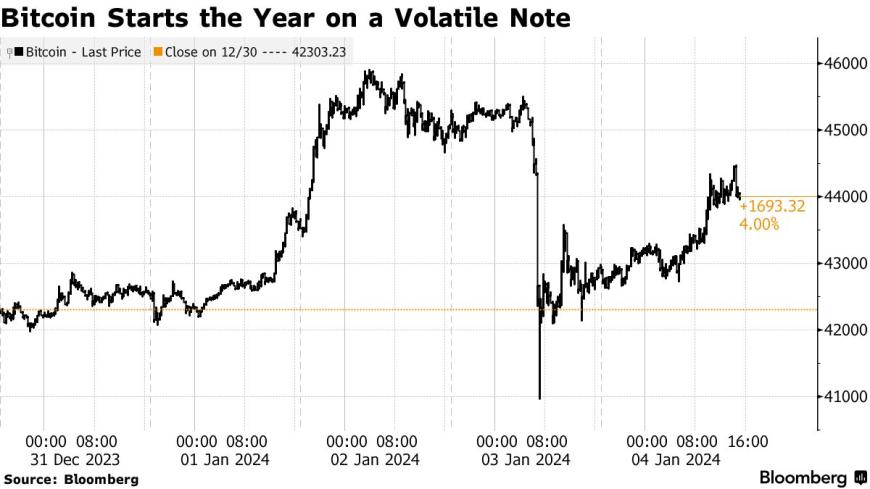

随着投资者恢复对于美国监管机构即将批准美国首只比特币现货交易所交易基金(ETF)成功发行的信心,比特币价格在年初的过山车行情中再次转为上涨,收复了周三闪电式暴跌造成的一部分损失。投资者们对于直接持有这种数字资产的ETF即将获批的信心迅速修复,比特币价格周四一度涨超4%,而此前于周三创下2022年11月以来最大单日跌幅。随着1月10日美国证券交易委员会(SEC)关于是否批准比特币现货ETF的决议的最后期限越来越近,比特币自12月初以来已上涨逾15%。

As investors regained confidence that US regulators were about to approve the successful release of America’s first Bitcoin spot exchange transaction fund (ETF), Bitcoin prices rose again in the first year of the year, recovering part of the damage caused by a tremor fall. Investors’ confidence in an ETF that held such digital assets directly was about to be rapidly restored, with Bitcoin prices rising by 4% on Thursdays, compared to the largest single day since November 2022 on Wednesday. With the US Securities Exchange Commission’s (SEC) resolution on whether to approve Bitcoin spot ETFs approaching on 10 January, Bitcoins has risen by more than 15% since early December.

周三,全球最大规模的加密货币比特币价格暴跌9.2%,创下自2022年11月以来的最大单日跌幅,主要因加密货币金融服务提供商Matrixport分析师马库斯·蒂伦(Markus Thielen)在一份重磅报告中写道,他预计美国证券交易委员会(SEC)本月将拒绝所有比特币现货ETF的发行申请。

On Wednesday, the world’s largest encoded currency, bitcoin, fell by 9.2 per cent, the largest single-day fall since November 2022, mainly as a result of a heavy-pound report by Markus Thielen, the crypto-currency financial service provider, who expected that the United States Securities and Exchange Commission (SEC) would reject all Bitcoin spot ETF applications this month.

但是,来自彭博情报(Bloomberg Intelligence)的加密货币分析师们则在随后的一份报告中预计,SEC在1月10日前批准比特币ETF的可能性高达90%。据媒体援引消息人士透露的信息报道称,比特币现货ETF“非常接近”获得美国SEC的正式批准,并表示多家公司申请发行的比特币ETF将获批,具体通知预计近日公布。

However, crypto-currency analysts from Bloomberg Intelligence predicted in a subsequent report that SEC would be up to 90% more likely to approve Bitcoin ETF by 10 January. According to media sources, the Bitcoin spot ETF was officially approved by the United States SEC, according to reports that it was “very close” to it, and that the Bitcoin ETF, which several companies had requested to issue, would be approved, with a specific notice expected to be published in the near future.

周四,比特币交易价格一度上涨超4%,接近44,900美元关口,随后回吐部分涨幅。在整个2023年,比特币飙升幅度接近160%,因为人们越来越乐观地认为,美国证券交易委员会(SEC)对比特币ETF的正式批准将大幅度提振比特币的整体需求。

On Thursday, the price of the Bitcoin transaction rose by more than 4%, close to the US$ 44,900 threshold, followed by a partial upturn in vomiting. Throughout 2023, the Bitcoin surge was close to 160%, as there was growing optimism that the formal approval by the US Securities and Exchange Commission (SEC) of the Bitcoin ETF would significantly boost the overall demand for Bitcoin.

来自Bitwise资产管理公司(Bitwise Asset Management)的首席投资官马修·霍根(Matthew Hougan)表示:“市场非常关注ETF获得批准的可能性,因此,随着杠杆化的头寸被平仓,即使是影响力很小的消息也会引发相对较大的市场波动。”“周三发生的事情就是这样,随着比特币ETF成功发行被市场重新考虑,今天市场正在反弹。”Bitwise资产管理公司表示,该公司正在申请发行比特币ETF。

The Chief Investment Officer, Matthew Hougan, from Bitwise Asset Management, stated: “The market is very concerned about the possibility of an ETF being approved, so that, as the leveraged position is downsized, even less influential news can trigger relatively large market fluctuations.” “This is what happened on Wednesday, and the market is re-examining today with the successful distribution of the Bitwice ETF.” Bitwise Asset Management stated that it was applying to issue the Bitcoin ETF.

ARK Invest 和 21Shares等潜在比特币ETF发行人的新一波申请令加密货币交易员们感到宽慰。ARK以及21Shares为它们的比特币ETF提交了一份修订后的证券登记文件。然而,一些分析人士警告称,这些修正后的文件并不一定意味着比特币ETF申请一定会获得批准。

A new wave of applications from potential Bitcoin ETF issuers, ARK Invest and 21Shares, reassured the encrypt currency traders. ARK and 21Shares submitted a revised securities registration document for their Bitcoin ETF. However, some analysts warned that the amended documents did not necessarily mean that the Bitcoin ETF application would be approved.

“最近的价格走势与比特币ETF将在未来几天获得批准并迅速推出有关,”该行业历史最悠久、规模最大的基金之一Pantera Capital的投资组合经理Cosmo Jiang表示。“我们有很多理由相信这一点,包括ETF的备案变化。”

“Recent price trends are related to the approval and rapid roll-out of the Bitcoin ETF in the next few days,” said Cosmo Jiang, the portfolio manager of Pantera Capital, one of the oldest and largest funds in the industry. “We have many reasons to believe this, including changes in the ETF's filing.”

2023年夏天,全球最大规模的资产管理公司贝莱德(BlackRock Inc.)发起了最新一轮比特币现货ETF申请热潮,此后富达(Fidelity)等其他重量级资管机构也加入了这一行列。在2023年8月,灰度投资公司(Grayscale Investments)在法律上取得了胜利,可以说为比特币ETF获得批准打开了大门。

In the summer of 2023, the world’s largest asset management company, Black Rock Inc., launched the latest round of spot ETF applications in Bitcoin, after which other heavyweight regulators, such as Fidelity, joined the ranks. In August 2023, Grayscale Investments won a legal victory, opening the door to arguably approving the ETF in Bitcoin.

2024年,比特币价格或将创下历史新高

在2024年,6.9万美元这一比特币价格最高历史纪录很可能将被打破。一些业内高管坚称新一轮比特币牛市已经开始,主要基于两件重磅事件:分别是比特币“减半”,以及比特币交易所交易基金(比特币现货ETF)极有可能在美国首次获得批准。

In 2024, the historical record of the highest bitcoin price of $69,000 is likely to be broken. Some industry executives maintain that a new round of Bitcoin’s cattle has already begun, mainly on the basis of two heavy-pound incidents: the “50-per-cent” of Bitcoin and the “bitcoin exchange transaction fund” (bitcoin spot ETF) are highly likely to be approved for the first time in the United States.

来自CoinShares的研究主管James Butterfill表示,在美国政府可能批准比特币ETF的推动之下,加密货币资产的前景将在2024年发生“重大变化”。“这一期待已久的发展将扩大加密货币资产的投资者基础,并将其与传统金融市场更紧密地整合在一起,”Butterfill接受媒体采访时表示。

According to James Butterhill, research director from CoinShares, the outlook for encrypted monetary assets will be “significantly changed” in 2024, driven by a possible United States government approval of the Bitcoin ETF. “This long-awaited development will broaden the investor base of encrypted monetary assets and integrate them more closely with traditional financial markets,” Butterhill said in an interview with the media.

“有预测数据显示,从目前资产管理机构管理的资产中增加20%的投资(大约30亿美元)可能会将比特币的价格推高至8万美元。”与此同时,Butterfill补充称,全球央行降息的预期也可能在推动比特币价格走高方面“发挥决定性的作用”。

“Predicted data suggest that an increase of 20 per cent (approximately $3 billion) in investment from assets currently managed by asset management agencies could push the price of bitcoin up to $80,000.” At the same time, Butterfill added, expectations of interest cuts by the global central bank could also be “decisive” in driving the price of bitcoin up.

在2023年11月,渣打银行(Standard Chartered)发布报告表示,10万美元大关将受到众多ETF获批的大力推动。该行还表示,减半大事件也将支持比特币价格趋势。早在4月份,渣打银行就发布报告预测称,2024年年底比特币有望冲击10万美元。

In November 2023, Standard Chartered released a report stating that $100,000 would be strongly promoted by a large number of ETFs. The bank also stated that halving major events would also support Bitcoin price trends. As early as April, Chartered Bank issued a report predicting that Bitcoin was expected to hit $100,000 by the end of 2024.

自称为加密金融服务公司的Matrixport在11月发布了一份重磅报告,预计比特币到2024年4月将达到63140美元,到2024年年底将达到12.5万美元。

Matirxport, known as Encrypted Financial Services, released a heavy-pound report in November, which is expected to reach $63140 in Bitcoin by April 2024 and $125,000 by the end of 2024.

“根据我们的通胀模型,预计宏观环境放松仍将是加密货币的强劲推动力。预计通货膨胀率将再次下降,这可能促使美联储开始降息周期。”“再加上地缘政治‘逆流’,因此这种健康的货币支持政策应该会在2024年将比特币推向新高。”Matrixport在报告中表示。

“As a result of our inflation model, the macro-environment easing is expected to remain a strong driving force for encrypted currencies. Inflation is expected to fall again, which may prompt the Fed to start interest-rate reduction cycles.” “In addition to geopolitical `reverse currents’, this healthy monetary support policy should push bitcoin up to a new high in 2024.” Matirxport states in his report.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论