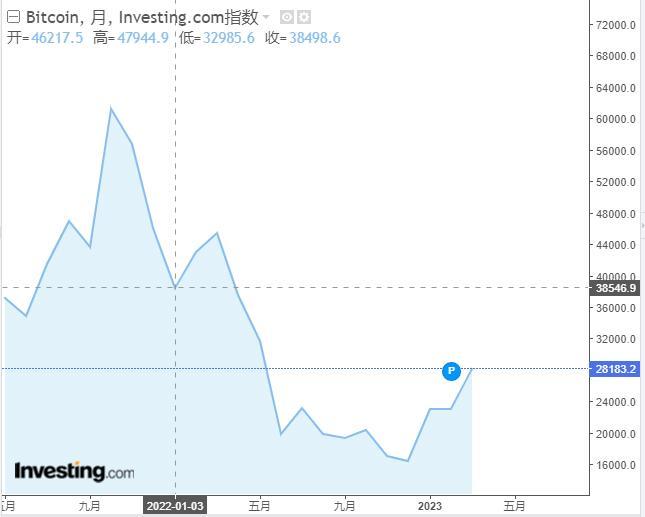

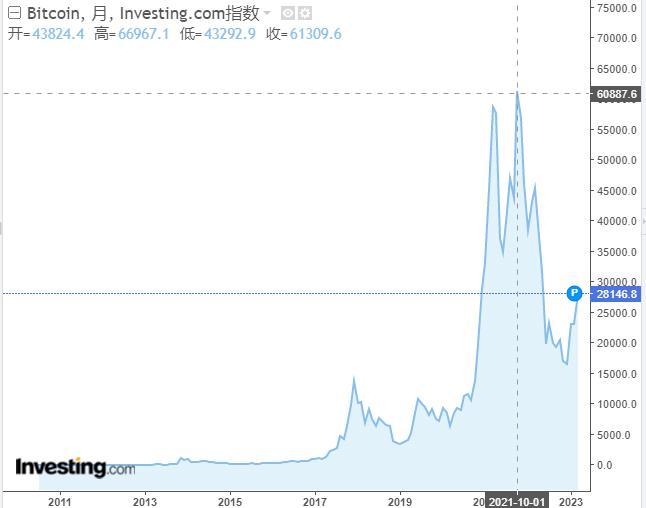

?以比特币为代表的加密资产价格再次上扬!北京时间3月20日凌晨,比特币价格突破2.8万美元,截至当日18时50分,比特币报价28127.7美元,24小时涨幅4.03%,7日内涨幅达28.2%。

{\cHFFFFFF}{\cH00FFFF} The price of encrypted assets, represented by bitcoin, rose again! In the early morning hours of 20 March Beijing time, the price of bitcoin exceeded $280,000. At 1850 that day, Bitcoin offered $281.27, a 24-hour increase of 4.03 per cent, and an increase of 28.2 per cent in seven days.

“最直接的因素是美联储货币政策变化增加了全球风险资产的波动性,其次是硅谷银行倒闭事件凸显了以比特币为代表的去中心化加密资产的避险特性,吸引了更多传统投资者的关注。”分析人士表示。

“The most immediate factor is that changes in the Federal Reserve's monetary policy have increased the volatility of global venture assets, followed by the collapse of Silicon Valley Bank, which has highlighted the decentralised security features of encrypted assets, represented by bitcoin, attracting more attention from traditional investors.” According to analysts.

对于后期走势,上述分析人士指出,“由于未见新增资金入场,料本轮行情只是熊市的反弹并非行情的反转,加密资产市场将继续保持较高的波动率,后续不排除还会出现深度回调,但长期趋势将持续,加密行业发展的关键与核心必须要通过帮助产业实现转型升级、提质增效来体现。”

With regard to later trends, the analysts noted that “in the absence of new funding, the current cycle is simply a rebound in Bear City, the crypto-asset market will continue to be subject to high volatility rates, which will not preclude deep feedback, but long-term trends will continue, and the key and core of the development of the encryption industry will have to be demonstrated by helping the industry to upgrade its transformation and improve its efficiency”.

加密资产市场行情回暖

Encrypted Assets Market Warming

以比特币为代表的加密资产迎来回暖行情。Investing数据显示,过去一周,比特币价格涨幅高达28.2%,连续突破了2.2万美元、2.5万美元以及2.8万美元大关。以太坊过去一周上涨12.7%,到1777.68美元。

Inventing data shows that the price of Bitcoin has risen by 28.2 per cent over the past week, breaking the $22,000, $25,000 and $280,000 mark. Ether has risen by 12.7 per cent over the past week to $1777.68.

比特币和以太坊的价格上扬,带动其他加密资产价格上涨,其中BNB(币安币)一周上涨14.16%至337.6美元,XPR(瑞波币)上涨6.14%,艾达币上涨3.75%,Polygon上涨4.35%,狗狗币上涨7.43%,Solana上涨21.02%至23.097美元。

The upturn in the prices of Bitcoin and Etheria has led to higher prices for other encrypted assets, with BNB rising by $14.16 to $337.6 a week, XPR by 6.14 per cent, Idaco by 3.75 per cent, Polygon by 4.35 per cent, dogs by 7.43 per cent and Solana by $21.02 to $23.097.

中国通信工业协会区块链专委会共同主席、UWEB校长于佳宁对记者分析指出,本轮加密资产上涨主要与全球金融市场密切相关。银门银行 (Silvergate Bank)、硅谷银行(Silicon Valley Bank,SVB)和签名银行 (Signature Bank) 在不到一周的时间内接连倒闭,对美国传统金融的稳定产生了严重的影响,也引发了无数人对于金融股和传统金融市场的恐慌和不信任,这也使得更多人关注到区块链和以比特币为首的加密资产。

UWEB, co-chair of the China Communications Industry Association’s sector chain committee, and head of the UWEB committee, analysed journalists in Gyaning, saying that the increase in encrypted assets in this round is largely closely linked to global financial markets. The closure of Silvergate Bank, Silicon Valley Bank, SVB, and Sign Bank (Signature Bank) in less than a week has had a serious impact on the stability of traditional US financial systems, and has triggered fear and mistrust among countless people about financial units and traditional financial markets, which has also led to increased attention to block chains and encrypted assets headed by Bitcoin.

此外,市场普遍认为美国银行业破产事件后,美国财政部、美联储和美国联邦存款保险公司共同出手救助市场,这一动作代表着未来美联储或许会减缓加息的步伐,因此风险资产悉数上涨。全球经济的不确定性较大,避险因素导致全球资金加速流入黄金等避险资产中,现在比特币以其全球流通、稀缺的属性,也成为避险资产之一。

Moreover, it is widely believed that the US Treasury, the Federal Reserve, and the US Federal Deposit Insurance Corporation have joined forces to bail out the market in the wake of the US banking bankruptcy, a move that represents an increase in risk assets as the Fed may slow interest increases in the future. With greater uncertainty in the global economy, risk avoidance has led to an accelerated flow of global capital into risk-free assets, such as gold, and now Bitcoin, with its global circulation and scarcity, is one of the risk-free assets.

最后,消息面的向好为轧空行情的出现提供了较为有利的条件。由于目前的虚拟资产领域存在着相当大的金融衍生品市场,不少散户都选择使用较高的杠杆倍数进行投资,在本轮反弹前比特币永续合约资金费率长期处于高负费率,这表明大量投资者正在做空比特币,而在基本面出现变化后,许多投资者还处于空头思维中,并未察觉到外围市场的变化。

Finally, the flow of information provides a more favourable condition for the emergence of a vacuum. Given the considerable financial derivatives market that currently exists in the virtual asset area, a large number of dispersed households have opted for higher leverage multiples of investment, and the billing rate of Bitcoin’s permanent contract has long been high before the current round of rebounds, indicating that a large number of investors are making space bitcoins, and that many investors, after changing their fundamentals, are still emptied of changes in peripheral markets.

事实上,根据Coinglass数据,从3月11日起,比特币的每日空单合约爆仓量就超过1.5亿美元,3月14日更是达到1.785亿美元。“在市场杠杆率较高的情况下,一旦出现价格反弹就会造成部分高倍杠杆仓位爆仓,进而会加速上涨,这也是为什么本轮反弹行情相对较为迅猛的原因。”于佳宁分析说。

Indeed, according to Coinglass, from 11 March onwards, Bitcoin’s daily empty-way contract crashed at more than $150 million, and on 14 March it reached $178.5 million. “In a situation of high market leverage, a price rebound could result in some of the high-leveraging positions, which could accelerate the rise, and that is why the current round of rebounds was relatively rapid.” According to Janin.

危机频发导致行情波动下行

在过去一年,因项目和对冲基金发生了一系列倒闭、破产,以及全球第二大加密货币交易所FTX倒闭等危机事件,加密资产价格长期在下行区间。比特币价格从去年1月初到3月有一波上涨,此后到6月持续下跌,6月之后波动下跌,去年全年暴跌65%。 Over the past year, the price of encrypted assets has been on the downside for a long time as a result of a series of failures, bankruptcys, and crisis events such as the collapse of the project and hedge funds, as well as the collapse of the world’s second largest encrypted currency exchange, FTX. Bitcoin prices rose in a wave from early January to March, and then continued to decline in June, with fluctuations falling after June, with a sharp fall of 65 per cent throughout the year. 记者了解到,除了“币圈茅台”LUNA币、加密货币对冲基金三箭资本、FTX以及加密做市商Alameda的爆雷之外,行业还经历了诸如加密借贷平台Celsius、Voyager Digital、BlockFi的破产,加密经纪商Genesis及其母公司Digital Currency Group(DCG)的危机。 & nbsp; journalists learned that, in addition to the LUNA dollar, the Three Arrow Capital of the Encrypt currency hedge fund, FTX and the Alameda mine of the cryptographer, industry has experienced crises such as the bankruptcy of the encryption lending platform Celsius, Voyager Digital, BlockFi, the encryption broker Genesis and its parent company, Digital Crime Group (DCG). 欧科云链研究院高级研究员蒋照生告诉记者,从内部看,去年是加密市场去杠杆化的一年,上轮周期中因大量机构入场而积累了许多泡沫,但在经历UST稳定币闪崩、FTX爆雷、三箭资本破产等一系列利空后,这些泡沫正逐步被戳破和被消化;从外部来看,去年美联储的连续加息让加密市场难以获得更多的外部流动性,市场增长缺乏动力。 Mr. Chiang, Senior Researcher at the Ocoun Chain Institute, told journalists that, internally, last year was a year of deleveraging the encryption market, with a large number of institutional entry bubbles accumulated during the last round, but these bubbles are gradually being punctured and digested after a series of booms in the UST’s steady currency, FTX mines, three arrow capital collapses, etc.; externally, successive increases in the Fed’s interest last year made it difficult for the encryption market to gain more external liquidity and market growth less dynamic. “表面因素是美联储加息,实质因素是泡沫破裂,比特币产生的核心诉求是作为世界货币替代美元,但实际上加密资产中出现了很多爆雷案例,这些案例说明比特币作为世界货币的可能性不高,反而会因为炒作而成为投机者的工具。”浙江大学国际联合商学院数字经济与金融创新研究中心联席主任盘和林认为,比特币最终的结果依然是下跌,如果没有实际成为世界货币,本身波动性很大,那么顶多算一种投机品。 “Apparently, the Fed increased interest rates, the essence of which was the burst of bubbles, and the central claim generated by Bitcoin was to replace the United States dollar as a world currency, but in fact there were a lot of blasting cases in encrypted assets, which showed that Bitcoin was less likely to be a world currency than a tool for speculators because it was staged.” According to the co-director of the Centre for Research on Digital Economy and Financial Innovation of the United Business School of Zhejiang University and Lin, the ultimate result of Bitcoin was still a fall, and that if it did not actually become a world currency, it would be highly volatile in itself, at best a speculator. 中国计算机学会区块链专委会执行委员高承实在接受记者采访时表示,加密资产过去一年进入价格下行区间,与以美联储为代表的全球主要央行收紧流动性有直接关系。美联储收紧流动性以后,更多的流动性从包括加密资产在内的众多领域被收回到美联储。 In an interview with a journalist, the Executive Commissioner of the China Computer Society’s District Chain Committee, Xiaozheng, stated that encrypted assets had entered the lower price range over the past year, directly related to tightening liquidity in the major central banks of the world, represented by the Federal Reserve. With the tightening of liquidity in the Fed, more liquidity has been recovered from many areas, including encrypted assets, to the Federal Reserve. 于佳宁分析指出,加密资产价格过去一年波动下行,一是受全球金融市场的大周期影响,过去一年市场都处于美联储加息阶段的探底行情中,波动下行的价格也不能逃脱资金面的紧张;二是随着价格的逐步降低,部分机构用户已进入止损阶段,这些在牛市助推加密资产价格上涨的资金,在熊市也是加速下跌的因素;三是DeFi(去中心化金融)项目的连环爆雷,以及其牵扯的机构大规模连环清算,致使出现抛售的“踩踏”。 Yu Gyanning's analysis points out that the price of encrypted assets has fluctuated over the past year and has been affected by large cycles in global financial markets, and that the market has been in the hands of the Fed during the past year, and that the price of the floating down has not escaped the financial constraints; that, as prices have fallen, some institutional users have entered the loss phase, and that the funds that have contributed to the increase in the price of encrypted assets in the cattle market are also a factor in the acceleration of the decline in the Bear City; and that there has been a series of explosions in the DeFi (decentralized finance) project and the large-scale liquidation of the institutions involved, which has led to a “stamping” of sales. 发展核心是赋能产业转型升级 事实上,比特币在2021年价格就达到突破6万美元的峰值。高承实分析指出,加密资产今后的价格走势,在总体上会取决于以下几个方面:首先是全球的流动性,如果流动性充裕,比特币等加密资产价格还会继续走高。这一点就类似于黄金,比特币等加密资产在此时起到了保值和避险的作用。 Indeed, Bitcoin’s price peaked at $60,000 in 2021. High-level analysis suggests that future price trends for encrypted assets will generally depend on global liquidity, which, if sufficiently liquid, will continue to raise the price of encrypted assets such as Bitcoin. 其次是加密资产的应用创新,创新的虚拟货币交易形态有可能带来去中心化虚拟货币的影响继续扩张,也会导致虚拟货币价格再度走高。再次是货币金融领域非正常事件的影响,传统的货币金融体系都是中心化的,包括中心化交易所等一部分加密资产应用也是中心化的。这些中心化应用的爆雷会强化人们对加密资产去中心化的共识,由此也会带来其价格的进一步走高。 & nbsp; followed by innovations in the application of encryption assets, the potential for innovative virtual currency trading patterns to lead to the continued expansion of decentralized virtual currencies, and to a further rise in virtual currency prices. Again, the effects of unusual events in monetary finance, where traditional monetary financial systems are central, and some of the encryption asset applications, such as centralized exchanges, are central. 最后是加密资产与人类实际生活的关联。截至目前,加密资产及其应用还是传统货币金融的影子应用,如果加密资产与人类生活发生更多实质上的关联,得到更多实际应用,这将极大提高虚拟货币的价格。高承实表示,在分析加密资产价格趋势时,也需要进一步分析不同加密资产的共识机制和应用场景,以及其市场影响力,而不应笼统地将所有加密资产混为一谈。 So far, encryption assets and their applications have been shadow applications of traditional monetary finance, and if encryption assets are more substantively associated with human life and more applied in practice, this will greatly increase the price of virtual money. High-level claims that, in analysing price trends for encrypted assets, there is also a need for further analysis of consensus mechanisms and applications of different encrypted assets, as well as their market influence, rather than a general mix of all encrypted assets. 蒋照生表示,虽然硅谷银行破产让不少加密社区意识到不能过度依赖银行等中心化金融机构,而重新关注比特币以及DeFi等原生加密创新,但在全球范围内,加密世界和传统金融体系的融合仍将继续。这是因为加密市场仍需主流金融市场提供流动性和应用空间,主流金融市场也需要加密市场的创新与活力。所以,未来美联储的加息操作以及各国监管机构的监管措施都将对加密市场产生更加深刻的影响。 According to Chiang, while the bankruptcy of Silicon Valley Bank has made many encryption communities aware of the need not to rely too much on central financial institutions, such as banks, and to refocus on original encryption innovations such as Bitcoin and DeFi, the integration of encryption worldwide and traditional financial systems will continue. This is because encryption markets still need liquidity and application space in mainstream financial markets, as well as innovation and dynamism in encryption markets. 于佳宁表示,加密资产市场将继续保持较高的波动率,后续不排除还会出现深度回调,但长期趋势将持续。目前处在资金流出、资产价格下行、新兴资产大量崩盘,甚至多次出现安全问题的衰退期,只有彻底打乱从前加密资产内部的等级排序,让市场进行价值重估,才能让真正优秀的项目脱颖而出,带来新商业模式,重构分配模式、市场结构、组织形态以及产业关系。 Yu Gianning states that the crypto-asset market will continue to maintain high volatility rates, not excluding deep retrenchment, but long-term trends will persist. At a time of financial outflows, downside asset prices, massive collapses in emerging assets, and even repeated security-related recessions, only a complete disruption of the ranking within the former encrypted assets and a revaluation of the market’s value will enable truly excellent projects to emerge, bringing about new business models, re-engineering distribution patterns, market structures, organizational patterns, and industrial relations. “数字资产可以被认为是一种‘未来资产’,其价值能够有效穿越经济周期,但其‘基本面’始终是全球的数字经济发展。因此我们可以将数字资产理解为数字经济发展的一面镜子,就如同股市反映实体产业的关系一样,数字资产价值重估反映数字经济的发展和繁荣。区块链技术最终的目的还是要服务实体经济,加密行业发展的关键与核心必须要通过帮助产业实现转型升级、提质增效来体现。”于佳宁表示。 “Digital assets can be considered a ‘future asset’ whose value can effectively pass through the economic cycle, but their ‘fundamental face’ has always been a global digital economy. So we can interpret digital assets as a mirror of digital economic development, reflecting the development and prosperity of the digital economy as the stock market reflects the relationship between the real industry. 记者 | 余继超 Reporters,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论