文|PANews Carol

PANews Carol

编辑|毕彤彤

Edit Xiao Bing Bing.

在新冠肺炎疫情阴影笼罩下的全球金融市场上,“市场持续下跌”和“政府量化宽松”成了两条叙事主线。随着美股创下史无前例的一周4次熔断后,美联储按捺不住出手救市,降息、无限量QE、2万亿美元刺激计划相继出台,这一系列措施意在为市场提供充足的流动性。随后,美股应声反弹。

In the global financial markets, under the shadow of the new coronary pneumonia epidemic, “markets continue to fall” and “government quantitative easing” become two main lines of narrative. With the unprecedented four meltings of the US stock during the past week, the Fed has been unable to move out of the rescue market, with interest-reduction, unlimited QE, and $2 trillion stimulus packages, a series of measures designed to provide sufficient liquidity for the market.

除了传统资产以外,在此次抛售潮中,新兴数字资产比特币也没能守住“数字黄金”的地位。根据PAData早前对此次合约“大屠杀”的观察,比特币的价格在3月12日晚间暴跌37%,仅当天的爆仓金额就高达27.98亿美元,期货持仓量腰斩53%,大单成交缩水81%……

With the exception of traditional assets, the emerging digital asset Bitcoin did not hold up the status of “digital gold” during this sellout. According to PAData's earlier observation of the contract, the price of Bitcoin fell by 37% on the night of March 12, with a blast of $2.798 billion on that day alone, 53% of futures held and 81% of the bulk of the list.

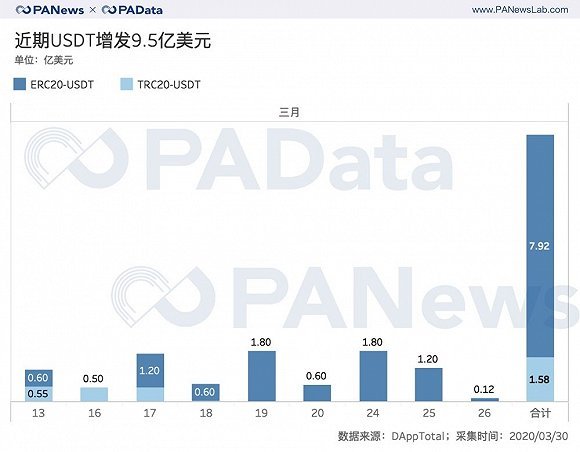

各项数据都表明,数字货币市场也正面临着严重的流动性紧缺问题。作为数字货币市场流动性的提供者,多个稳定币都在近期开启了“疯狂印钞”模式。根据DAppTotal的统计,自12日流血暴跌后,仅ERC20-USDT就增发了8次,累计净增发金额达到7.92亿美元。

As a provider of the liquidity of the digital money market, several stable currencies have recently started a “crazy printing” model. According to DappTotal, after a bloodbath in 12 years, the ERC20-USDT alone increased eight times, with a cumulative net increase of $792 million.

加密货币市场在获得流动性补充后是否恢复了以往的活力?尤其是此次遭受重创的合约市场目前恢复几成?哪家交易所回血情况和目前表现最好呢?

Has the encrypt currency market recovered its previous dynamism after having been replenished with liquidity? In particular, how many per cent of the contract market that has been severely damaged is now recovering?

暴跌后USDT增发9.5亿

投资者对经济发展的预期恶化使得避险情绪高涨,无论是风险资产还是避险资产都被抛售。美元回流使得包括数字货币在内的多个市场流动性紧缺,而资本流出后的资产暴跌又加剧了市场流动性的不足程度。

The deterioration of investors’ expectations for economic development has led to a heightened sense of risk avoidance, with both risky and risk-free assets being sold. The return of the United States dollar has made multiple markets, including digital currency, scarce, while the collapse of assets after capital outflows has exacerbated the inadequacy of market liquidity.

为了打破这个循环,缓解流动性问题,多国央行紧急干预,或降息,或启动QE,或实施财政补贴,而在这些财政政策干预之外的数字货币市场,多个稳定币都在近期开启了“印钞”模式,以缓解暴跌带来的流动性不足。

In order to break the cycle and ease liquidity problems, the multinational central banks intervened urgently, either to reduce interest rates, to activate QE, or to introduce fiscal subsidies, while the digital currency market, which is outside of these fiscal policy interventions, has recently opened a “book printing” model in order to alleviate the liquidity deficit caused by the collapse.

根据DAppTotal的统计,3月以来,稳定币总市值持续上涨。截至3月29日,稳定币总市值约为76.6亿美元,较3月9日上涨了17亿美元,涨幅约为28.52%,其中暴跌后的13日较前一日环比上涨5.37%。

According to DappTotal, the total market value of the stable currency has been rising steadily since March. As at 29 March, the total market value of the stable currency was approximately $7.66 billion, an increase of $1.7 billion compared to 9 March, an increase of approximately 28.52 per cent, with a sharp fall of 5.37 per cent on the previous day.

其中,稳定币市场的主导者USDT在暴跌发生后动作频频。根据统计,13日至29日期间,ERC20-USDT和TRC20-USDT累计增发12次,累计净增发金额高达9.5亿美元。

Among them, USDT, the leader of the stable currency market, has been active since the crash. According to statistics, between 13 and 29 years, the ERC20-USDT and TRC20-USDT cumulatively increased by 12 times, with a cumulative net increase of $950 million.

值得注意的是,过去三周仅USDT的增发金额就已经明显高于2月1日至3月9日期间所有稳定币的总净增发金额5.6亿美元。稳定币为数字货币市场注入的流动性是迅速且巨量的,那么“大水漫灌”以后,此前受到重创的合约市场是否立刻“回血”了呢?

It is worth noting that the increase in USDT alone over the past three weeks has been significantly higher than the total net increase of $560 million in all stable currencies during the period from 1 February to 9 March. The liquidity injected by stable currencies into the digital currency market is rapid and huge, so after the “water pour” did the contract market, which had been devastated, “reflecate” immediately?

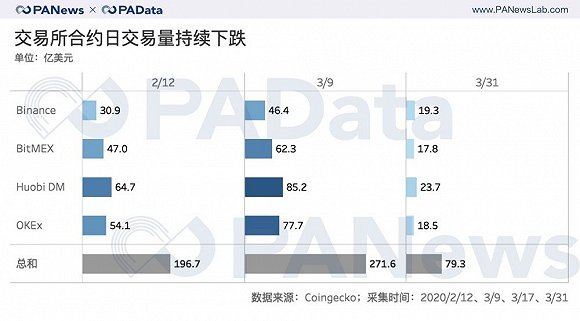

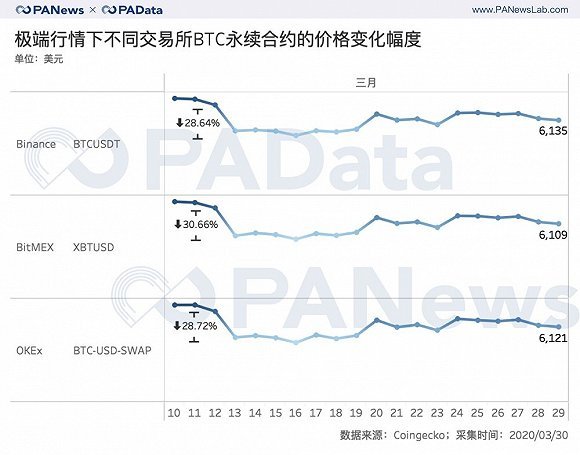

四大所合约持仓量平均“回血”28%

自今年以来,在减半行情的预期下,投资者纷纷进入合约市场,加杠杆以小博大,成交量屡创新高。根据Coingecko的统计,2月12日,OKEx、BitMEX、Huobi和Binance四大主力合约市场的单日名义交易量达到了196.7亿美元,而在大约一个月后的3月9日,这个数值上升至了271.6亿美元。 Since the beginning of the year, investors have entered the contract market with half of what is expected, leveraging it to be small and innovative. According to Coingecko, on 12 February, single-day transactions in the four major major contract markets, OKEx, BitMEX, Huobi, and Binance, reached $19.67 billion in nominal terms, rising to $27.16 billion on about a month later, on 9 March. 但一个月前还在想着怎么抓住减半行情的投资者,现在都被行情减半抓牢了。合约“大屠杀”后,3月31日四大主力合约市场的单日名义成交量已经下跌到了79.3亿美元,大约只是暴跌前的30%。而且,四大交易所的单日合约交易量基本接近,相互之间的交易量差距较极端行情前有所缩小。 After the “Holocaust” contract, the single-day deal in the four major contract markets fell to $7.93 billion on 31 March, about 30% before the collapse. Moreover, the single-day deal volume of the four exchanges is almost close, and the trade gap between them is narrower than before the extremes. 虽然交易量上4家交易所当下咬的很紧,但从持仓量来看,目前BitMEX和OKEx是持仓量最大的两个合约市场,分别为4.43亿美元和4.35亿美元,大约是Huobi和Binance持仓量的两倍多。 Despite the tight bites of the four exchanges in terms of volume, BitMEX and OKEx are currently the two largest markets for stock holdings, at $443 million and $435 million, respectively, which is more than double the holdings of Huobi and Binance. 要知道,由于合约持仓基数高,BitMEX和OKEx在极端行情期间(3月10日至16日)的爆仓金额都超过了30亿美元,Huobi和Binance则都不到10亿美元,但即使BitMEX和OKEx受伤更严重,两者仍然是目前最大的两个合约市场。可见,在合约市场遭受重创后,市场还是维持此前的格局。 You know, because of the high stocking base of the contract, BitMEX and OKEx spent more than $3 billion during extreme events (10-16 March) and Huobi and Binance less than $1 billion, but even if BitMEX and OKEx were injured more seriously, they are still the two largest contracts markets today. So, after the heavy damage to the contract market, the market remains the same as before. 就目前市场体量最大的两强BitMEX和OKEx而言,两者持仓量的恢复情况却不太相同。总体而言,BitMEX在极端行情后持仓量仍呈下跌趋势,OKEx则呈上涨趋势,前者目前的持仓量较3月13日下跌了2.85%,而OKEx目前的持仓量较3月13日上涨了19.18%。 In the case of BitMEX and OKEx, which are currently the two largest markets, the recovery of their holdings is not quite the same. Overall, BitMEX is still on a downward trend after extreme events, while OKEx is on a rising trend, with its current holdings falling by 2.85% on 13 March and its current holdings rising by 19.18% on 13 March. Huobi和Binance的持仓量在13日以后也成逐渐恢复的态势,四大主力合约市场目前的持仓量较3月13日平均上涨了28%,但仍远低于暴跌前的水平,稳定币“开闸放水”的效果并非立竿见影。 The holdings of Huobi and Binance also recovered gradually after 13 days, with the current holdings of the four major contract markets rising by an average of 28 per cent on 13 March, but still well below pre-shock levels, and the effect of stabilizing the currency's “opening and release of water” was not immediate. 极端行情下主力合约市场的抗风险能力 交易深度是衡量一个市场活力和抗风险能力的重要指标。交易深度影响价格,如果一个市场的深度越好,在面临极端行情时,其能为投资者提供的支撑也越强。 The depth of transactions is an important measure of a market’s dynamism and resilience to risk. The depth of transactions affects prices, and if a market is as deep as possible, the more supportive it can provide investors in the face of extreme behavior. PAData分析了四大主力合约市场上持仓量较大的BTC永续合约和BTC当季合约盘口价差,从买一价和卖一价的价差来看,除了Binance的BTC永续合约为1.34USDT,大于其交易系统深度整合最小单位0.01USDT以外,其余三大所的主力合约盘口买一价与卖一价的价差都是该所交易系统最小深度整合单位。 PAData analysed the difference between the BTC stand-alone and BTC's current-season contract prices in the four major major contract markets, except for BTC's one-price and one-price differential, which is 1.34 USDT for Binance, which is greater than the lowest unit for deep integration of its trading system, 0.01 USDT, and the difference between the purchase and sale of one price in the three main contracts is the lowest depth integration unit of the trading system. 根据Coingecko的收录数据来看,四大交易所所有BTC合约的盘口价差(spread)大约都在0.10%-0.12%之间,交易深度彼此接近。 According to the data collected by Coingecko, the price differential (spread) for all BTC contracts in the four major exchanges ranged from about 0.10 per cent to 0.12 per cent, and the depth of the transaction was close to each other. 但从不同交易所的不同合约在极端行情下的价格跌幅来看,不同交易所中不同合约产品的深度又有所不同。从BTC永续合约来看,12日至13日,Binance的BTC永续合约跌了28.64%,OKEx跌了28.72%,BitMEX跌了30.66%。火币BTC永续合约由于推出较晚,暂未被Coingecko纳入统计。 But the depth of different contracts in different exchanges varies from one exchange to another in extreme terms. From 12 to 13, BTC in Binance fell by 28.64%, OKEx by 28.72%, and BitMEX by 30.66%. 如果统计每日爆仓金额的合约构成,可以发现,BTC永续合约的爆仓金额占绝大多数。从PAData于3月10日统计的爆仓金额构成来看,当天1.01亿美元的爆仓总额中42.15%来自BTC永续合约,因此BTC永续合约的交易深度的重要性可能远高于市场其他单个合约类型。 If the contract composition of the daily blast rate is counted, it can be observed that BTC has a large majority of the BTC lease value. The composition of PADATA’s March 10 cut-off amount is that 42.15% of the $101 million on that day came from the BTC permanent contract, so the BTC’s trading depth is likely to be much higher than that of the other individual types of contracts in the market. 从体量更接近的OKEx和BitMEX来看,OKEx在BTC永续合约的交易深度上表现更好,虽然两者的跌幅接近,但是根据PAData早前的统计,价格每波动1%造成的爆仓金额在4千万美元左右,因此如果交易深度多支撑0.1%,那就相当于减少4百万美元的爆仓金额,对散户投资者而言,这种支持是可观的。 In terms of a closer volume of OKEx and BitMEX, OKEx performed better on the BTC's trading depth for a permanent contract, although the decline was close, but according to PAData's earlier statistics, 1 per cent of each price fluctuation resulted in an explosion of about $40 million, so that if the depth of the transaction was more than 0.1 per cent, it would be equivalent to a reduction of $4 million, which would be significant for bulk investors. BTC当季合约是除了BTC永续合约以外,市场上最大的交割合约,12日至13日,Huobi的BTC当季合约跌了30.84%,BitMEX跌了32.61%,OKEx跌了34.97%。值得注意的是,当季合约在极端行情下的合约价格波动普遍高于永续合约。币安暂无当季合约,因此未纳入统计。 BTC’s current-season contract was the largest in the market, except for the BTC permanent contract, which fell by 30.84% between 12 and 13 years, BitMEX by 32.61%, and OKEx by 34.97%. It is worth noting that the current-season contract’s price volatility is generally higher than the permanent contract. 综合来看,持仓量更大的OKEx和BitMEX在极端行情时的合约价格跌幅都略高于Huobi和Binance,但如果剔除合约产品数量对单个合约交易深度的“稀释”,拥有219个合约产品的OKEx或在整体交易深度上是领先的。 Taken together, the larger stock of OKEx and BitMEX contract prices fell slightly more than Huobi and Binance in extreme behaviors, but if the volume of contract products is “reduced” to the depth of individual contract transactions, OKEx owns 219 contract products or is in the lead on the overall trade depth. 合约基差随交割时间扩大,中期走势仍不乐观 虽然稳定币已经“开闸放水”,合约持仓量也已恢复28%,但市场的恐慌情绪仍未消散。整体而言,主力合约市场的多空势力比较胶着,即使出现“锯齿形”的多空比悬殊形态,也仅局限于单日,次日即恢复至胶着状态,这意味着市场对BTC打破过去4个月平衡状态后的方向仍然不明确。 Although the steady currency has been “opened” and the contract holdings have been restored to 28%, the panic in the market has not dissipated. On the whole, the multi-empty power of the main contract market, even in the form of “sawing” multi-space differentials, is limited to one day, the next day returning to glue, which means that the market remains unclear as to the direction of the BTC after it has broken the balance of the last four months. 其中,OKEx季度合约的多空比最为接近,“锯齿”较少,多空最大差距仅有6.2%,市场运行较平衡。而BitMEX则是主力合约市场中多空“锯齿”最多的,3月21日多空最大差距达到了26.2%,投资者对于市场的走向分歧度最大。需要指出的是,多空比偏离1越大,说明市场的预期一致性越大,群体踩踏的风险越大。 Of these, the OKEx quarterly contracts are the closest, with fewer “sawings,” with the largest gap of 6.2%, and more balanced market operations. BitMEX, for its part, has the most empty “saws” in the main contract market, with the largest gap of 26.2% on March 21, with investors most divided about the market’s direction. 截至3月29日,三大主力合约市场都是空头占优,其中OKEx季度合约和Huobi季度合约成交单中开多的比例约为49.9%,开空的比例约为50.1%,BitMEX合约成交单中开多的比例约为48.5%,开空的比例约为51.5%。 As at 29 March, the three main contracts markets were empty, of which the ratio was about 49.9 per cent for the quarterly contract with OKEx and the quarterly contract with Huobi, 50.1 per cent for the opening, 48.5 per cent for the BitMEX contract and 51.5 per cent for the opening. 不仅当前“空军”占优势,而且在BTC交割合约中,远期合约的基差比近期合约更大。 Not only does the current “air force” prevail, but in BTC contracts, the basis for forward contracts is larger than in recent contracts. 根据基差的定义,基差=现货价格-期货价格,基差大于零意味着现货价格高于期货价格,空头势利强盛,反之意味着期货价格高于现货价格,多头势利强盛。 According to the definition of the base spread = spot price — futures price, the base spread greater than zero means that spot prices are higher than futures prices, that they are more powerful than futures, and that, conversely, futures prices are higher than spot prices and that they are more powerful. BitMEX BTC当季合约的基差为1.28%,次季合约的基差为1.56%。Huobi BTC当周合约的基差为0.4%,次周和当季合约的基差分别为0.69%和1.07%。OKEx BTC当周合约的基差为0.33%,次周合约的基差为0.63%,当季和次季合约的基差分别为1.15%和0.74%。 BitMEX BTC has a base difference of 1.28% for the current season and 1.56% for the sub-season. Huobi BTC has a base difference of 0.4% for the week, 0.69% for the week and 1.07% for the period, respectively. OKEx BTC has a base difference of 0.33% for the week, 0.63% for the week, and 1.15% and 0.74% for the season and the sub-season, respectively. 整体而言,基差与交割时间成正比,即随着BTC交割合约交割期间的推移,基差逐渐扩大。这意味着从中期来看,市场上的空头势力仍然强大。其中,BitMEX的基差较其他交易所同期交割合约的基差更大,这或因BitMEX上做空的投资者更多。而OKEx的投资者对BTC中期走势最为乐观,其次季合约的基差比当季更低,略高于次周。 On the whole, the base difference is proportional to the timing of the delivery, that is, it is growing as BTC moves over the cut-off period. This means that, in the medium term, the market’s empty power remains strong.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论