来源:石榴财经

近期火币也推出了合约交易服务,但其安全性和交易体验如何,市场仍在疑虑中。

The recent introduction of contract trading services has also been accompanied by concerns about its safety and trading experience.

作为全球三大数字货币交易所之一的火币,近段时间交易量持续下滑。根据CNBC公布的各大交易所9月10月交易量对比,火币10月同比下降47%。

内部人士担忧,持续的交易量断崖式下滑,远比公开的数据严重。业务下滑加速了火币内部权力洗牌。业内传言,火币二把手COO朱嘉伟核心业务被收缩,分管团队也开始化整为零,有被架空趋势。

People inside

业务下滑也导致了公司人力资源的异常行为,九月底,发生了“火币违规辞退孕妇”事件,以至于火币CEO李林深夜发朋友圈,意指是员工“违规操作”。11月17日,火币开启了全球裁员节奏,仅巴西业务就裁掉了60%员工。

The decline in business has also led to unusual behaviour on the part of the company's human resources. At the end of September, there was an incident in which the "soldier's irregular dismissal of pregnant women" led to the late-night circle of friends of the Coyote CEO Lee Lin, meaning that the employee was “off-limited”. On November 17, , it opened the global staff cut-off rhythm, leaving 60% of the Brazilian business alone.

合约交易的推出,会挽救内外交困的火币吗?石榴财经希望就业务下滑和推出合约交易采访火币,但截至发稿,尚未获得回应。

Will the launch of the contract deal save the currency of internal diplomacy? Pomegranates wants to interview it about the decline in business and the roll-out of the contract deal, but as of the date of the release, no response has been received.

2018区块链新经济杭州峰会上,泛城资本陈伟星说,预计比特币会再跌50%,而且70%以上的区块链团队无法继续运营。连日来比特币、以太坊等主流币市值大跌。彭博社甚至断言,比特币将跌至1200美元。

At the new economic summit of the 2018 block chain, Pan-City Capital Chen Weissing said that it was expected to fall by another 50%, and that more than 70% of the block chain teams could not continue to operate. The market value of mainstream currencies such as Bitcoin, Ether, etc., fell sharply.

市场的跌宕起伏,直接影响了数字货币传统交易对交易的活跃,但刺激了合约交易。火币酝酿合约交易已有相当一段时间,迟迟未能上线,主要是技术储备不足。

The volatility of the market has had a direct impact on the dynamics of the digital currency traditional transactions, but it has stimulated contractual transactions. has been developing contract transactions for quite some time and has been delayed, mainly because of insufficient technological reserves.

高杠杆合约交易领域,一直是BitMEX和OKEx两家“楚汉争雄”。在合约交易市场上,OKEx靠着合约交易的先发之势占尽“天时”,拥有了大量的合约用户和极高的交易量。而BitMEX和其超高杠杆一直是业内传说。

The area of highly leveraged contract transactions has always been BitMEX and OKEx, the “Chu-Hu-Hu-Hu-Hu.” In the contract trading market, OK-Ex has taken up “the day” on the pre-eminence of contract transactions, with a large number of contract users and a very high volume of transactions.

高杠杆交易也存在巨大的技术性风险和道德风险。火币合约交易上线,适逢市场出现剧烈动荡,其系统能否提供安全的完备的交易体验,是其成功与否的关键。

There are also significant technical and moral risks to highly leveraged transactions.

石榴财经依据BitMEX和OKEx的公开资料,与火币的合约交易的公开资料,进行技术性对比,来分析目前全球数字货币合约交易的现状。

Pomegranate finance analyses the current status of global digital-currency-contracting transactions by means of publicly available information from BitMEX and OKEx, and by means of technical comparisons with publicly available information on contract transactions for the tender.

01

合约交易对系统设计要求很高

谈及合约交易,无法回避的话题就是杠杆。

When it comes to contractual transactions, the inescapable topic is leverage.

火币官方对于杠杆有如下定义:

The official definition of leverage is as follows:

“合约交易杠杆倍数分别为1倍、5倍以及更高倍杠杆。例如BTC周合约杠杆倍数为10倍,用户只需要拥有1个BTC作为保证金,就可以开多/开空最多价值10个BTC的仓位,以获得更多收益。

“Contract transactions are leveraged by a factor of one, five, and even more. For example, the BTC weekly contract is leveraged by a factor of ten, and the user needs only one BTC as a security deposit to open up/open a maximum of 10 BTC warehouses in order to generate more returns.

用户在开仓前,需要先选择杠杆倍数。选择杠杆倍数后,用户的当周、次周、季度合约,都使用同一种杠杆。用户只有在无任何持仓、且无任何挂单的情况下,才能切换杠杆倍数。”

The user needs to select a multiple of leverage before opening the warehouse. After selecting a multiple of leverage, the user uses the same leverage for the week, week, quarter contracts. Users can switch the multiple of leverages only if there is no warehouse and there is no hang-up.

打开火币的官方说明,其上显示的截图是1、5、10倍三种杠杆的选择。

Opens the official description of the gun, which shows a screen of 1, 5 and 10 times the option of leverage.

目前可以看到,火币合约的杠杆倍数不及OKEx的20倍杠杆,与BitMEX的百倍杠杆更无法相提并论。同普通投资者不同,富有经验和资金的专业投资者和机构投资者更偏爱高倍杠杆。

At present, it can be seen that a gun contract has less leverage than the 20-fold leverage of OKEx, much less the 100-fold leverage of BitMEX. Unlike ordinary investors,

提供倍率相对低的杠杆,一方面可以说是火币推出合约交易比较谨慎,另一方面也说明,火币对合约交易没有足够信心。

provides a relatively low leverage, which, on the one hand, can be said to be more prudent in initiating contractual transactions and, on the other hand, shows that it does not have sufficient confidence in contractual transactions.

杠杆在放大风险的情况下,盈利同样被放大。如果使用OKEx的20倍杠杆,可以迅速把盈利放大20倍;而BitMEX100倍杠杆意味着只要能涨1%,那么瞬间暴富不是传说。

Leveraging is also magnified when risks are magnified. Using the 20-fold leverage of OKEx can quickly magnify profits by 20-fold; while BitMEX 100-fold leverage means that as long as it increases by 1 per cent, instant wealth is not a legend.

“高杠杆伴随着高风险,但是同样也会赢来高回报,在BitMEX上爆仓可以说是家常便饭,因为它有多国语言聊天功能,所以有人爆仓了都会隔三差五全频道庆祝一下,欢乐得很。”一位投资人在接受石榴区块链采访时说。

“High leverage carries a high risk, but it also wins a high return, and the bang on BitMEX can be described as a regular meal, because it has a multi-language chat function, so some people go off and celebrate with three or five full channels.” An investor said in an interview with the pomegranate block chain.

低倍杠杆对于合约交易新手了解合约交易比较实用。除此之外,杠杆倍数越低保证金越少,这使得一些散户也有机会尝试低倍杠杆与合约交易。

Low leverage is more practical for newcomers to contract transactions. In addition, the smaller the leverage multiplier, the smaller the bond, gives some scatteredrs an opportunity to try low leverage and contract deals.

但是,选择杠杆交易的用户,不是有经验的投资者,就是冒险的赌徒。对于前者,低倍杠杆根本无法保证收益率;对于后者,赌徒心态决定了他们偏好更高倍的杠杆。这样一来,低倍杠杆就成了一个近似“鸡肋”的存在,火币求稳的战略势必注定无法吸引大多数用户。

However, the users of the leverage deal are either experienced investors or risk-taking gamblers. For the former, low leverage does not guarantee a rate of return; for the latter, the gamblers' mentality determines their preference for higher leverage.

另外,从账目模式来看,火币新上线的合约交易与其他老牌合约交易所也有着极大的差别。

In addition, in terms of accounting patterns, there are significant differences between the new-line contract transactions of the currency and other established contract exchanges.

不论是BitMEX,还是OKEx,在账户模式上都会提供“逐仓”“全仓”两种可供选择的模式,而在火币新上线的合约交易系统中,却只有“全仓”一种模式。

, whether BitMEX or OKEx, provides two alternative models of “silo-by-silo” in the account mode, whereas in the new-line contract trading system, there is only one model of “sto-silo”.

全仓模式指同一账户的所有合约持仓风险和收益都合并在一起进行计算的,一旦出现爆仓,大家一起承担损失,又可以叫“连坐制”。而逐仓模式下的账户,各个合约的持仓的风险和收益是分别计算的,因此也不会一起承担损失。采用逐仓模式的用户,很有可能会选择单独爆仓止损,或者换取更高的收益。

The whole warehouse model means that all contract holdings and benefits of the same account are calculated together, and that, in the event of a crash, everyone bears the loss and can be called “sitting.” The risks and benefits of each contract are calculated separately from those of the accounts under the warehouse-to-house model, and therefore do not bear the loss together. Users using the warehouse-to-ware model are likely to opt for a stand-alone breakout, or for a higher gain.

账户模式的设置,直接关系着被爆仓后损失多少的风险,显然火币仅提供全仓这一种模式,无疑加大了投资的风险。

The establishment of the account model has a direct bearing on the risk of loss in the aftermath of the explosion, and it is clear that it provides only a full warehouse model, which undoubtedly increases the risk of investment.

实际上,火币未尝是没有意识到这一点的重要性,但是逐仓交易对技术的要求比全仓要高得多,需要在每个币种下再去生成一个子账户,并且要开发配套的追加保证金、自动追加保证金等功能。这对于交易所的技术团队来说是一个考验。考虑到火币在现货交易时多次发生宕机“黑历史”,其采取全仓模式也是一种退而求其次的选择。

In fact, it is not aware of the importance of this, but the technology of a silo-by-sell transaction is much more demanding than a full silo, requiring the generation of a sub-account in each currency, and the development of matching additional bonds, automatic additional bonds, etc. This is a test for the technical team of the exchange. , considering that the stow-up model is also a second-best option, considering that the stale has been “black history” on many occasions during spot transactions.

与用户收益息息相关的另一点则是指数计算的逻辑。

Another point related to the interest and interest of the user is the logic of index calculation.

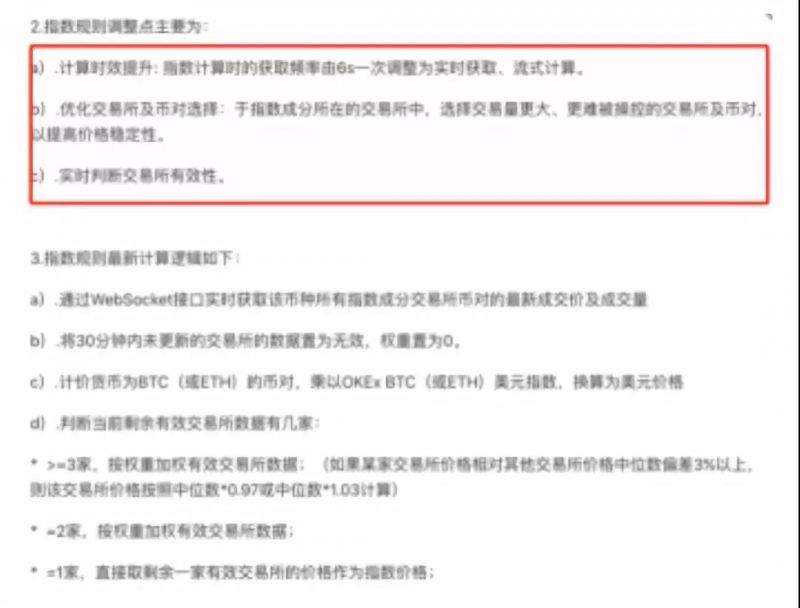

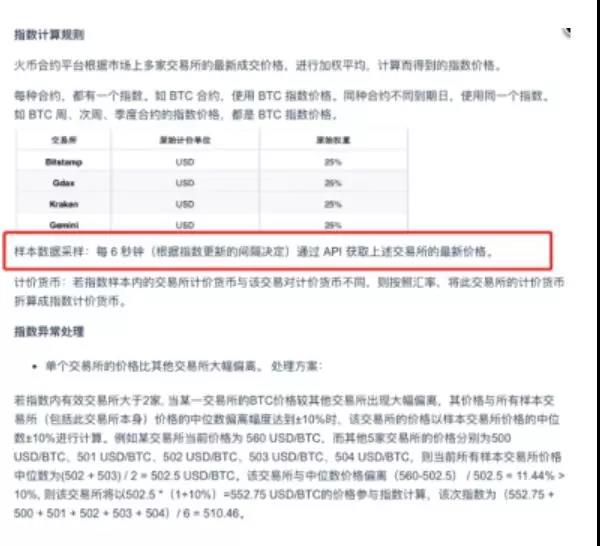

长期以来OKEx的指数为每6秒更新一次。目前,OKEx已经升级为实时更新和流式计算,数据显示已经做到灵敏,这对需要做对冲的量化机构而言较为友好。传闻这也是OKEx为后续的标记价格系统上线做准备。

The index of OKEx has been updated for a long time every six seconds. At present, OKEx has been upgraded to real-time updates and current calculations, and the data show sensitivity, which is friendly for quantitative agencies that need to be hedged.

OKEx指数计算升级为实时更新、流式计算

OKEx index calculations upgraded to real-time updates, current calculations

而火币的指数计算逻辑,目前的逻辑基本与OKEx的旧版保持一致,而整个产品逻辑、解释说明,都有明显抄袭的意味。

The logic of the index calculation of and the gun price is basically consistent with the old version of OKEx, and the whole product logic, explanation, has a clear copy.

火币指数计算仍停留在旧版

The gun index is still in the old version.

同时,OKEx的指数成分偏差处理逻辑阈值,由原来的10%调整为3%。这样一来,由于某一家指数成分数据异常而导致异常波动情况就会减少很多。

At the same time, the logical threshold for the index component deviation treatment of OKEx was adjusted from 10 per cent to 3 per cent. As a result, abnormal fluctuations due to abnormal data on a particular index component would be significantly reduced.

02

合约交易需要交易的深度和流动性

交易深度,通俗来说就是有多少人在进行交易。对于大户和量化交易团队,如果合约交易深度不够,就没有足够大的套利空间。对于普通投资者来说,如果交易深度不够,市场会更容易被大户所操纵,普通投资者更容易被收割。而且如果市场深度不好,很容易出现连环爆仓的问题。

The depth of the transaction, popularly speaking, is how many people trade. does not have enough arbitrage for large households and quantitative trading teams if the depth of the contract transaction is not sufficient. For ordinary investors, if the depth of the transaction is insufficient, the market will be more easily manipulated by large households, and ordinary investors more likely to be harvested. And if the depth of the market is not good, the problem of staggering can easily arise.

且不论其他,仅就合约交易的用户规模一项而言,BitME、OKEx和火币作为早期的老牌交易所不分伯仲。但合约交易而言,目前前两者领先火币许多,包括成熟的量化机构、大户、普通投资者等等。所以这两家合约交易所显然拥有着合约市场上比较好的深度;即便目前的熊市每天的交易量也有几十亿美金。

{\cHFFFFFF}{\cH00FF00} But, in the case of {\cHFFFFFF}{\cH00FF00} contracts, the first two are now leading in many ways {\cHFFFFFF}{\cH00FF00}, including mature quantitative agencies, large-scale corporations, ordinary investors, etc. } So it is clear that the two contracts exchanges have a better depth in the contract market; even the current bear market has billions of dollars a day.

而由于火币合约刚刚处于内测阶段,大户和量化机构对于系统稳定性没有足够的信任,所以每天的交易量很小、深度也很差。目前火币合约的交易深度还远远不够,遇上较大的行情变化,以火币测试版目前的交易深度,恐怕无法从容应对。

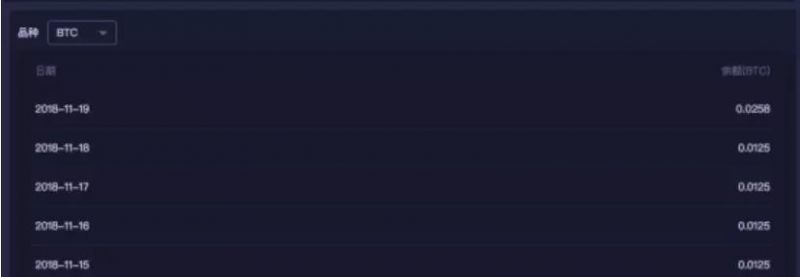

And since the tender contract is just in its internal measurement phase and large households and quantitative agencies do not have enough confidence in the stability of the system, the volume of transactions per day is small and very deep. 可以预计的是,如果火币无法顺利的完成冷启动,那么就很容易进入一个始终没人玩、也无法进入正向循环的状态。 It can be expected that, if the tender is not successfully completed for cold start-up, it can easily enter a state that has always been unattended and unable to enter a positive cycle. 此外,费率情况也会影响着市场的流动性。对于火币的合约交易费率和其他的数字货币合约交易所的情况也需要进行详细的考量。 also affects the liquidity of the market. also requires detailed consideration of the contract rates and other digital currency contract exchanges for military currency. 首先来看OKEx的费率: OKEx实行的是梯度手续费制度,OKEx按照交易量的大小将交易者分成Lv0-Lv8一共八个等级,不同等级的手续费不一样。BitMEX合约的手续费的收取同样遵循提供流动性和提取(消耗)流动性不一样的原则。所有的合约交易,包括传统金融领域都遵循这样的原则:交易量越大,单笔交易手续费越低。 OKEx operates a gradient fee system whereby it divides traders into Lv0-Lv8 levels, depending on the volume of transactions, with different levels of fees. BitMEX contracts are also subject to the principle of providing different liquidity and extracting (consumption) liquidity. All contractual transactions of OKEx费率表 Table of OKEx rates 而另一方面,普通用户对于手续费率并不是很敏感,对交易量小的用户收更高的手续费其实有利于维持平台收入,支撑平台更好的发展;而对于交易量较大的机构用户,收取较低的手续费费率对于深度会有较大的帮助,很多的机构会通过做市商策略提供深度,赚到手续费返点和盘口点差。 On the other hand, ordinary users are not very sensitive to fee rates, and higher fees for low-volume users are in fact conducive to maintaining the platform's revenue and supporting its better development; and 而火币的合约交易,对于所有用户全部按照相同的手续费来收取费率,并没有根据交易量来区分用户,做进一步精细化运营。而对于交易量大的用户,也没有任何的优惠政策。 On the other hand, the contract transaction for the currency, for which all users are charged the same fees, does not differentiate between users on the basis of the volume of the transaction, further fine-tuning the operation. Nor is there any preferential policy for users with large volumes of the transaction. 微信图片_20181127124901 Twitter photo_20181127124901 火币费率表 Instrument for standardized international reporting of military expenditures 曾经火币依靠“免除手续费”起家,而如今上线合约交易,却连最基础的刺激交易手段都没有,略显粗糙。 "Strong" used to start off with "exemption of fees" and now has no basic incentive for online transactions. It's a little rough. 03 合约交易受制于风控能力 contract transactions are subject to wind control 数字资产行业虽然是一个新兴的事物,但是就目前几大头部交易所的玩法来看,运营模式、产品创新都出现了一定程度上的同质化现象。如此一来,风控能力就成为衡量实力的重要指标之一。 While the digital asset industry is an emerging phenomenon, business models and product innovations are becoming somewhat homogenous in terms of the way in which several major head exchanges currently play. , wind control is one of the key indicators of strength. 但是,众所周知,风控是一个系统的行为,而不是单一的逻辑概念。 However, it is well known that wind control is a systemic act, not a single logical concept. 直观地就经验上来说,OKEx的合约交易做了很多年,无论是团队、模式、事故处理都有着丰富的经验。如何应对极端行情、如何消灭风险苗头、如何在市场不可控的情况下,最大程度上保证减少损失,OKEx相对来说,都具有丰富的经验。 Intuitively, OKEx's contract deals have been going on for many years, in terms of team, model, accident management. How to deal with extreme behavior, how to eliminate risks, and how best to ensure that losses are reduced when the market is uncontrollable, OKEx is relatively experienced. 虽然火币无疑也是极为资深的老牌交易所,但是在合约交易方面的经验依旧是0。新的合约及其运营、风控团队没有经历过各类行情和重大事件,所以紧急事件的处理当中,难免可能会出现问题。 Although there is no doubt that the gun is also a very senior and old exchange, the experience with contractual transactions is zero. The new contract and its operation, the wind control team have not experienced all sorts of events and events, so there may be problems in dealing with emergencies. 此外关于风险控制,风险准备金这一项指标无疑值得重点考量。 In addition, with regard to risk control, there is no doubt that the indicator of risk reserve deserves priority consideration. 根据数据显示,OKEx曾注入了2000BTC,用于抵扣用户的分摊损失。同时以目前OKEx的合约交易量来看,每周大约可以积累几十到几百个BTC的风险准备金,用于抵扣穿仓损失。 According to the data, OKEx injected 2000 BTC to offset the share of losses by users. At the same time, the current contract volume of OKEx allows for the accumulation of approximately dozens to hundreds of BTC's risk reserves per week to offset the loss of containment through the warehouse. OKEx风险准备金截图 A screenshot of the OKEx risk reserve 由于目前火币合约处于测试阶段,所以目前还没有任何风险准备金的积累,再加上深度平平,所以在出现大的行情时,很有可能出现较大比例的分摊。这一点无疑有着长期积累和先发优势的老牌交易所更值得信赖。 is likely to have a larger share of the share in the event of a major event, given that the contract is currently being tested, and that there is no accumulation of risk reserves, coupled with a level of depth. is certainly more credible for an old exchange with a long-term build-up and pre-emptive advantage. 微信图片_20181127124910 Twitter photo_20181127124910 火币风险准备金截图 Fire currency risk reserve screenshot 此外,OKEx开放的合约交易的币种共8种,合约种类为当周、次周、季度三种。支持的币种有:BTC、ETH、BCH、ETC、BTG、XRP、EOS、LTC;BitMEX开放的合约交易的币种也是8种,合约种类为永续合约、季度合约两种。支持的币种有:XBT(就是BTC)、ADA、BCH、EOS、ETH、LTC、XRP、TRX。而火币合约目前只支持BTC一种,种类上较另外两家都有所不及。 In addition, eight different types of contracts are opened by OKEx. The following currencies are supported: BTC, ETH, BCH, ETC, BTG, XRP, EOS, LTC, BitMEX, and BitMEX, both of which are permanent and quarterly. The currencies supported are: XBT (i.e. BTC), ADA, BCH, EOS, ETH, LTC, XRP, TRX. , which currently supports only BTC, unlike the other two. 其实,目前的一切,都是历史的重演。早在2013年6月,796交易所在比特币业内率先开发出了比特币周交割标准期货—T+0双向交易虚拟商品作押易货合约(合约交易)。标志着合约交易的正式出现,也结束了此前比特币不能做空的历史,开启了比特币衍生品市场发展繁荣的序幕。 As early as June 2013, the 796 Exchange, in the Bitcoin industry, pioneered the development of the Bitcoin weekly delivery standard futures-T+0 two-way transaction of virtual goods as a pledge barter (contract deal). It marked the formal appearance of a contract transaction and ended the history of Bitcoin’s inability to be empty and set the stage for the booming of the Bitcoin derivatives market. 而在2015年虚拟货币经历的寒冬,小交易所陆续倒闭,大交易所开始裁员,最后国内只剩三四家,交易所为了求生,火币、OKEx、比特币中国纷纷开通合约交易,而最终合约交易所只剩下了OKEx。可见合约交易不是万灵药,用户的认可才是关键。 And in the winter of 2015, when the virtual currency went through, the small exchange collapsed, the big exchange started to lay off, and there were only three or four of them in the country. In order to survive, the exchange opened contract deals in China, which left only the contract exchange with OKEx. can see that the contract deal is not a panacea, but user approval is the key. 依靠简单的模仿和之前现货交易积累的用户量,火币合约能否与OKEx和BitMEX能否让加密货币合约交易市场出现“三国鼎立”的局面?每个人的心里或许都有着答案,而孰对孰错,也只能交给市场和时间去检验了。 relies on simple simulations and the amount of users accumulated by previous spot transactions. Can a gun contract with OKEx and BitMEX create a “troika” situation in the market for encrypted currency contracts? Each person may have an answer in his/her heart, and what is right or wrong is left to the market and time to test.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论