偶尔会涌现一些新的DeFi(去中心化金融)应用,突然一炮而红。Friend.tech绝对是其中之一,拥有超过1.5万名活跃用户,还有来自加密货币Twitter上最大的意见领袖们的大量炒作。

Occasionally, some new DeFi applications (de-centralized finance) have emerged, and suddenly they're red. Friend.tech is definitely one of them, with more than 15,000 active users, and a lot of speculation from the biggest opinion leaders on encrypted currency Twitter.

在这个问题中,我们将深入探讨庞氏经济学,并探讨博弈论。

In that context, we will explore the economics of Ponzi in depth, as well as the game theory.

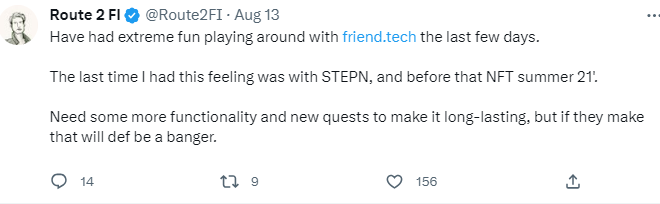

Friend.tech 刚刚在一个多月前推出,我是在它刚刚上线的第一天开始使用的。这是我当时的直接反应:

Friend.tech was just launched more than a month ago, and I started it on the first day it was just online. This is my direct response:

所以friend.tech是由 @0xRacerAlt 开发的,他是一位加密领域的资深玩家。他曾担任 @TweetDAO 的首席开发人员 - 这是一个允许使用共享Twitter账号发布内容的NFT项目。该项目在发展过程中曾一度疯狂传播,是去中心化社交媒体的最早尝试之一。

So Friend.tech was developed by @0xRacerAlt, a senior player in encryption. He was the lead developer in @TweetDAO - a NFT project that allowed the distribution of content using shared Twitter accounts. This project was one of the first attempts to centralize social media.

friend.tech 是一个去中心化社交媒体应用,用于Token化加密货币领域的个人:

Friend.tech is a decentralised social media application for individuals in the field of Token encryption:

- 您可以购买和出售这些个人的“Key”

- You can buy and sell these individuals' Keys.

- 拥有Key使您可以进入与该个人的私人聊天

- Having Key gives you access to personal conversations with the person.

- Key的价格根据供需情况波动

- Key prices fluctuate according to supply and demand

是的,Key的价格是根据供应和需求来确定的。

Yes, Key's price is based on supply and demand.

有人为此制作了一份电子表格:https://docs.google.com/spreadsheets/d/1AW6by8ZXqD1vV3z4TfC8N7SZwt8RD-lFT-G9_hGMdPk/edit#gid=0

A spreadsheet has been produced for this purpose:

创作者会从每笔交易中的买入/卖出税中获得一部分(5%给协议,5%给创作者),这意味着Key的价格越低,赚钱就越容易。

The creator receives a share of the purchase/sale tax for each transaction (5 per cent to the agreement and 5 per cent to the creator), which means that the lower the price of Key, the easier it is to make money.

让我来解释一下:

Let me explain.

假设你从一个拥有10个持有者的人那里购买了一个钥匙。一个10个持有者Key的购买价格是0.00625 + 10%税=0.006875 ETH。

Suppose you buy a key from a person with 10 holders. The purchase price for a 10-holder Key is 0.00625 + 10% tax = 0.006875 ETH.

假设你想在这个人拥有15个持有者时再次出售这个Key。销售价格是:0.0125 - 10%税=0.01125 ETH。

Suppose you want to sell this Key again when this person has 15 holders. The sale price is 0.0125 - 10% tax = 0.01125 ETH.

因此,你的利润是0.01125 - 0.006875=0.004375。顺便说一下,这些价格可以在我之前提供的Excel表格中找到。

So your profit is 0.01125 - 0.006875 = 0.004375. By the way, these prices can be found in Excel tables that I provided earlier.

好的,但如果我们想购买一个有150个持有者的Key呢?

Okay, but what if we want to buy a Key with 150 holders?

一个拥有150个未卖出Key的人的购买价格为:1.40625 + 10%税=1.546875 ETH。

The purchase price of a person with 150 unsold Key is 1.40625 + 10% tax = 1.546875 ETH.

假设你想在这个人拥有155个持有者时再次出售这个Key。销售价格是:1.48225 x 10%税=1.334025 ETH。

Suppose you want to sell this Key again when the person has 155 holders. The sales price is 1.48225 x 10% tax = 1.334025 ETH.

你可以很容易地看出这大约是0.2 ETH的亏损。

You can easily see that it's about 0.2 ETH's loss.

要收回成本,你需要在你之后有17名买家!如果在有167个持有者时出售,你的价格是:1.7225 + 10%税=1.55 ETH。

If there are 167 holders, your price is 1.7225 + 10% tax = 1.55 ETH.

虽然在你之后需要1-2人购买才能从少数钥Key持有者中获利,但当Key价格上涨时,你需要更多的人。

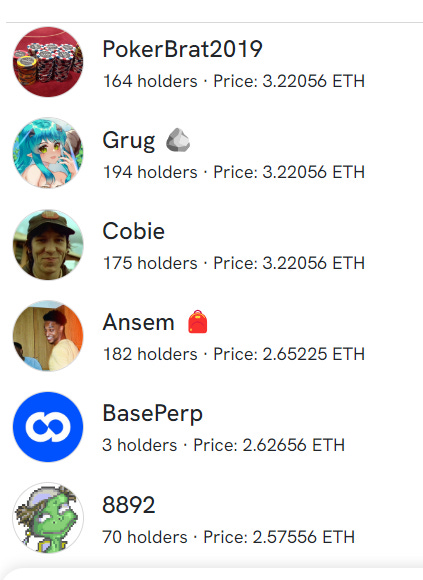

现在想象一下,如果以超过8 ETH的价格购买Racer的钥匙。快速粗略估算告诉我们,购买需要8.8 ETH,而销售则需要7.2 ETH。正如您可能了解的,你需要相当多的新Key持有者在你之后才能从中获利。

Now imagine, if you buy Racer's keys for more than 8 ETHs. A quick rough estimate tells us that it takes 8.8 ETHs to buy and 7.2 ETHs to sell. As you may understand, you need a significant number of new Key holders to profit from it after you.

好的,人们明白了在较大的账户中翻牌是不可能成功的游戏(就像我的例子中大多数情况下适用于较便宜的钥匙)。

Well, it's understood that turning a card in a larger account is a game that cannot be successful (as in most of my cases it applies to cheaper keys).

那么,聪明人是如何赚钱的呢?

So how do smart people make money?

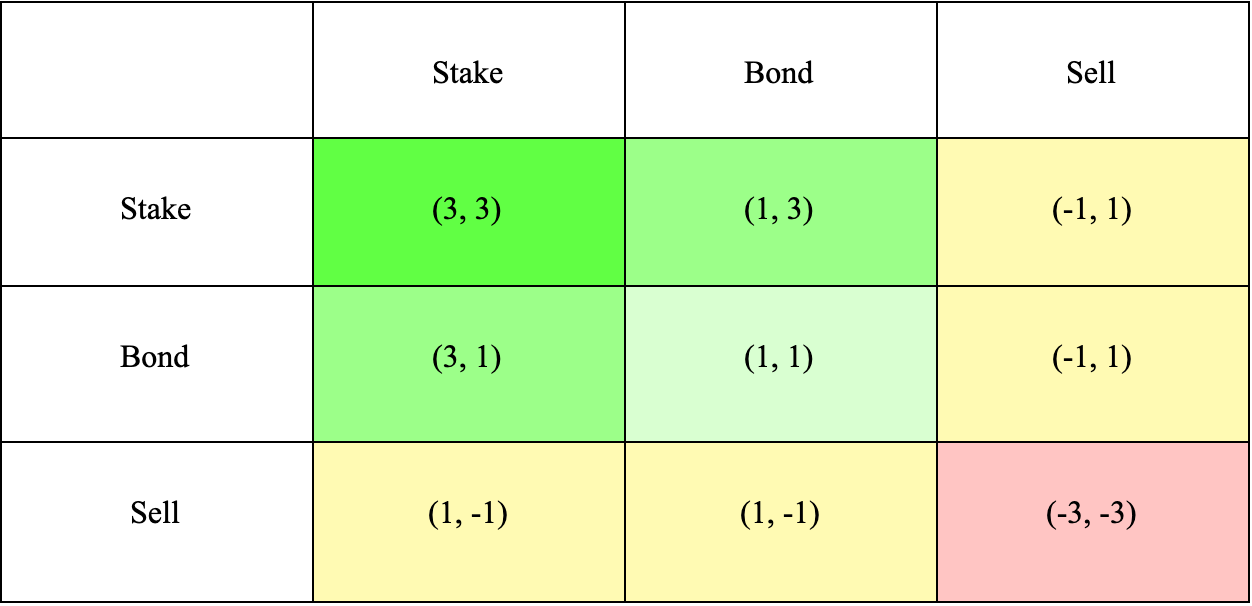

你还记得Olympus DAO ($OHM) 和 3,3吗?让我们回到2021年,Olympus DAO和3,3。这是最大的庞氏博弈理论。

Do you remember Olympus Dao and 3,3? Let's go back to 2021, Olympus Dao and 3,3. This is the biggest Ponzi game theory.

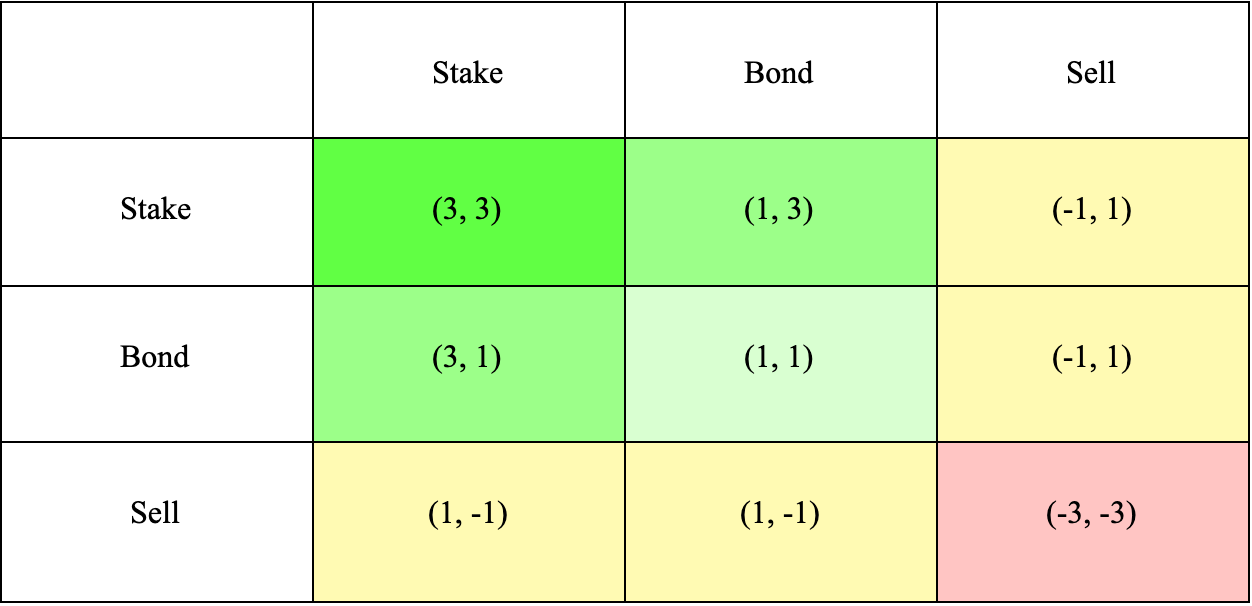

最初当你看到(3, 3)时,它只是对$OHM最有利的纯抵押策略的参考。

最初当你看到(3, 3)时,它只是对$OHM最有利的纯抵押策略的参考。

抵押和绑定(3, 1)或卖出和绑定(-1, 1)的组合总体上不太有利,因此你不太可能看到有人吹嘘这些策略。

The combination of collateral and binding (3, 1) or sale and binding (1, 1) is generally not favourable, so it is unlikely that you will see people bragging about these strategies.

抵押被认为是Olympus网络所有参与者采取的最有利行动,它通过导致初始购买Token的积极买盘来帮助提高OHM的价值,而且它通过锁定更多供应来增加OHM的稀缺性。

Mortgage is considered to be the most beneficial action taken by all Olympus participants, helping to increase the value of OHM by leading to the initial purchase of Token's active plate, and by targeting more supplies to increase the scarcity of OHM.

在上面的表格中有什么熟悉的地方吗?也许是两个“抵押”标题对齐的地方?这个(3, 3)符号是Olypus DAO参与者之间最大正面结果的博弈理论缩写。如果每个人都抵押OHM,那么OHM的价值将上升。

Is there anything familiar about the table above? Maybe the place where the two “collateral” titles are aligned? the symbol (3,3) is an abbreviation of the game theory of the greatest positive result between Olypus DAO participants. If everyone mortgages OHM, the value of OHM will rise.

所以将(3, 3)添加到Twitter用户名的末尾有点像呼吁,意思是,“我抵押OHM,你也应该抵押!”它传达了这个人持有OHM并希望看到其价值上升,因此可以理解为微妙的鼓励,让您也应该抵押OHM。

therefore adds (3,3) to the end of the Twitter user's name a little bit like an appeal, meaning, “I mortgage the OHM, you also mortgage!” it conveys that this person holds the OHM and wants to see its value rise, and can therefore be understood as a subtle encouragement that you should also mortgage the OHM.

(3, 3)的梗一直效果很好... 直到它不行了(稍后会详细讨论)。

(3, 3) The infarction has worked very well... until it's gone.

无论如何,cryptoyieldinfo和0xMakesy是最早开始讨论3,3如何适用于friend.tech的Twitter用户之一。

In any case, Cryptoyieldinfo and 0xMakesy were among the first Twitter users to begin to discuss how 3 applies to their friends.tech.

让我们回顾一下。每个人都想赚钱。

Let's look back. Everybody wants to make money.

你如何才能赚到最多的钱?

How can you make the most money?

- 当人们购买或出售你的钥匙时获得的费用

- The money people get when they buy or sell your keys.

- 翻牌(低价买入/高价卖出)

- Turn the cards over (low/high)

- 3,3

假设你的Key价值0.1 ETH,你有一个朋友也价值0.1 ETH。如果你们互相购买彼此的Key怎么样?你们两个都将获得5%的费用,而且根据绑定曲线,你们的价值将增加(从0.10 ETH增加到0.12 ETH)。

If your Key is worth 0.1 ETH, you have a friend worth 0.1 ETH. What if you buy each other's Key? You both get 5% of the cost, and according to the bound curve, your value increases (from 0.10 ETH to 0.12 ETH).

因此,从技术上讲,你实际上将你的投资组合价值增加了约0.02 ETH(0.015 ETH的钥Key价值+0.005 ETH的费用)。

, therefore, technically, you have actually increased the value of your portfolio by about 0.02 ETH (0.015 ETH Key Key Key Key + 0.005 ETH).

然后,你可以用另一个朋友重复相同的操作,再次增加你的价值。重复这个动作100次,你的钥匙开始变得非常有价值。

And then you can do the same thing with another friend, adding your value again. Repeat this 100 times, your key starts to be very valuable.

这也带来了一些其他效果。3,3的目标是攀升排行榜,并向其他账户发出信号,表明你是一个持有者,不会出售他们的钥匙。

This brings with it some other effects. The goal of

这反过来会吸引对你的钥匙、更多的持有者和更多的网络机会。这也会吸引那些只想显示自己拥有高投资组合价值(净正值)的翻牌者和人们的注意。

This, in turn, attracts key, more holders, and more opportunities for the Internet. It also attracts the attention of those who simply want to show that they have a high portfolio value (net positive).

这种策略的缺点是,你还必须能够回购你的钥匙持有者,这要么涉及添加更多ETH,要么出售一些你拥有的不可回购的钥匙。

The disadvantage of this strategy is that you must also be able to buy back your key holders, which involves either adding more ETHs or selling some of your non-purchaseable keys.

3,3会有什么问题?只要每个人都在购买和持有,每个人都会很高兴。

What's the problem? Everyone will be happy as long as everybody's buying and holding it.

价格上涨,你朋友的价格也上涨,每个人都在赚钱。

The price rises, your friend's price rises, everybody's making money.

每个人都为潜在的空投获得了大量积分。只要激励措施存在,这种情况可能会持续很长时间。

Everyone gets a lot of credit for potential airdrops. As long as incentives exist, this may last for a long time.

然而,最终这将变成一个谁最快出局的竞赛。

, however, will eventually turn into a race for whoever's fastest out.

friend.tech目前处于测试阶段。测试期总共预计持续6个月(因此还剩下4.5个月)。人们猜测在那个时候将进行空投。

The test period is expected to last for a total of six months (and thus 4.5 months remaining). It is assumed that the drop will take place at that time.

我认为这将是人们真正开始抛售的时候。

I think this is the time when people really start dumping.

还记得3,3吗?

Remember three or three?

嗯,反过来也是一样的。

Well, the reverse is the same.

-3,-3。

如果你卖,我也卖。现在每个人都在亏损。如果你在大规模抛售开始时没有警觉,最后你可能会比NFT的人还穷。由于UI/UX非常流畅,这可能会发生得很快。不需要处理Metamask。

If you sell it, I'll sell it. Everyone's losing. If you don't be alert when a large-scale sale starts, you might end up poorer than the NFT. Because UI/UX is very fluid, this could happen very quickly. There's no need to deal with Metamask.

最终,我们将来到一个大规模抛售将发生的时刻(根据我们今天拥有的信息)。也许friend.tech的创建者设法推出一个可持续性的系统?我不这么认为,但让我们拭目以待。

At the end of the day, we'll be at the moment of a large-scale sale (according to the information we have today). Perhaps the founder of the friend.tech managed to launch a sustainable system? I don't think so, but we'll see.

不过,在Twitter时间线上最有趣的事情是有人说在friend.tech的渠道中有“alpha”。

The most interesting thing on Twitter, however, is that there are “alphas” in the channels of the friend.tech.

但请问自己,你真的在这里得到了任何你在Twitter/TG/Discord上没有抓到的“alpha”吗?看了几天前Friendbook分享的内容后,我对那里是否有任何“alpha”都不太确信。在我看来,因为绑定曲线的原因,购买大型低估值的人更有道理。他们价格越便宜,你就可以因为费用而以更高的价格再售出。

But ask yourself, do you really get here any of the “alphas” you did not catch on Twitter/TG/Discord? After looking at what Friendbook shared a few days ago, I am not sure about any of the “alphas” there. It seems to me that, for the reason that the curves are tied, those who buy large low values are more justified. The cheaper they are, the more they can sell them at higher prices.

如果friend.tech就像NFT一样是一种游戏。你只需尽可能以最便宜的价格收集最有价值的玩家,然后以比购买价更高的价格再售出。你真的在意你最喜欢的意见领袖是否与你聊天吗?我认为这一点被过度强调了。

If your favorite opinion leader is talking to you, I think it's over-emphasized.

让我们坦诚相待。我们使用这个应用程序是因为我们想要空投和快速涨跌。

Let's be honest. We're using this application because we want to drop and drop fast.

从这个意义上说,3,3到目前为止表现得非常出色。我自己使用friend.tech来赚钱,而不是因为我长期相信这个概念。对我来说,这就像Olypus DAO和Wonderland DAO一样是一个炒作/抛售计划。

In that sense, 3,3 has done a great job so far. I've used my friend.tech to make money, not because I've long believed in the concept. For me, it's like Olypus DAO and Wonderland DAO is a ploy/sales scheme.

3,3会一直有效,直到有一天不再有效。只需搜索$OHM和$TIME的价格,或者Stepn(通过步行/跑步赚钱)。

All you have to do is search for the price of $OHM and $TIME, or Stepn.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论