比特币的话题依然在持续,只是这次不再是讨论它在过去的一年时间里暴涨了多少,而是它在过去的6天里暴跌了多少。

The topic of Bitcoin is still going on, except this time it is no longer about how much it has risen in the past year, but how much it has fallen in the last six days.

“虽然之前几乎所有人都在预警说‘(价格)太高了太高了’,但投资人似乎更愿意相信‘还会更高’。在短时间里,出现了如此大的下跌,且反弹乏力,还是出乎很多人的意料。损失之大,可想而知。” 一位欧洲比特币玩家对第一财经记者如是说。

& & ldquo; although almost everyone was warning &lsquao; (prices) too high &rsquao; but investors seem more willing to believe &lsquao; it's even higher &rsquao;. In a short period of time, it's not surprising that there has been such a big drop and a weak rebound.

12月17日,比特币价格一度站上近20000美元(约合13.2万元人民币)的高点,然而强劲的势头在随后急转而下。上周五(12月22日),比特币价格在24小时内跌破从16000到11000美元的六道整数关口,较历史高位跌去8000多美元。

On December 17, Bitcoin prices were once at a high of nearly US$ 20,000 (approximately RMB 132,000), but the momentum turned sharply. Last Friday (December 22), Bitcoin prices fell from US$ 16,000 to US$ 110,000, down from US$ 8,000 at an all-time high.

换言之,在仅仅5天时间内,比特币的价格跌去了大约三分之一。

In other words, in just five days, the price of Bitcoin fell by about one third.

更为“夸张”的是,从12月22日下午开始,虚拟代币市场出现集体暴跌,临近北京时间当天23时左右,包括比特币在内的多种虚拟代币出现全面下跌,平均跌幅超过30%。

More & & ldquo; exaggeration & & rdquao; and, from the afternoon of 22 December, there was a collective collapse in the virtual currency market, which was close to 2300 the same day in Beijing, and there was an overall decline in various virtual currencies, including Bitcoin, with an average decline of more than 30 per cent.

截至当地时间12月22日美股收盘,比特币的下跌狂潮也暂告一段落,并重新站上14000美元,其余虚拟代币的跌幅也逐渐收窄。

As of 22 December, local time, the United States stock had closed and the fall in bitcoin had been suspended and $14,000 had been restored, while the fall in the remaining virtual tokens had been gradually narrowed.

但从北京时间24日晚间开始,比特币与“小兄弟”们重启暴跌模式。截至发稿,比特币24小时跌幅达11%,比特币现金、瑞波币的跌幅已扩大至20%。

But starting in the evening of 24 Beijing time, Bitcoin and & & ldquao; little brother & rdquao; and they reboot the crash pattern. By the time of the release, Bitcoin had fallen by 11 per cent 24 hours, and Bitcoin's cash and Ripon's fall had increased to 20 per cent.

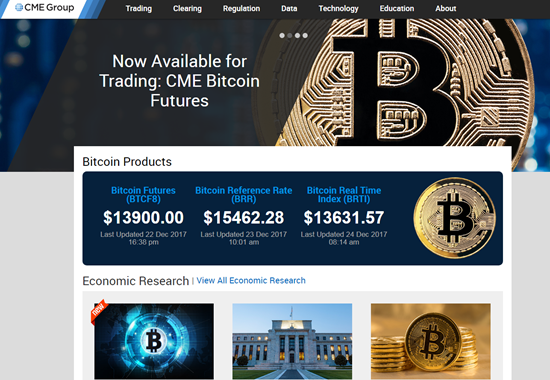

与此同时,受币价下跌的影响,刚刚上线数日的比特币期货也出现较大跌幅。截至发稿,芝加哥商品交易所(CME)比特币期货BTC 1月合约收跌1430美元,报13900美元。自其12月18日推出比特币期货合约以来,已连跌7天。

At the same time, as a result of the fall in currency prices, bitcoin futures fell significantly in just a few days. As of the date of the release, the Chicago Commodity Exchange (CME) bill BTC, which fell by $1430 in January, reported $13,900.

比特币现货暴跌之时,芝加哥期权交易所(CBOE)的近月比特币期货盘中触发熔断,后恢复交易。截至第一财经记者发稿时,比特币期货XBT 1月合约收跌1340美元,报13950美元。

一位手上握着100多枚比特币的日本玩家告诉第一财经记者,在上周里,他几乎每天都在和全球不同地区熟识的同行保持联系,大家都试图从各种渠道来打听这次暴跌的原因。“虽然上次中国有关部门出台监管政策也让市场出现了大跌,但很快得到了修复,并且价格继续走高。分析一下上周的情况,除了韩国对比特币正在进行‘围剿’,我们并没有看到其他有大的经济体在酝酿新的政策。”

A Japanese player with more than 100 bitcoins in his hand told the first financial journalist that he had almost daily been in contact with his colleagues in different parts of the world, and that everyone had tried to find out the reasons for the crash from various sources. And & ldquo; while the previous regulatory policy of the Chinese authorities had caused the market to crash, it was quickly repaired and prices continued to rise. An analysis of last week’s situation, with the exception of South Korea’s bitcoin ‘ the siege of ’ and we did not see other large economies developing new policies. & & rdquao;

事实上,不仅是这位日本玩家和他的朋友们对这次暴跌的原因不得其解。第一财经记者注意到,同样是在上周,原本因为政策所限而早已非常冷清的比特币“玩家”交流群突然又活跃了起来——毫无疑问,如此大幅度的“暴跌”,让“前玩家”们又兴奋了。

In fact, it is not only this Japanese player and his friends who are unable to understand the reasons for the crash. The first financial journalist also noticed that last week, too, the bitcoin&ldquao, which was already very cold due to policy constraints; player & rdquao; the conglomerates were suddenly again active — & mdash; undoubtedly, so much & & ldquao; & rdquao; & & ldquao; the former player & & rdquao; and they were excited again.

总结下来,相当多的观点认为,比特币这波下跌一方面是因为前期涨幅过猛,短线回调属于正常现象;另一方面,在圣诞节年关将至之时,持币大户因此前大幅获利而不断卖出比特币现货清仓,随后暂时离场;同时,也不排除一部分投资人和机构想要做空比特币的可能。

In summary, there is a considerable view that the drop in Bitcoin is due, on the one hand, to the fact that the pre-optimal surge and short-line retrenchment is normal; on the other hand, at the close of Christmas Year, large-scale money-bearing households continue to sell out of the bitcoin spot and then leave temporarily; and, on the other hand, it does not rule out the possibility that some investors and institutions would want to make an empty bitcoin.

“现在,很多资金从比特币流入到了其他可替代的数字货币。”悉尼财富顾问公司ASR Wealth Advisers的股票和衍生产品顾问沙恩·查内尔(Shane Chanel)近日对媒体表示。

& ldquo; now a lot of money goes from bitcoin to other alternative digital currencies. & & & rdquo; Shane & Middot, stock and derivatives adviser to the Sydney wealth consultant, ASR Wealth Advisers; and Shane Chanel has recently indicated to the media.

不难发现,这一波下跌开始于12月17日,正是芝加哥商品交易所上线比特币期货的时间。

It is not difficult to find that the wave began to fall on 17 December, precisely when Bitcoin futures were on the line of the Chicago Commodity Exchange.

“毫无疑问,由于比特币前期上涨太猛,已积聚了足够大的风险,比特币期货这种‘对冲风险’的工具一推出,就立刻被认为是‘压垮骆驼的最后一根稻草’。”上述日本玩家表示,“再加上当时价格已经到了20000美元的整数关口,从投资者心理上来说,无论如何都会考虑一下‘是不是该抛了’。”

& & ldquo; Unquestionably, due to the excessive upturn in Bitcoin, which has accumulated sufficient risk, the Bitcoin futures & squao; hedge risk & squao; tools were immediately considered as ‘ the last straw to crush the camel & rsquao; & & & rdquo; & & & & & & & & & & & & & & & ; & & & & & & & & & & & ; & & & & & & & & ; & & & & & & & & & ; & & & & & & dquao;

第一财经记者留意到,很多玩家非常“笃信”比特币的前期暴涨和近期的暴跌都是“白鲸”(whales)干的。

The first financial journalist noticed that many players were very & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & & ; & & & & ; & & & ; & & ; & & & & ; & & ; & & & & ; & & & ; & & & & ; & & & & ; & & & & & ; & & & ; & & & & ; & & ; & & & & ; & & & ; & & & ; & & & & & & ; & & & ; & & & & & & & & & & & & ; & & & ; & & & & ; & & & & ; & & & & & ; ; & & & & & ; ; & & & & ; & ; & & & & & & & & & & & & ; & & ; & ; ; ; ; ; ; ; ; ; ; ; & & & & & & & & & & &? ; ; ; ; ; & & & ; ; ) ) )?? &??? &??????? & & & & & & &

“白鲸”一词,因最近出现在美国彭博社的报道中而被各国投资者所津津乐道,它是指“持有大量比特币的大佬们”。该报道称,全球近40%数量的比特币控制在仅约1000人手里,这些人对比特币行情会有较大影响。

& & & & & & & & &quao; the term, which was enjoyed by investors in various countries as a result of their recent appearance at Bloomberg in the United States, refers to & & & & & & & & & & ; big men with large amounts of bitcoins. The report states that nearly 40% of the world's Bitcoins are in the hands of only about 1,000 people, who have a greater impact on their operations.

美国著名的资本管理公司AQR前执行董事兼金融市场研究部负责人布朗就非常认同这一说法。他在接受媒体采访时表示,“白鲸”们会同步行动或预先沟通,“很多大佬都彼此熟悉,在比特币早期还不为人知的时候,他们就通过比特币互相认识,所以很有可能会联合起来控制市场走势。”

Brown, a former executive director of AQR, a well-known American capital management company, and head of financial market research, agreed with this statement. In an interview with the media, he said that &ldquao; beluga whales & & rdquao; they were synchronized or communicated in advance, & & & ldquao; many big guys knew each other, and they knew each other through bitcoin when it was not known earlier, so it was likely that they would unite to control the market. & & rdquao;

第一财经此前报道过的“法漂”Baron,也是一位比特币的爱好者。几年前他从伦敦政治经济学院毕业后,加入了一家欧洲大型投资机构,平日主要负责权益类投资事务。在接受第一财经采访时,Baron表示,他在很早之前就已经注意到了“比特币白鲸”的说法。“如果真存在‘白鲸’,且他们之间真的在协同作战,那么因为比特币的特殊性,‘白鲸’们可能不会受到任何惩罚,或者说,压根就很难查到谁是‘白鲸’。由于比特币的匿名性特质且交易很难追踪,各国证券监管部门在查处股票内幕交易上的做法,对比特币来说基本不适用。”他说。

After graduating from the London School of Political and Economics a few years ago, he joined a large European investment agency, which was mainly responsible for equity investment. In an interview, Baron said that he had noticed & & & & & & & & & & ; earlier. & & & & & & & & & & & ; & & & & & & ; & & & & & ; & & & & & & & & ; & & & & & & & & & & & ; & & & & & & & & & & & & & & & & & & & & & & & ;, he said, because of bitcoins's anonymity's anonymity and difficulty in tracking & & & & & & & & & & & ; & & & & & ;

在自然界,无数的“磷虾”为大型海洋动物提供了丰富的食物,那么在比特币的生态圈里,如果说存在“白鲸”,那谁又是“磷虾”呢?答案是:散户投资人。

In nature, numerous & ldquo; krill & rdquo; rich food for large marine animals, then in Bitcoin's biosphere, if there is & ldquao; beluga whale & rdquao; who is & ldquao; krill & rdquao; and the answer is: the amphibious investor.

据香港媒体此前报道,比特币价格的不停上涨吸引不少人入场,甚至有人嫌赚得不够,用尽各种办法来投资比特币。就在本月上旬,有投资者逢高出货,套现1700万港元后买进香港豪宅单位“海之恋”;不过也有人的做法正好相反,卖掉自家的物业资产,大肆买入比特币。

According to previous reports in the Hong Kong press, the constant rise in the price of bitcoin has attracted many people to the market, and even some feel that they have not made enough money to invest in bitcoin. In the early part of the month, investors bought Hong Kong Mansions & ldquo after paying 17 million Hong Kong Hong Kong dollars; Sea Love & rdquo; yet others have done the opposite by selling their own property assets and buying bitcoin.

Google Trends(谷歌趋势)的数据显示,12月份,对如何用信用卡进入加密货币领域感兴趣的人数出现激增。随着比特币价格飙升,互联网上有关“用信用卡购买比特币”的搜索量暴增,本月创下了历史新高。

Google Trends (Google Trends) data show that in December there was a surge in the number of people interested in using credit cards to enter the area of encrypted money. As bitcoin prices soared, &ldquao was on the Internet; bitcoin&rdquao was purchased with credit cards; and there was a sharp increase in searches, which reached an all-time high this month.

与此同时,一些原本在华尔街相当有话语权的投资界大佬也在推波助澜。

At the same time, some of the big investors who used to have quite a voice on Wall Street are also helping.

在上周的一份报告中,摩根大通前首席策略师、美国证券研究公司Fundstrat联合创始人托马斯·李(Thomas Lee)将比特币2018年年中目标价从11500美元上调至20000美元——尽管当天比特币价格大跌,一度跌破11000美元。

In a report last week, Thomas & Middot, former chief strategist of Morgan Chase and co-founder of the United States securities firm Fundstrat; Thomas Lee, who raised the mid-2018 target price of Bitcoin from $11,500 to $20,000 & mdash; and & mdash; despite a sharp fall in Bitcoin prices that day, at one time it fell by $11,000.

他还将比特币2022年目标价维持在2.5万美元不变,并将美股场外市场的一只基金——比特币投资信托(Bitcoin Investment Trust,GBTC)的2018年年中目标价从1300美元上调至2200美元。今年迄今为止,GBTC上涨逾1500%,至1990美元。

He also raised the target price of Bitcoin for 2022 from $1,300 to $2,200 in mid-2018 from a fund & mdash; & mdash; and Bitcoin Investment Trust, GBTC. So far this year, GBTC has increased by more than 1,500 per cent to $190.

不过相对于“年轻一代”投资家的激进,老前辈们的态度显然是极其保守的。“股神”巴菲特的黄金搭档——伯克希尔·哈撒韦公司的副主席查理·芒格近日首次谈到了他对加密货币的看法。在他看来,比特币的炒作是彻头彻尾的“疯狂之举”,甚至直言不讳地说,“人们应当像躲瘟疫那样避开比特币”。

But with respect to & & ldquo; the young generation & rdquo; the radicalism of investors, the attitude of the ancients is clearly extremely conservative. & & & rdquo; Buffett's gold partner & mdash; & mdash; Birkhshire & Middot; Charlie & Middot, Vice-President of Hasaway; Manger spoke of his idea of encrypted currency for the first time in recent days. In his view, Bitco is a complete & & ldquao; mad & & rdquao; & & ldquao; people should avoid bitco & rdquao as they avoid the plague.

从大佬们的上述两种截然不同的表态不难看出,几乎整条华尔街在比特币这件事上出现了完全分裂。

As can be seen from the above two very different statements by the big guys, almost the whole of Wall Street is completely divided over the matter of Bitcoin.

就在各方为比特币争论不休时,部分国家的监管机构已经出手,或表明了立场。

At a time when there was an ongoing debate over Bitcoin, regulators in some countries had taken action or taken positions.

今年9月,中国监管层下发禁止ICO(首次代币发行)和比特币交易的监管通知后,各国也在逐步出台相应监管政策。本月13日,韩国企划财政部宣布,针对近期韩国境内流行的虚拟货币交易,将推出包括“全面禁止未成年人及非居住外国人开设虚拟货币账户”在内的最严管制措施。

In September, China’s regulatory system issued a regulatory notice prohibiting trade in ICO (the first currency to be issued) and Bitcoin. On 13 of this month, the Korean Ministry of Finance announced that the most stringent controls, including & ldquo, would be introduced in response to recent virtual currency transactions in South Korea; a complete ban on the opening of virtual currency accounts by minors and non-resident foreigners & & rdquo;

此外,从全球来看,除日本对于数字货币和区块链创新的政策相对宽松外,当前另一个比特币交易大国——美国的监管态度也变得日益明确。

In addition, globally, in addition to Japan's relatively liberal policy towards digital currency and block chain innovation, the regulatory attitude of another bitcoin trading power & mdash; & mdash; and the United States has become increasingly clear.

美国证券交易监督委员会(SEC)日前在官网发布声明,重申加密货币存在“被盗窃或损失,包括黑客攻击”等重大风险。SEC主席杰伊·克莱顿(Jay Clayton)表示,比特币和其他借比特币热潮发起的交易热潮令他感到担忧,目前加密货币市场对于投资者的保护远远低于传统的证券市场,相应地也产生了更多的欺诈和内部交易机会。

The United States Securities and Exchange Supervisory Commission (SEC) recently issued a statement on its web site reiterating the existence of &ldquo of encrypted currency; the significant risks of theft or loss, including hacking & & rdquo; and so forth. SEC Chairman Jay & Middot; Jay Clayton, who stated that he was concerned about the surge in transactions initiated by Bitcoin and other borrowings of bitcoin, which currently protected investors far less than traditional securities markets, and thus created more opportunities for fraud and internal trading.

来源:第一财经

Source: First Finance.

原标题:比特币“白鲸”猎场:信用卡购币、卖房购币者迎来暴风雨

Original title: bitcoin "Beluga whale" hunting grounds: credit card purchases, home buyers in a storm

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论