Key points:

2020年12月比特币最高价格比2017年的历史最高价格高出800美元

By December 2020, the highest price in Bitcoins was $800 higher than the highest price in 2017.

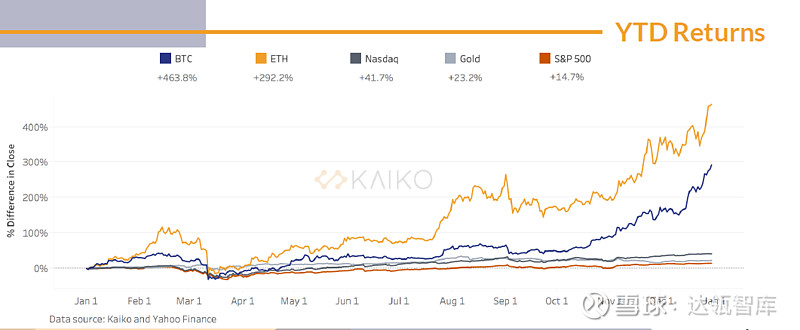

2020年初至今比特币的价格涨幅已超过460%

Bitcoin prices have increased by more than 460% since the beginning of 2020.

2020年ETH突破700美元高点,但仍比历史最高价格低近800美元

By 2020, ETH had crossed a high of $700, but it was still close to $800 below its highest price ever.

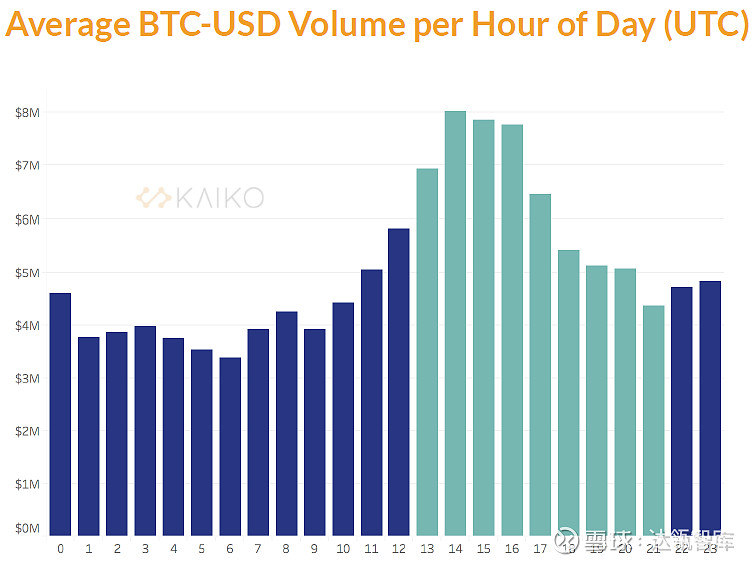

2020年比特币交易时间集中在纽约时间13时到21时

By 2020, bitcoin trading time was concentrated between 13 and 21 p.m. New York time.

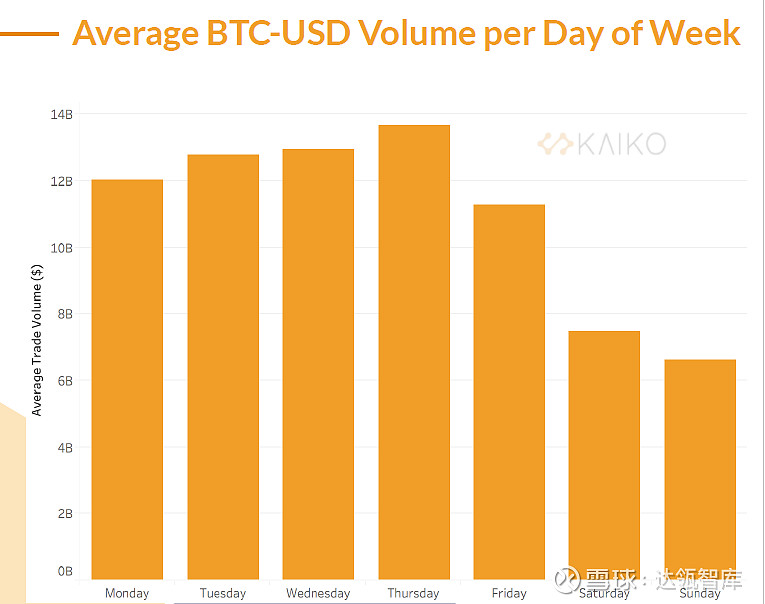

2020年比特币的平均交易成交量在周四达到峰值(约140亿美元),周末的交易成交量只有工作日的一半

In 2020, the average volume of transactions in Bitcoin peaked on Thursdays (about $14 billion) and on weekends it was only half the number of working days.

月度概述

Monthly overview

在2020年的最后一个月,我们不难看出美国加密资产行业在过去一年里所取得的成就和遭受的曲折。2020年12月份比特币突破2.8万美元的价格,创下历史新高。

In the last month of 2020, we can easily see what the US encryption asset industry has achieved and suffered over the past year. By December 2020, Bitcoin passed the price of $28,000, reaching an all-time high.

曾经购买过这项资产的投资者都或多或少的取得了盈利。同时,著名数字资产公司Coinbase宣布他们已经向SEC(美国证券交易委员会)提交了申请。这也是在准备公开募股的阶段,第一次出现这样规模和影响力的加密资产公司。然而,在一片欢欣鼓舞的气氛中,SEC对瑞波(Ripple)提起诉讼,指控XRP(瑞波币)发行时是未经注册的证券,且在非法的募集资金,这迅速引发了XRP在交易所的退市潮,并导致其市场价格暴跌。无论真相如何,XRP的大崩盘伤害了无数投资者,并且提醒着人们加密资产市场并非是完美的,更多规定和管控即将到来(如果做得好,这不一定是一件坏事)。

However, in an encouraging atmosphere, the SEC filed a lawsuit against Ripple alleging that XRP was issued as unregistered securities and that it was raising funds illegally, which quickly triggered the retreat of XRP in the exchange and led to a collapse in its market prices. Regardless of the truth, the XRP crash had harmed numerous investors and reminded people that the cryptographic asset market was not perfect and that more regulation and regulation was about to come (which was not necessarily a bad thing).

2020年的经济不确定性刺激了一批投资者从传统金融市场转向数字资产市场,并且这一趋势短期内不会改变。

Economic uncertainty in 2020 stimulated a shift from traditional financial markets to digital asset markets, and this trend will not change in the short term.

比特币的两个牛市:

Two cows in Bitcoin:

2017 vs 2020

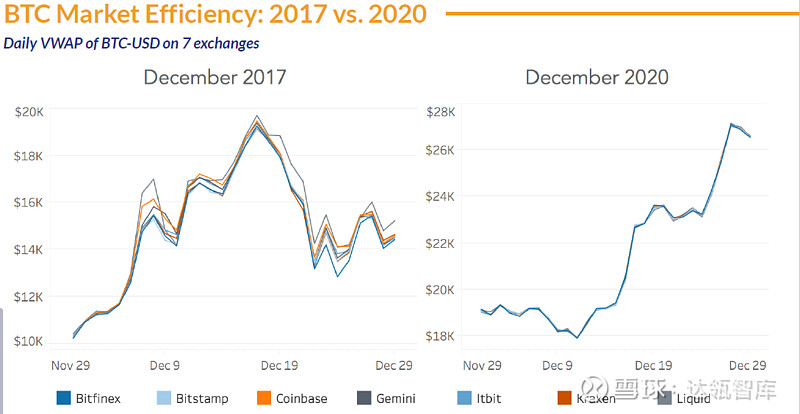

比特币的交易价格目前仍处在一个波动很大的范围内。现在比特币的价格比2017年的历史最高价格高出800多美元。那这次牛市与2017年相比有什么不同呢?

Bitcoin’s trading price is still in a highly volatile range. Bitcoin’s price is now more than $800 higher than its highest price in 2017.

通过纵观各交易所的价格差异,我们可以观察到比特币市场如今的效率要高得多。与三年前相比,投资者的信息不对称情况有所减轻,市场一体化程度不断提高,这些都表明交易者总体上有更大的知情权也更加理性,而这也正是行业成熟的标志。

By looking at price differences across exchanges, we can see that the Bitcoin market is now much more efficient. Investors’ information asymmetries have been reduced and market integration has been increasing, compared to three years ago, indicating that traders generally have a greater right to information and a more rational sense, which is a sign of industry’s maturity.

图1

Figure 1

虽然本月比特币的ATH(历史新高价格)多次被打破,但比特币的交易额并没有达到2017年的顶峰。有分析指出,一方面市场减少了冲动交易,另一方面不同比特币组合(尤其是BTC-USDT)之间交易量比较分散,这些都是比特币、美元交易额相对下降的原因。

Although Bitcoin’s ATH (historical high prices) was broken several times this month, Bitcoin’s transactions did not peak in 2017. Analysis shows that, on the one hand, the market has reduced impulsive transactions and, on the other hand, the relative fragmentation of transactions between different bitcoins (especially BTC-USDT), which explains the relative decline in Bitcoin and dollar transactions.

此外,机构的进入对这次牛市的出现产生了巨大影响,他们倾向于投资购买比特币,而这是不会在交易所的交易记录中反映出来的。

In addition, the presence of institutions has had a significant impact on the emergence of the cattle market, which tends to invest in the purchase of bitcoin, which is not reflected in the exchange's record of transactions.

比特币和经济形式

Bitcoin and economic form

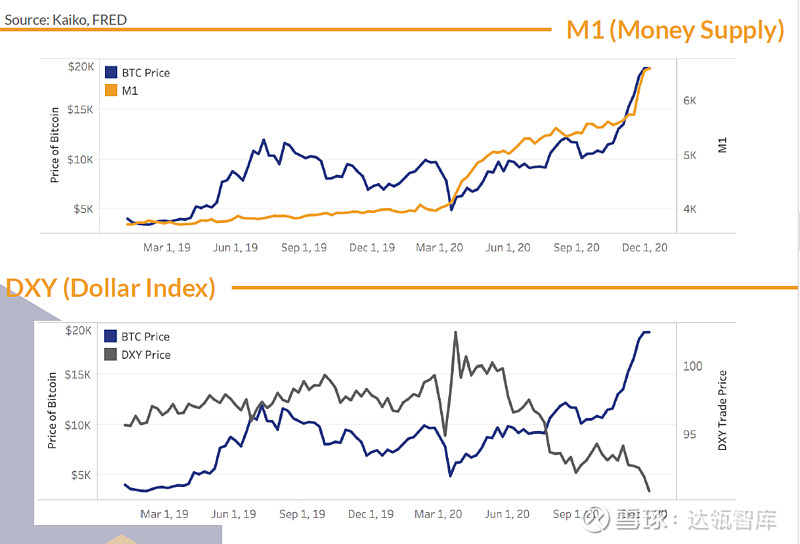

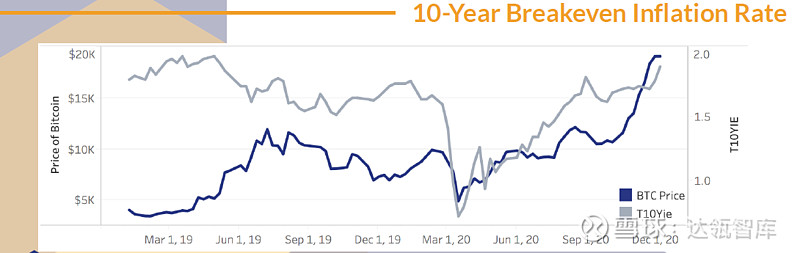

疫情为数字资产的流行创造了完美的市场条件。比特币作为风险对冲工具,其弹性和不确定性是可以在如今的市场条件下进行测试的。

The epidemic creates perfect market conditions for the prevalence of digital assets. Bitcoin, as a risk hedge tool, can be tested for elasticity and uncertainty in today’s market conditions.

比特币的价格走势与目前经济形式的关系也不难理解:比特币的价值随着其供应量减少和法币通胀率提高而上升。

The price trends in bitcoin are also not difficult to understand in relation to the current form of the economy: the value of bitcoin increases as its supply decreases and the rate of French inflation rises.

与此同时,美元贬值至多年以来的低点,政府不得不开始考虑去中心化数字资产的价值。以上解释都支持了比特币是抵御经济冲击(包括相应的政府应对措施)的完美对冲工具这一观点。但现实要更复杂一些。例如,货币供应量的增加不一定会引起通货膨胀(在2008年危机中得到证实),而且现今的经济通胀率预计仍是低于2018年。

At the same time, when the dollar has been devalued at most years at a low point, governments have to start thinking about decentralizing the value of digital assets. All these explanations support the idea that bitcoin is a perfect hedge against economic shocks, including corresponding government responses.

但毫无疑问的是,越来越多的机构正在逐渐意识到将比特币作为对冲工具加入其资产配置中的好处。面对经济的不确定性,未来的经济趋势只会加强这种说法。

But there is no doubt that a growing number of institutions are becoming aware of the benefits of adding bitcoin as a tool to their asset allocation. In the face of economic uncertainty, future economic trends will only reinforce this claim.

图2

Figure 2

图3

Figure 3

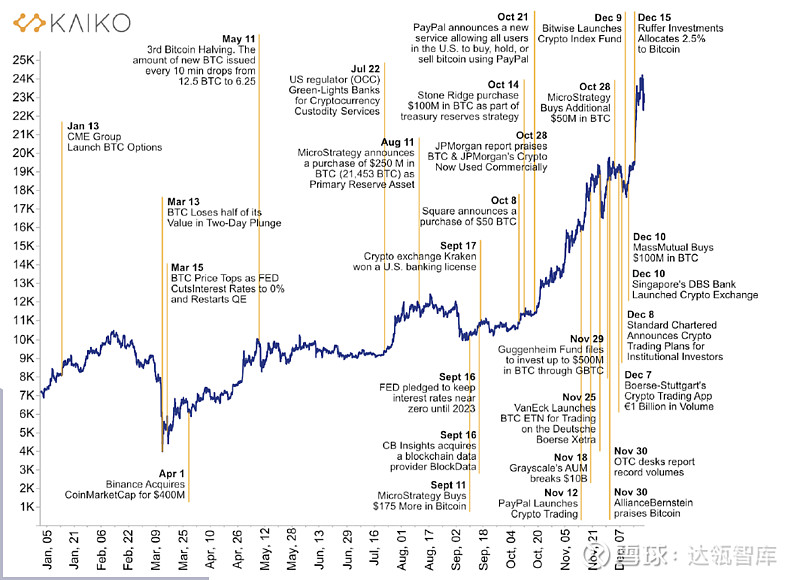

机构入场

Introduction

机构被认为是目前比特币牛市的主要推动者。图4展示了过去一年里发生在加密资产市场里的机构性事件,这些事件主要集中在今年最后三个月。随着一家家新的数字资产公司宣布将比特币纳入其资产配置中,比特币的增长势头也越来越强,甚至其年初至今的涨幅已经超过460%,而与之相比,传统金融资产的回本速度有所下降。

As a new digital asset company announces the inclusion of Bitcoin in its asset allocation, the growth of Bitcoin is increasing, even as it has increased by more than 460% since the beginning of the year, compared with a decline in the return of traditional financial assets.

图4

Figure 4

图5

Figure 5

比特币交易数据

Bitcoin transaction data

从图6可见,过去6个月比特币的平均交易量通常在纽约时间13时到21时达到顶峰。总体而言,大多数交易都发生在美国和英国重叠的交易时间段里。在亚洲和澳大利亚的交易时段,比特币的交易量约为一半,这表明可能大部分比特币交易员集中在美国。

Overall, most transactions took place during the United States and Britain’s overlapping trading periods. In Asia and Australia, about half of the transactions took place, suggesting that most of the Bitcoin traders might be concentrated in the United States.

图6

Figure 6

图7表明,比特币交易主要集中在工作日。从过去6个月的数据来看,成交量在周四达到峰值,周末的平均交易量仅为工作日的一半。由此可见,比特币的成交量趋势与传统金融资产的成交量趋势非常相似。值得注意的是,加密市场全天候开放,而股票市场仅在一周有限的时间内开放。

Figure 7 shows that Bitcoin transactions are mainly dominated by working days. According to data for the past six months, transactions peaked on Thursdays, with the average number of transactions on weekends being only half the number of working days.

图7

Figure 7

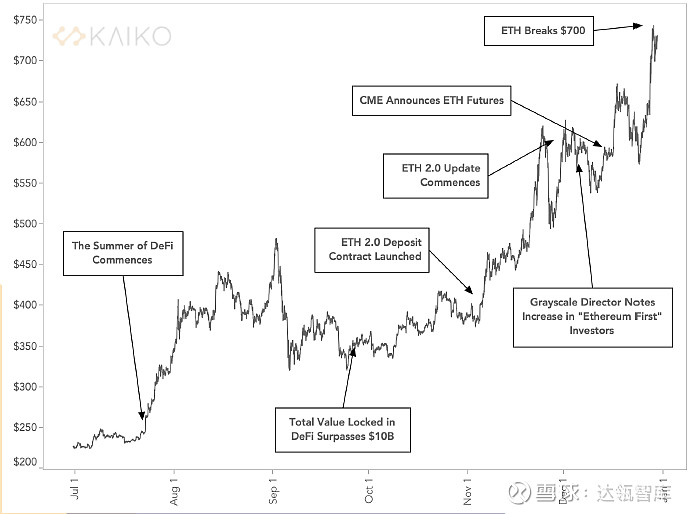

以太坊里程碑式的一年

a landmark year

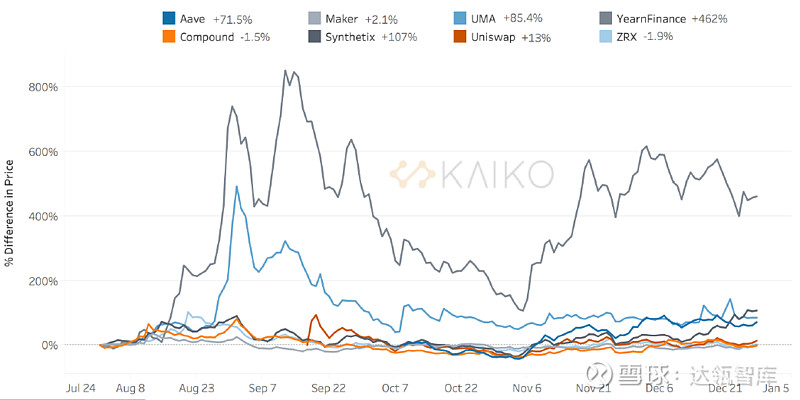

从有记录的数据里可以看出,以太坊上的DeFi Token为平台创造了高额收益并带来源源不断的资本流入了这个新兴生态系统里。今年秋天,比特币的价格反弹又给以太坊注入了新的活力,使得与年初相比,以太坊上的大多数Token 价格在夏天有所上涨。但有些可惜的是,以太坊上Token价格在现阶段还没有回到之前的水平。

As can be seen from the recorded data, DeFi Token in the Taiwan created high returns for the platform, with constant capital flows to the emerging ecosystem. This autumn, the price rebound in Bitcoin injected new dynamism into Etheria, causing most of the Token prices in the Taiwan to rise in the summer compared to the beginning of the year.

图8

Figure 8

ETH大事记

ETH Highlights

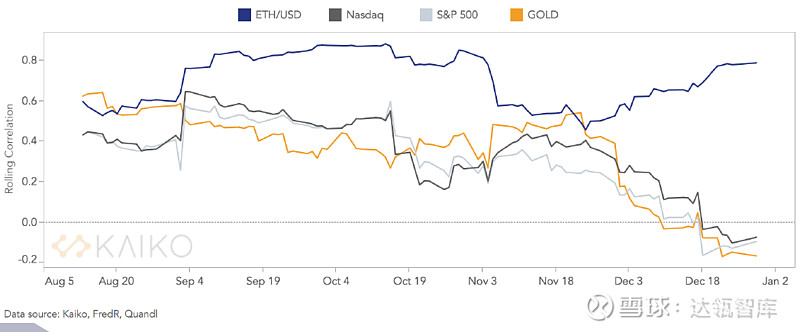

比特币并不是2020年唯一成功的数字资产。以太坊在推出ETH 2.0之后,迎来了新的发展势头,这同样也是有史以来最大规模的网络升级。本月,芝加哥商品交易所(CME)宣布将上市ETH期货,而Grayscale(灰度公司)表示,ETH的机构投资者也将越来越多。在比特币牛市的尾声中,ETH终于突破了700美元高点,但ETH交易价格仍比其历史最高价低近800美元。

Bitcoin is not the only successful digital asset in 2020. After Etherno’s launch of ETH 2.0, new momentum has emerged, and this is also the largest network upgrade ever. This month, 图9 Figure 9 比特币和传统资产的负相关性 Bitcoin and traditional assets 过去三个月,比特币之所以对机构投资者更具吸引力,是因为其独特的对冲功能是传统金融市场所不具备的。当股市下跌时,投资者会寻找能够对冲的工具,而这也正是比特币目前所拥有的特质。不过,情况并非总是如此,自3月以来,比特币价格与股市和黄金存在部分正相关性。 Bitcoin has become more attractive to institutional investors over the past three months because its unique hedge function is not available in traditional financial markets. When stock markets fall, investors look for tools that can hedge, which is what Bitcoin currently has. 图10 Figure 10 本文为译文,内容旨在信息传递,不构成任何投资建议。 This document is a translation and is intended to convey information and does not constitute an investment proposal. 部分图片来源于原文。 Some of the pictures are from the original language. 翻译:李宁峰丨达瓴智库 This post is part of our special coverage Lebanon Protests 2011. 校对:肖文静丨达瓴智库 This post is part of our special coverage Syria Protests 2011. 编辑:杨俊义丨达瓴智库 Editor: Yoon Joon-yee-Daji think tank 审核:Amber丨达瓴智库 Audited: Amber D'Adam think tank 原文链接: Original link:

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论