新年的第二天,比特币再破万元大关。

On the second day of the New Year, Bitcoin broke the tens of thousands.

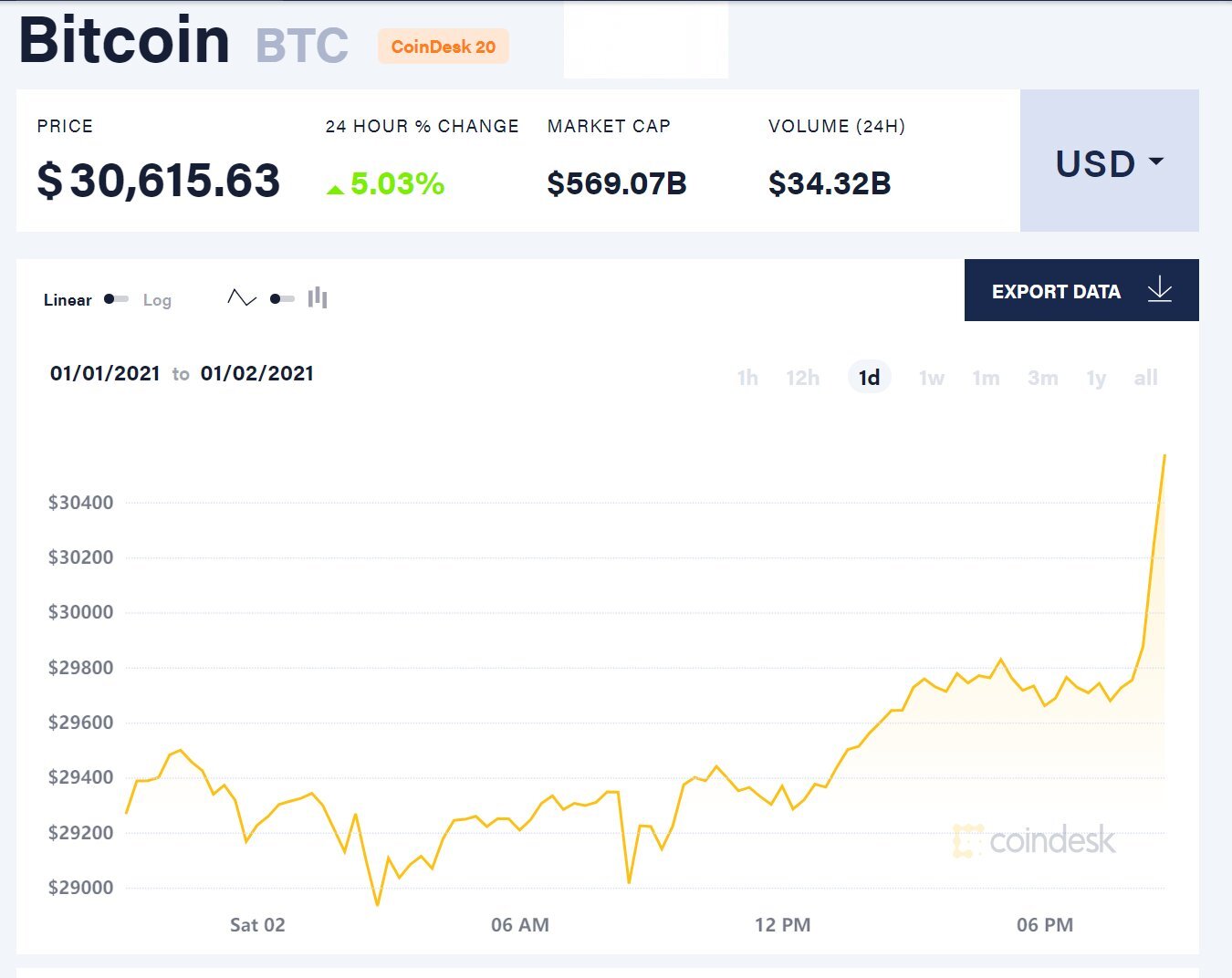

2021年1月2日,比特币价格站上3万美元。根据比特币新闻资讯网Coindesk价格,比特币价格最高达到30850美元,截至发稿,比特币价格约为30615美元,24小时内涨幅达5.03%,24小时内比特币成交额为343.2亿美元,市值为5690.7亿美元。

On 2 January 2021, the Bitcoin price was $30,000. According to the Coindisk price of the Bitcoin news network, the price was as high as $30,850. As of the date of the publication, the Bitcoin price was approximately $30615, an increase of 5.03 per cent within 24 hours, and the Bitcoin was sold at $34.32 billion within 24 hours, with a market value of $569.97 billion.

比特币24小时价格走势 来源:比特币新闻资讯网Coindesk

另据合约帝行情统计报告显示,过去1小时比特币全网总计爆仓1.59亿美元,24小时比特币全网爆仓2.48亿美元,爆仓人数12163人。

In addition, according to the report of the Dealers, the entire Bitcoin network has exploded at a total of $159 million over the past one hour, the entire Bitcoin network has exploded at $248 million over the 24-hour period, and the number of blasters has been 12163.

而距离12月16日比特币站上20000美元,仅仅相隔半个月。

By December 16, only half a month away, the Bitcoin station stood at US$ 20,000.

火币研究院高级分析师Daisy表示,目前来看仍是开启减半行情的初期阶段。

According to Daisy, a senior analyst at the China Currency Institute, this is still an early stage in the process of halving the number of cases.

“在之前的多次分析中,不难看出长期产量减半的供应量减少的因素越来越强,由量变到质变,机构入场的节奏有条不紊,市场仍处于持续抢筹的阶段,疫情再起,美元走弱的逻辑仍然存在。”他说。

“In previous analyses, it was not difficult to see that the reduction in supply by halving production in the long term was increasing, from volume to quality, that the pace of institutional entry was orderly, that the market was still in a state of constant recovery, that the epidemic had re-emerged and that the logic of the weakening of the dollar persisted.” He said.

Daisy也认为,当然市场再创新高,可能是有新的因素。近期美国SEC开始加强监管,对于瑞波进行较强的打击,因此目前市场中除了之前的供需因素外,对于比特币的需求又有了新的需求。

Daisy also argued that, of course, there may be new elements to re-innovation in the market. Recently, the US SEC began to tighten its regulation and hit Ripper more strongly, thus creating a new demand for bitcoin in the market today, in addition to previous supply and demand factors.

12月22日,据纽约时报报道,美国证券交易委员会指控Ripple向全球投资者出售第三大数字代币瑞波币时,出售了未注册的证券。受此影响,瑞波币价格急跌,一度跌至0.275美元左右。

On 22 December, the New York Times reported that the United States Securities and Exchange Commission sold unregistered securities when Ripple accused global investors of selling the third largest single-digit currency, Ripoco. As a result, Ripoco prices fell sharply, once to around $0.275.

纽约联邦法院提起的诉讼认为,这种公司设置意味着瑞波币与比特币不同,应该被归类为一种证券而不是一种货币(currency)。由于Ripple没有将瑞波币注册为证券,公司违反了禁止出售未注册证券的法律。

In a lawsuit brought by the Federal Court of New York, it was held that this corporate set-up meant that Ribbon, unlike Bitcoin, should be classified as a security rather than a currency. As Ripple did not register Ribbon as a security, the company violated the law prohibiting the sale of unregistered securities.

此后,多家加密货币交易所纷纷宣布暂停美国的瑞波币交易,包括Bitstamp、Okex、币安以及或将成为第一家上市公司的加密货币交易所Coinbase。

Since then, a number of encrypted currency exchanges have announced a moratorium on trade in the Ribo currency of the United States, including Bitstamp, Okex, Aryan and Coinbase, which will become the first listed company.

Daisy表示,瑞波是一个历史悠久,但是非常中心化的项目,资产沉淀量很大,是市值一度排名第四的数字资产。这次面临大规模退市,一定会释放一定的资产沉淀,瑞波投资者不得不把问题资产转移到优质资产上,因此比特币意外的获得了更大的需求。这可能也是在年底假期之际,比特币价格仍被不断推高的原因之一。此次加强监管,可以更好地看出去中心化的意义,因此目前来看对比特币是正面的影响。

Daisy states that Ribot is a long-established, but very central project, with a large amount of asset deposition, and a fourth-high-value digital asset. Faced with a massive retreat, it will release a certain amount of asset deposition, and Ribo investors will have to transfer problematic assets to high-quality assets, thus unexpectedly gaining greater demand for Bitcoin.

(原标题:比特币价格站上3万美元,市值超过5600亿美元)

(original title: $30,000 at Bitcoin price, market value over $560 billion)

【责任编辑:张美儿】

【内容审核:林春森】

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论